What is the ‘hidden’ climate risk in your financial portfolio?

There is currently a gap in how the market understands and measures the extended climate risk that companies are exposed to via their interaction with the broader economy.

The finance sector’s ability to direct capital flows means it can have immense impact on climate and sustainability, and in turn on broader society. At the same time climate and other sustainability challenges can affect the finance sector and have a material impact on returns to capital. It follows that climate and sustainability matters are material to the finance sector and investment allocation decisions. To explore this we ran a novel experiment to test whether an investment portfolio adjusted to take these risks into account would deliver increased returns. Analysis of historical data revealed a gain of at least 1.6% annualised returns over a 10-year period compared with a standard index tracking portfolio.

Climate risk is generally discussed in terms of “physical risk” and “transition risk”, and the state of measuring these risks is improving. However, there is currently a gap in how the market understands and measures the extended climate risk that companies are exposed to via their interaction with the broader economy. This includes a company’s suppliers and their suppliers, and so on up the supply chain. The aggregate behaviour of the supply chain moves beyond individual business relationships, towards being a dynamic entity in and of itself, with emergent properties.

Therefore, understanding a firm’s interaction with the broader economy, and the economy’s reaction to the effects of climate change, is a business-critical concern. That climate-related large-scale disruptive occurrences will continue to occur is both inevitable and foreseeable; however, their expected effect on supply chains is measurable, at least in broad terms. Furthermore, proactive management can, to an extent, mitigate these disruptions.

Mitigating exposure to indirect climate risk

We developed an approach to assess indirect climate risk to equities across financial portfolios, considering both the country exposure and sector vulnerability to climate risk for every country and sector globally, and the exposure to these countries and sectors in the extended supply chain of every sector in the world. Effectively, we were able to produce an aggregated score of exposure to climate risk weighted across the entire supply chain of any company or sector globally.

Reducing exposure to this risk by applying a portfolio strategy that incorporates indirect climate risk analysis may be expected to lead to a measurable increase in overall returns. To test this hypothesis, we conducted an experiment based on empirical evidence, applying our indirect climate risk scores to historical capital markets data. We constructed portfolios of equities, with and without the application of our indirect climate risk scores, to determine the difference in returns over a 10-year period.

