Research Briefing

27 Aug 2025

Fiscal tightening in the US forecast? A wrenching assumption

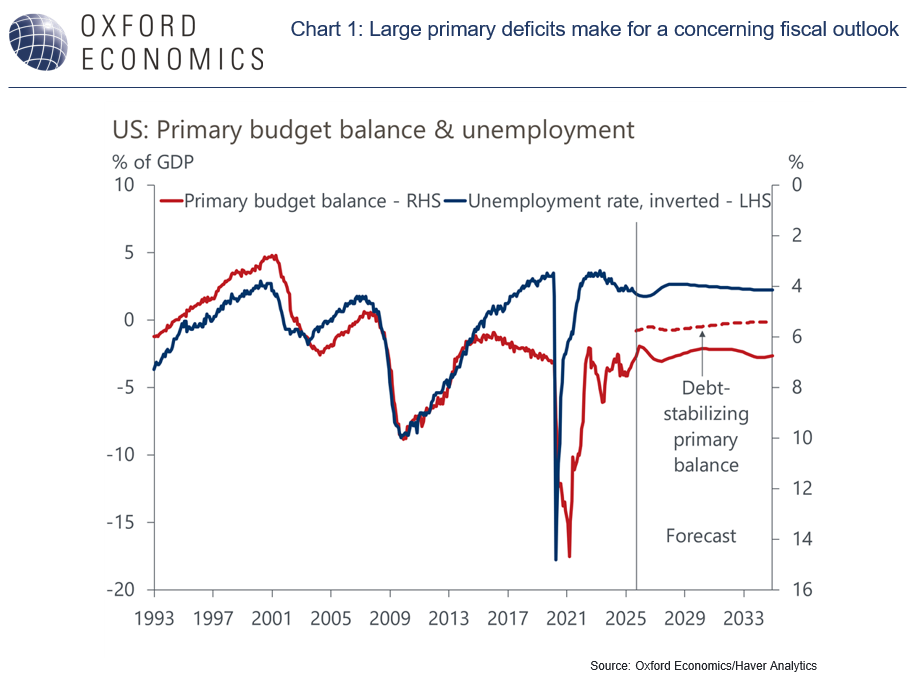

Large primary deficits make for a concerning fiscal outlook

The looming insolvency of the nation’s old-age entitlement programs will likely prompt necessary but painful reforms. Our forecast is for fiscal authorities in the mid-2030s to enact these reforms to rein in deficits and stabilize the public debt ratio by mid-century. This hugely unpopular political undertaking will be financially painful for many households in the long run.

- Despite the political challenges to fiscal reforms, we’re sticking to this critical assumption in our long-run forecast.

- Historically, US fiscal policy has been responsible, tightening the belt in response to rising debt. The post-2008 period is the aberration, which won’t last indefinitely.

- In an alternative scenario in which policymakers don’t take steps to stabilize the debt ratio, it’s tough to pinpoint the point of no return in which the US runs out of fiscal space and is at risk of a default. However, the danger zone would likely start once debt ratios rise past 205%.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]