Research Briefing

19 Sep 2025

Slower CRE inventory growth ahead for most US metros

For inventory growth, it continues to be an industrial and residential story

Our new building stock dataset provides insights into inventory growth trends at the commercial real estate sector and metro levels. We expect a slowdown in inventory growth for most US metros over the next five years.

- Much of the inventory growth in recent years was dominated by industrial and residential completions. We expect this trend to continue nationally over the next two years.

- For industrial, metros with robust construction pipelines over the next two years like Las Vegas, Denver, Charleston, Fort Worth, and San Antonio are grappling with vacancy rates more than double the national average. By contrast, some coastal and gateway markets face far lighter supply pressure.

- Multifamily construction activity remains elevated across many markets in the US. Metros with the most robust construction pipelines relative to existing stock include Nashville, Charleston, Kansas City, Raleigh-Durham, and Miami.

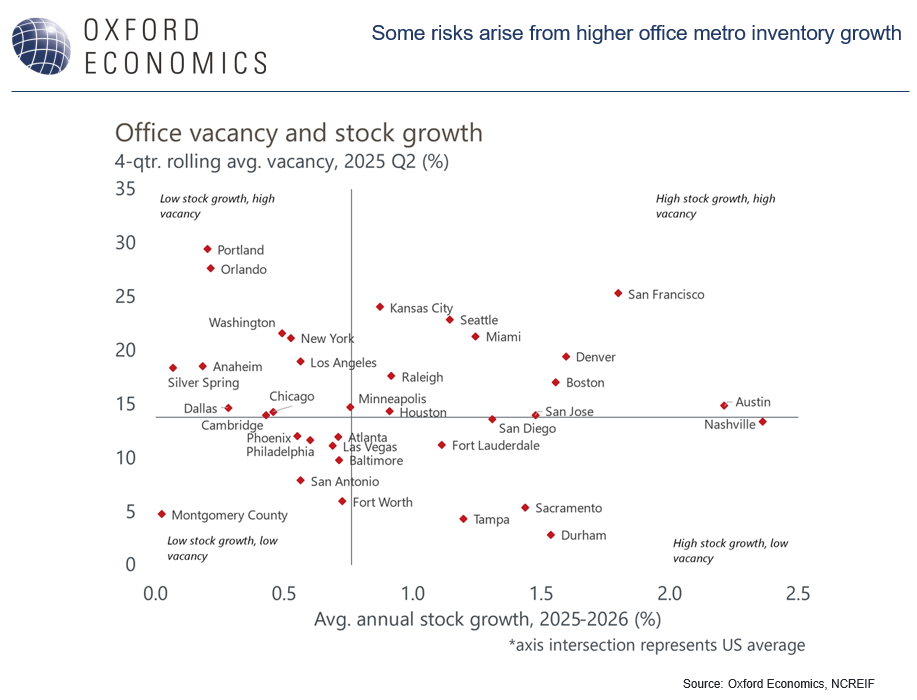

- The office sector is grappling with several headwinds to space market performance. Adding new supply to an already imbalanced sector may tip the scales in the wrong direction. Newer, well-located and well-amenitized buildings are seizing a larger share of office demand.

- In retail, we see evidence of a supply pickup following stronger population growth for some metros such as Austin, Tampa, and Phoenix.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]