Blog | 27 Feb 2024

What Could Cause the ‘Magnificent Seven’ Stocks Bubble to Burst?

Daniel Grosvenor

Director of Equity Strategy, Macro Forecasting & Analysis

In the dynamic world of the US equity market, the spotlight intensifies on a select group known affectionately as the ‘Magnificent Seven’. These titans—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla (although Tesla’s market cap has recently been surpassed by Eli Lilly)—forge ahead, propelling US equity indices to unprecedented concentrations. Yet, as 2024 unfolds, questions loom: Will the megacap dominance persist? What could potentially burst the megacap bubble?

The megacap dominance

The US equity market continues to be driven by a very small number of stocks. Having beaten the broader benchmark by almost 30% in 2023, the top 10 constituents of the S&P 500 have outperformed by a further 3% this year. This performance has pushed their weight in the index to a record level – they now make up 32% of total market capitalisation, around 6ppts higher than the weight of the top 10 stocks at the height of the late 1990s tech bubble.

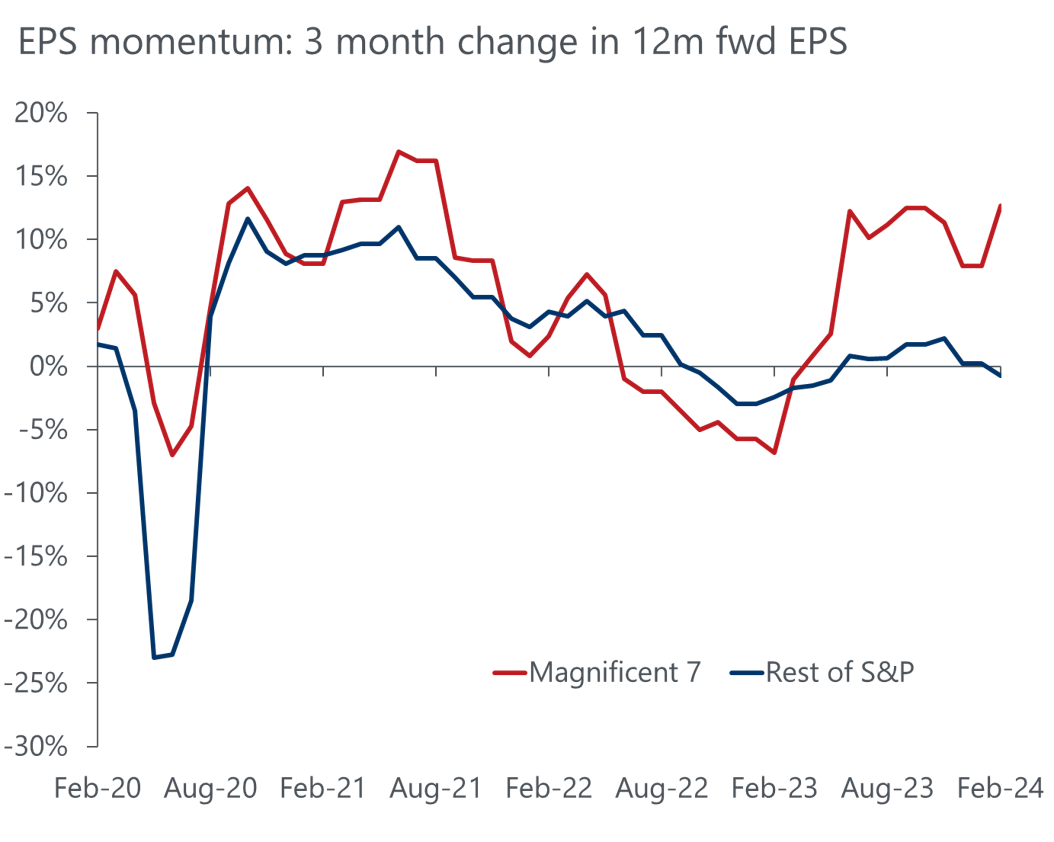

The Magnificent Seven account for the bulk of the top 10. The outperformance of these stocks has been underpinned by their superior EPS growth over the past year and momentum has remained strong in the latest reporting season. Although their results have not been uniformly positive, they have surprised to the upside in aggregate and analyst forecasts for their combined EPS have continued to move higher. In contrast, results for the broader equity universe, particularly smaller companies, have been relatively lacklustre and the gap between the Magnificent Seven’s EPS momentum and the rest of the market remains elevated.

