IFRS 9 and the BCST: How the Bank of England’s Latest Stress Test Measures Economic Shocks

Earlier this year, the Bank of England (BoE) published its updated stress test for the UK banking system, replacing the Annual Cyclical Scenario (ACS) with the new Banking Capital Stress Test (BCST).

This was the first stress test released by the Bank following the conclusion of the IFRS 9 ‘transitional arrangements’ which allowed banks to gradually adjust to the new regulatory requirements. Under the IFRS 9 accounting standard banks are required to record losses much earlier than under the previous accounting standard (IAS 39), thereby enhancing the capital buffers of lenders and thus the stability of the wider financial system.

The incorporation of IFRS 9 into banking system stress tests has led to changes in their methodology as well, as they now need to take into account the earlier provisioning under the new accounting standard. As a result, the Bank of England has recalibrated its scenario guidance, delaying the timing of peaks and troughs of key drivers of credit losses, as well as simplifying its methodology.

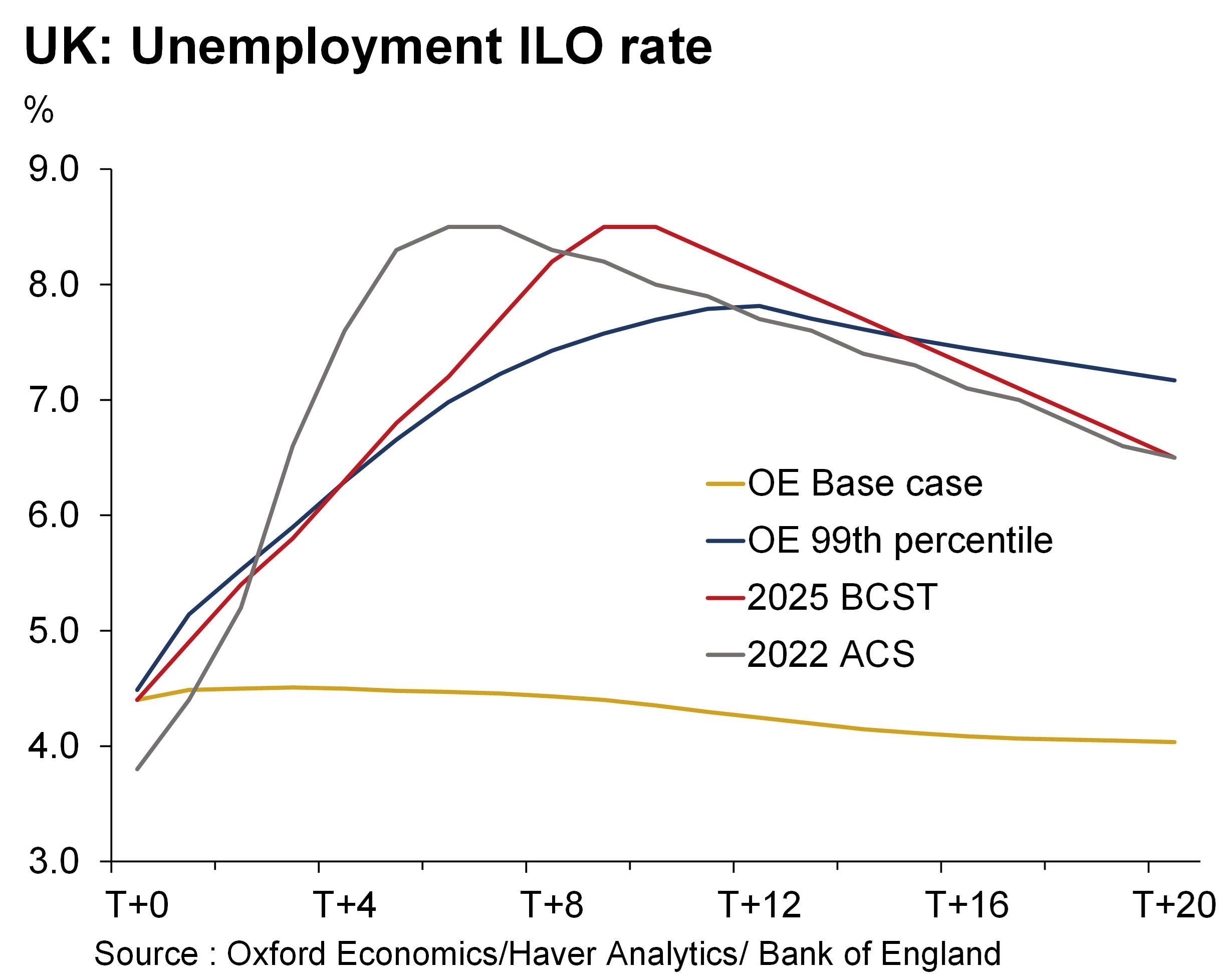

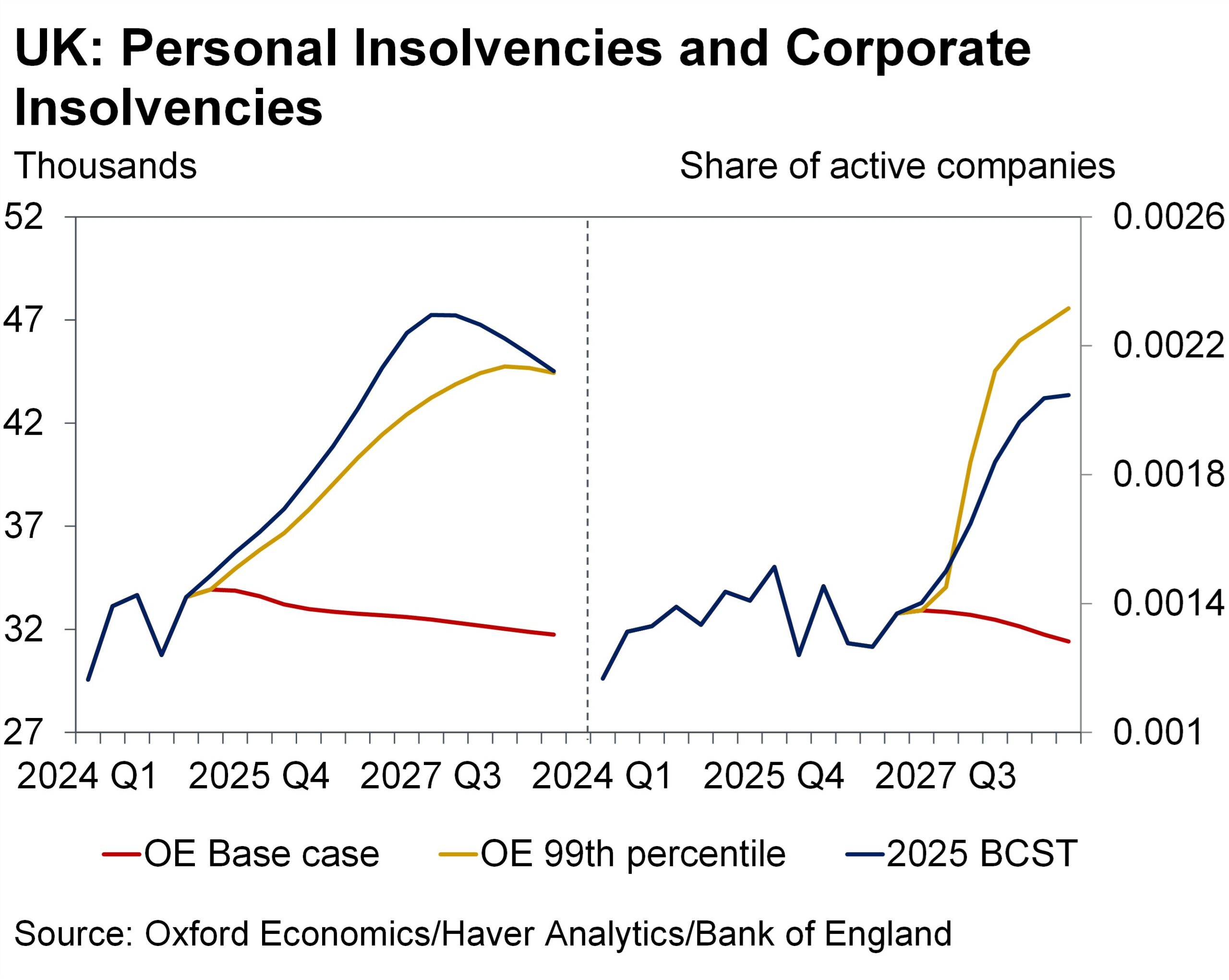

This new methodology results in the stress pathways being slightly less severe and unfolding more gradually than in previous updates of the stress test. When comparing the BoE’s updated guidance with our existing methodology for IFRS 9 scenarios, which is based on our proprietary dataset of 30-years of forecast errors, we find that the scenario projections now align even more closely. While the peak impacts observed in the BoE’s stress tests for key