Unlock exclusive climate and business insights—sign up for our newsletter today

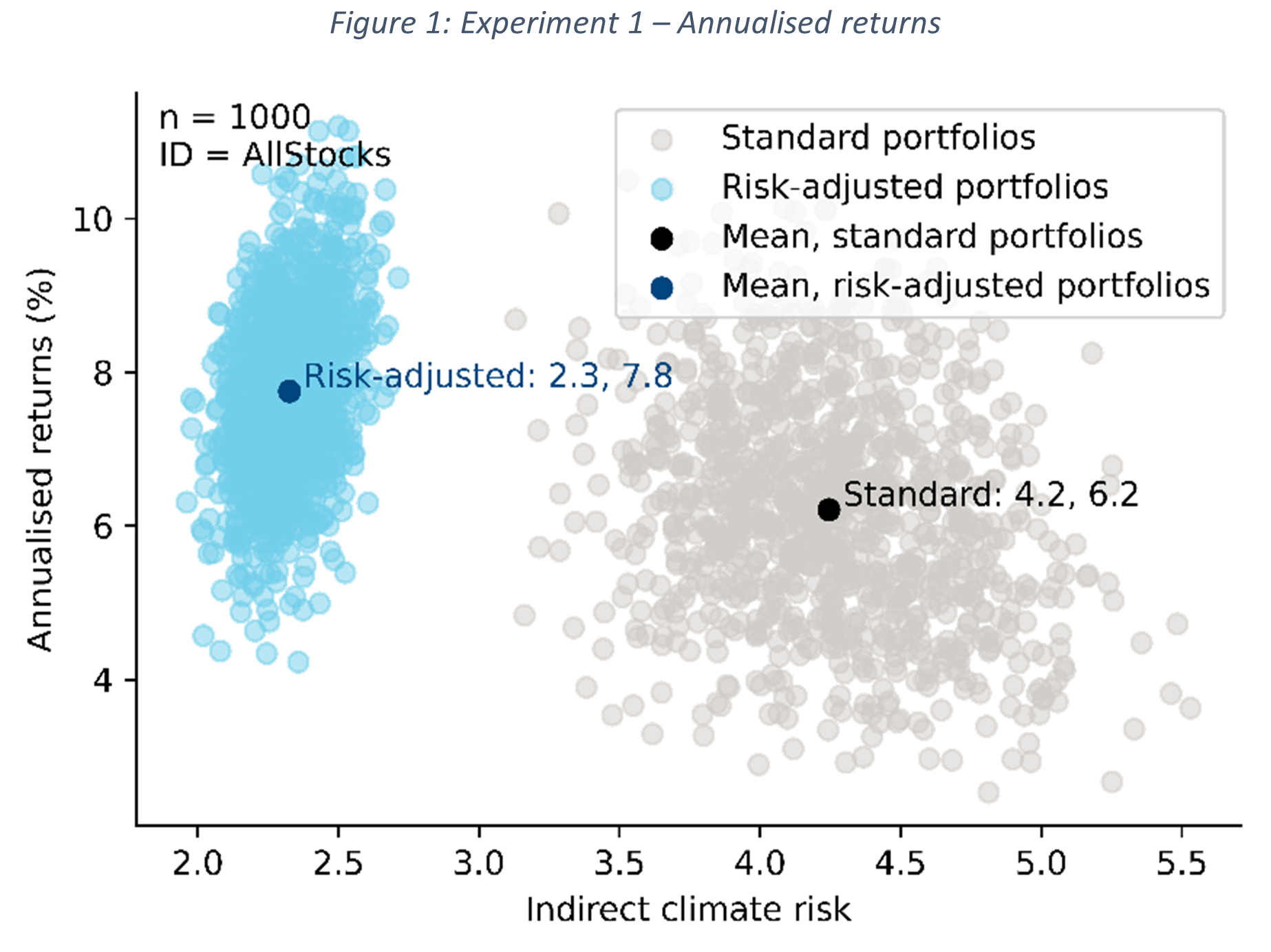

SubscribeThe total set of stocks were selected from the iShares MSCI ACWI ETF, an index made up of large and mid-sized developed and emerging market equities, from 1 July 2014 tracked to 30 June 2024. Within this set of stocks, over half of the firms were assessed as having higher indirect climate risk than direct climate risk. We find there is a statistically significant negative correlation between the indirect climate risk scores of the equities and their annualised 10-year total returns. The experiment also revealed that the mean total annualised return over 10 years in the risk-adjusted portfolios is 1.6% higher than that of the standard portfolios. Testing suggests the difference in performance is statistically significant.

As Figure 1 shows, there is greater variation in both the level of risk and returns in the standard portfolios, while the risk-adjusted portfolios performed better on average achieving both lower risk and higher annualised returns overall.

The experiment provides evidence that the application of our approach to measuring indirect climate risk does provide valuable information for portfolio analysis. It seems reasonable to infer that there is currently a gap in market information on indirect climate risks, which are effectively “hidden” from analysis that only focuses on direct climate risk. Climate risk is largely unprecedented, highly uncertain, potentially compounding, and increasingly persistent. It may be that currently the biggest blind spot in climate risk in financial analysis is in indirect climate risk hidden in supply chains. Addressing this blind spot will go a long way towards developing a comprehensive approach to climate risk.

The financial sector allocates resources by the laws of the market; one of which being that better information leads to greater efficiency. Better understanding of the impacts of climate change will lead to more efficient resource allocation. Firms and sectors that are particularly exposed will need to take action to mitigate that exposure or face restricted access to capital. Those that are more insulated or that actively address their exposure to climate change will attract more favourable access to capital. Greater understanding of indirect climate risk in financial analysis will therefore help build an economy that is more resilient to the effects of climate change. Our approach to indirect climate risk scores can act as a first step to better understanding exposure to this hidden climate risk.

Click on the button to read the full report:

Subscribe to our newsletters

Tags:

Related Reports

Key take-aways from COP30

COP 30’s agenda had placed a strong emphasis on countries’ implementation of their emissions reduction target and, for the first time, several workstreams included discussions on unilateral trade policies.

Find Out More

COP 30 in focus: How to stay the course on the path to Net Zero

EMDEs are projected to account for 70% of global CO₂ emissions by 2050, making accelerated emissions reductions in these economies essential. Yet gaps in AE leadership—such as US policy rollbacks and insufficient climate finance—risk slowing the global transition.

Find Out More

Advanced economy leadership is key to the low-carbon transition

We modelled how advanced-economy leadership in innovation and finance could accelerate a global low-carbon transition.

Find Out More

The changing energy order

To understand how the G20 countries are progressing in the energy transition, Oxford Economics PwC collaborated with PwC to create the Changing Energy Order Index. The index combines data from international economic organizations like the OECD and World Bank with with Oxford's own forecasts to evaluate each country's progress across five key pillars.

Find Out More