Blog | 23 Mar 2021

The world is not flat

Economic growth and urbanisation have always gone hand in hand. It was true in Ancient China and in the Roman Empire, in England during the Industrial Revolution, and now in Africa and Asia. But is it really an iron law of economics or of history? And do such laws survive when faced with the grim realities of coronavirus? There are many media reports that residents of the world’s great cities are moving to smaller cities, to towns, or even to the countryside, to escape from congestion, and from the consequent health risks that the big cities supposedly pose. A major study of London has suggested that 700,000 people moved away from the UK capital in 2020.

The example of London is extreme, and we are sceptical whether the numbers are quite that high. But it is true that the UK capital has long been host to a very large number of EU migrants, many of them working in the hospitality, culture, and leisure sectors that have been decimated by the pandemic. No doubt a significant number returned home in 2020, due to Brexit as well as coronavirus. We will be publishing our own estimates of the overall numbers in April.

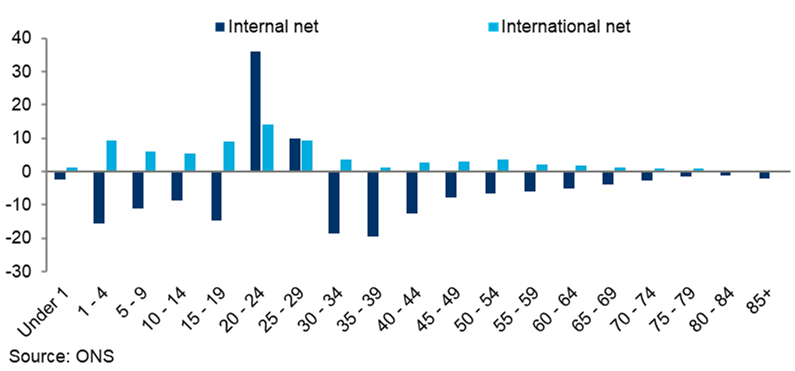

Either way, London illustrates an important point. As the chart shows, the normal pattern has been for adults in their early twenties to relocate to London from the rest of the UK and elsewhere, to study or work. But from their thirties onwards, people have always been more likely to move out of London than into it, taking their children with them, choosing to trade the hustle and bustle of the city for greater space and cheaper living costs. Coronavirus may have telescoped matters in 2020, but it did not mark a radical change of direction.

Domestic and international net migration, London, by age, 2019, 000s

Our expectation is that once vaccines become widely available for young adults and not just for older people and the highly vulnerable, then the reasons for ambitious young people to locate in those cities that are the most important nodes in the global economy will mostly reassert themselves.

The opposite view is that new digital technologies now provide a viable alternative to close proximity—or will do, once the next generation of apps appears in a few years or perhaps a few months’ time. So, the iron law of economics—that economies of scale are extremely powerful—jumps from the physical to the virtual world. Urban agglomerations give way to network economies, in which knowing people far away from you is as powerful a competitive advantage as knowing people close to you. Forget London: stay in Bordeaux.

But there is a chance that elements of both patterns will prevail. Young people will still want to move to the world’s most dynamic cities, and employers will still want to bring them together to build strong networks, share knowledge, and generate ideas. But then employers will actively encourage employees to relocate elsewhere, keeping their newly built networks in place virtually, but building new ones in other vibrant parts of the real world. The pattern of young inward migration into big cities and mature outward migration will become stronger, and the outflows will perhaps start earlier and become more focused on exciting satellite locations. If so, then there is smart money to be made spotting where people will move to. Bordeaux, anybody?

Tags:

You may be interested in

Post

Little by little—Manchester is closing the output gap

Greater Manchester has led the UK economy since 2008, driven by knowledge jobs, transport upgrades, and housing growth—but can prosperity reach its outer districts?

Find Out More

Post

Asia’s cities are reshaping the world

From Seoul to Delhi and Shanghai, Asia’s urban centres are rapidly overtaking global rivals as living standards soar. What will this mean for the balance of global economic power?

Find Out More

Post

The rise of Southern India’s business service hubs

Over the next five years, India is set to be one of the fastest-growing major economies across Asia Pacific, lead by the performance of its IT and business services. The Southern states of Karnataka and Telangana are at the forefront of this success as they are home to two of India’s most rapidly growing cities and productive cities—Bengaluru and Hyderabad.

Find Out More