drivers of expected credit losses have always been broadly in line with our ‘99th percentile tail-risk scenario’, we now also observe better alignment in the build-up of the stress and the duration of the peak impacts. This supports the Bank’s additional reasoning for the update to the stress test methodology, namely, to enhance the consistency with historical experience. As our forecast-error based distributions incorporate a wide range of global downturns, such as the Global Financial Crisis and the Covid-19 pandemic, our scenario projections capture well country-specific dynamics and global repercussions from tail risk events.

Using the Global Economic Model, we expand the BoE’s guidance to generate a fully consistent global scenario, enabling us to draw wider inferences on the impact of the updated stress test guidance. In the UK, house prices suffer an outsized start-to-trough fall of 28% in the stress scenario. This significant pressure on the housing market is compounded by a surge in unemployment and an outsized drop in households’ real income. As a result, households struggle to keep up with their debt repayments and personal insolvencies increase rapidly to levels in excess to those recorded during the Global Financial Crisis. Similarly, on the corporate side falling revenues, low confidence and tighter credit conditions lead to missed payments and higher insolvency rates, as businesses face mounting cash flow pressures and are unable to service their debts.

Since the Bank of England has shifted to carrying out the Bank Capital Stress Test only every other year, our 99th tail risk scenario enables lenders to test the resilience of their business on an ongoing bases, thus providing a dynamic benchmark to the BoE’s stress scenario. In the current environment of elevated macroeconomic volatility and rapidly evolving baseline projections, this can be a helpful additional benchmark to test the resilience to global shocks.

Click here if you want to learn more about our ‘tail-risk’ scenario and IFRS 9 service.

Subscribe to our newsletters

Tags:

Related Reports

Navigating fundamental drags and policy drives for China’s manufacturing investment in 2026

Chinese manufacturing fixed investment shrank by 6.7% year-on-year in October, deepening the slump that began in July. We expect this decline to continue for most of H1 2026. The pace of recovery will depend on the policy support in the Fifteenth Five-Year Plan.

Find Out More

India’s GST reform benefits durables, but far from a game changer

Research Briefing IFRS 9 and the BCST: How the Bank of England’s Latest Stress Test Measures Economic Shocks

Find Out More

The Impact of Intelligent Operations

Our survey of 1,000 senior leaders from the manufacturing, retail, and transportation and logistics sectors shows that improving workflows translates to a range of benefits, from financial gains to improved customer satisfaction and employee productivity.

Find Out More

The Digital Frontier—can the AI hype go on forever?

We believe that the current AI hype in financial markets will only be justified if companies can adopt AI quickly and effectively. In The Digital Frontier series, we will evaluate the state of AI and data centre investment and explore implications for different countries, cities, and sectors.

Find Out More