Japan’s software investment reduces the tariff shock to capex

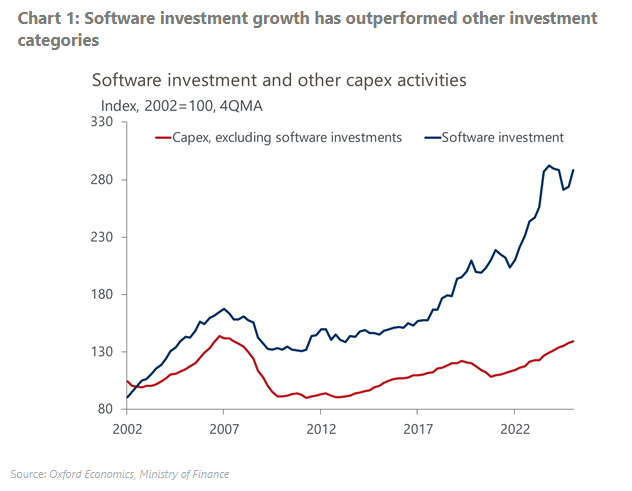

Software investment in Japan has risen sharply since the late 2010s, outpacing investment overall. We expect this high rate of growth to continue as the economy undergoes a digital transformation and the acute shortage of labour continues, driven by adverse demographics.

A wide range of companies are investing heavily in software, but small firms in the services sector have registered the highest growth rate. They’ve traditionally lagged on IT investment and are suffering the most from Japan’s labour shortage.

In the short run, software investment will offset the shock of tariffs and trade uncertainty on overall investment but only modestly, given its low share in total fixed investment. We continue to project a slowdown in fixed investment in H2, led by machinery and equipment, and construction, due to the delayed impact of the spikes in trade policy uncertainty earlier this year.

The second-round impact of the rise in software investment on domestic demand will also be limited as Japan relies on imports, especially from the US, for digital services. Indeed, the trade deficit for digital-related services has sharply expanded in recent years.