The Magnificent Seven’s performance is underpinned by strong EPS momentum

Although there are few signs that the performance of these stocks is fading, the dominance of such a small number of firms and the high degree of correlation between them increases risks for investors. A reversal in their fortunes could weigh heavily on the overall market and on investors’ trading strategies which have been leveraging their strong momentum.

The Lurking Risks

Despite the recent successes, it may become increasingly challenging for the Magnificent Seven to surpass analyst expectations this year. At the beginning of 2023 the consensus forecast was for just over 10% EPS growth for the Magnificent Seven in aggregate. This was easily surpassed as the group’s profit margins rebounded following the sharp decline in 2022. This year, the consensus forecast is for a further 22% rise, predicated on profit margins moving to a record high.

Although developments in artificial intelligence may help to boost the profitability of these companies in the medium-term, a lot of upside already appears to be baked into consensus expectations. This leaves room for disappointment. Indeed, history suggests that it takes a long time to see the benefits of technological change and there is no guarantee that these particular companies will be the ultimate winners. They may see their profitability eroded as competition between them and from new entrants increases.

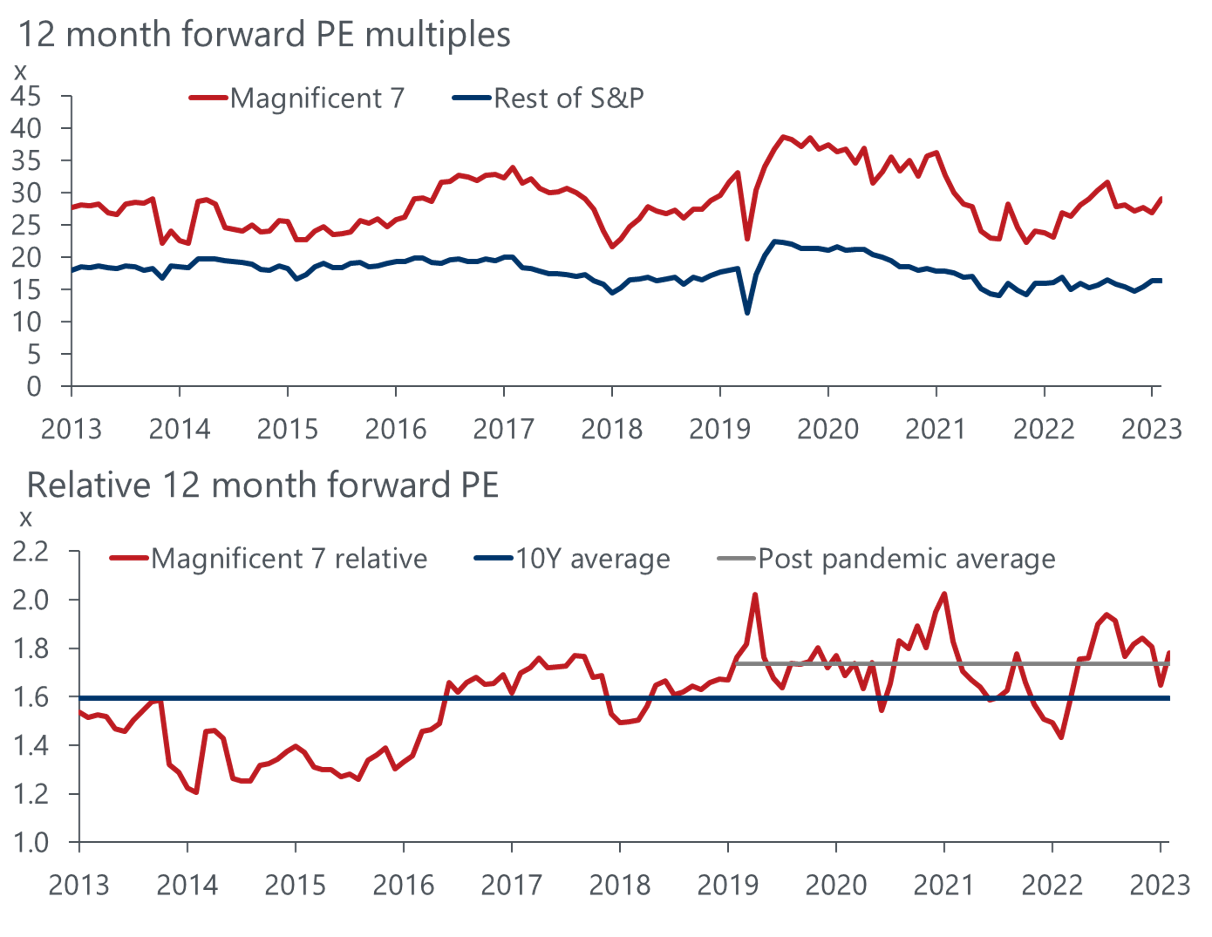

Moreover, the valuations of the Magnificent Seven are beginning to look stretched again. The group currently trades on an average 12-month forward PE of 29x compared to just 16x for the rest of the S&P 500 index (top panel of the chart below). This premium is well above its decade average and is now also above its post-pandemic average (bottom panel of the chart below).

The Magnificent Seven’s multiples are beginning to look stretched again

This elevated premium has persisted despite bond yields remaining well above their average over the period, which should weigh more heavily on the valuations of long-duration growth stocks. Our frameworks suggest that these parts of the market could be vulnerable to a correction if inflation proves stickier than expected and bond yields continue to move higher in the near term. The Magnificent Seven underperformed alongside the initial sharp rise in yields in 2022 and they also struggled to beat the wider market in Q3 last year as bond yields spiked, despite their superior earnings performance.

These stocks could also be vulnerable to a rise in policy uncertainty ahead of the US Presidential election in November this year. The tech sector remains under the regulatory spotlight from an antitrust perspective, and this is likely to be a key issue for the Democrats on the campaign trail.

The Magnificent Seven could also be exposed to an increase in uncertainty over trade policy. As a group they generate a much higher proportion of their revenues outside of the US than the broader S&P 500 universe and they have meaningful exposure to mainland China and Taiwan. In recent years their relative returns have had a negative correlation with measures of trade uncertainty, in line with other globally-oriented companies.

Analysis from our macro strategy team suggests there is a modest tendency for index concentration to revert over time; high levels of concentration are followed by underperformance of the biggest stocks. But the relationship is relatively weak particularly over a short time horizon, and a catalyst is needed for the reversal.

For investors and strategists these developments underscore the importance of vigilance and adaptability. The allure of the Magnificent Seven remains compelling, yet the evolving macroeconomic and regulatory backdrop necessitates a nuanced approach to trading strategy and asset allocation.

For more analysis from Daniel and our macro strategy team, click here to visit our asset management topic page.

Disclaimer

Analysis and information provided to clients by Oxford Economics through its macro strategy services is for research purposes only and does not constitute an offer to sell or buy any security or a recommendation to do so. Research and publications provide information and analysis that Oxford Economics believes to be accurate and are published with the understanding that neither the analyst nor Oxford Economics are providing investment advice; anyone who needs investment advice should consult an investment professional.

Author

Daniel Grosvenor

Director of Equity Strategy, Macro Forecasting & Analysis

+44 (0) 203 910 8106

Private: Daniel Grosvenor

Director of Equity Strategy, Macro Forecasting & Analysis

London, United Kingdom

Daniel is an equity strategist, responsible for developing our equity views across countries, sectors and investment styles. He joined Oxford Economics from HSBC, where he spent a decade working within their global equity strategy team, in both London and Hong Kong.

Tags:

Related Reports

Click here to subscribe to our asset management newsletter and get reports delivered directly to your mailbox

Indirect climate risk in financial analysis

Strategy Key Themes 2025: Opportunities amid heightened uncertainty

Gold rush will lose steam, but still a good strategic bet

Economics for Asset Managers

Read more of our analysis and reports on asset management and economic outlook.

Read more: Economics for Asset Managers