Blog | 08 Aug 2024

Small-cap stocks outperformance has further room to go

Alessandro Theiss

Director, Financial Modelling and Scenario

Small-cap stocks rallied sharply throughout July, boosted by lower-than-expected US inflation prints. However, they have not been immune to the recent equity market sell-off and have underperformed as US recession fears have risen. So, is this already the end of the small cap universes’ relative recovery? We don’t think so. We think US recession fears are overdone and believe small caps will be the key beneficiaries of our soft-landing view.

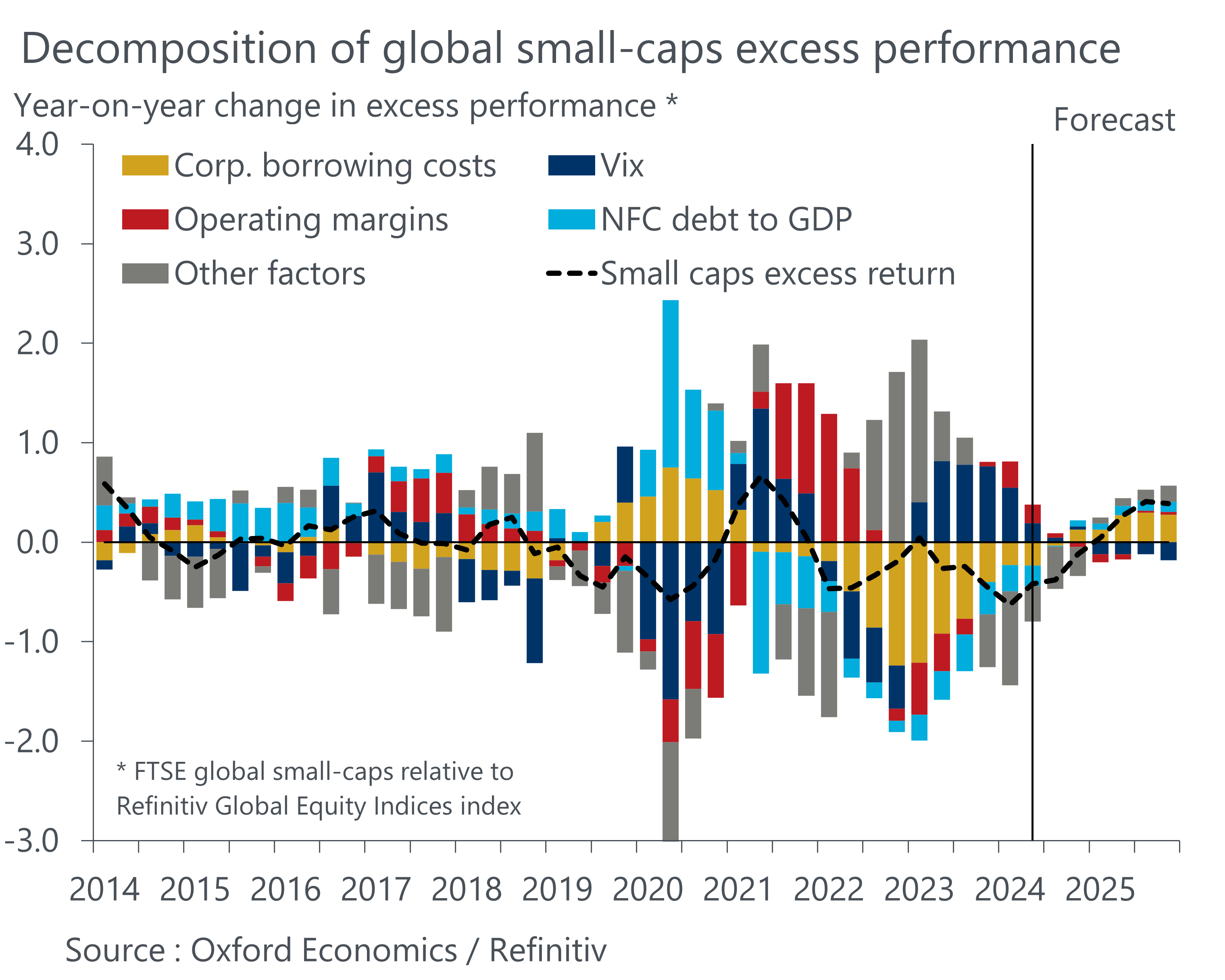

At the start of 2024 we developed a new model framework to gauge the potential upside for the global small-cap universe. Our model had suggested that the underperformance of small caps since 2018 may have run its course and that the outlook for the rest of 2024 and beyond is likely to be more upbeat. The timing of the expected outperformance has proved slightly premature, as the strong performance of global equities in H1 remained very top-heavy and as inflation proved to be stickier than we had anticipated, leading us to delay our forecast for a first Fed rate cut. But with disinflation now firmly underway, the key factors underpinning our prediction remain in place.

Based on our latest baseline forecast, our model points to outperformance of nearly 5% y/y for global small caps over the next twelve months, and more than 8% by end-2025. This compares to a decline of around 20% vis-à-vis the broad market from the peak in Q3 2018.

In line with the latest Fed guidance, we expect a first rate cut to be implemented in September, with a second cut anticipated before the end of the year. This, combined with our view that credit spreads will remain tight, suggests that corporate borrowing costs are at their cyclical peak and will start falling from here. This will be a relative boon for small caps given their generally weaker balance sheets compared to larger companies.

Indeed, small caps have been at the epicentre of investors’ concerns over rising interest rates throughout the past couple of years due to their greater reliance on short-term loans for funding and their relatively low solvency ratios. As we move into a monetary easing cycle, we also expect corporate deleveraging to bottom out, and anticipate leverage to pick up modestly again, which has typically been consistent with small-cap outperformance.

Small-cap earnings growth is also nearing a trough and we forecast a strong cyclical recovery over the next few quarters, supported by a manufacturing upturn and an easing of wage pressures. This should help to close the EPS growth gap with the large cap universe, following a prolonged period of small-cap underperformance.

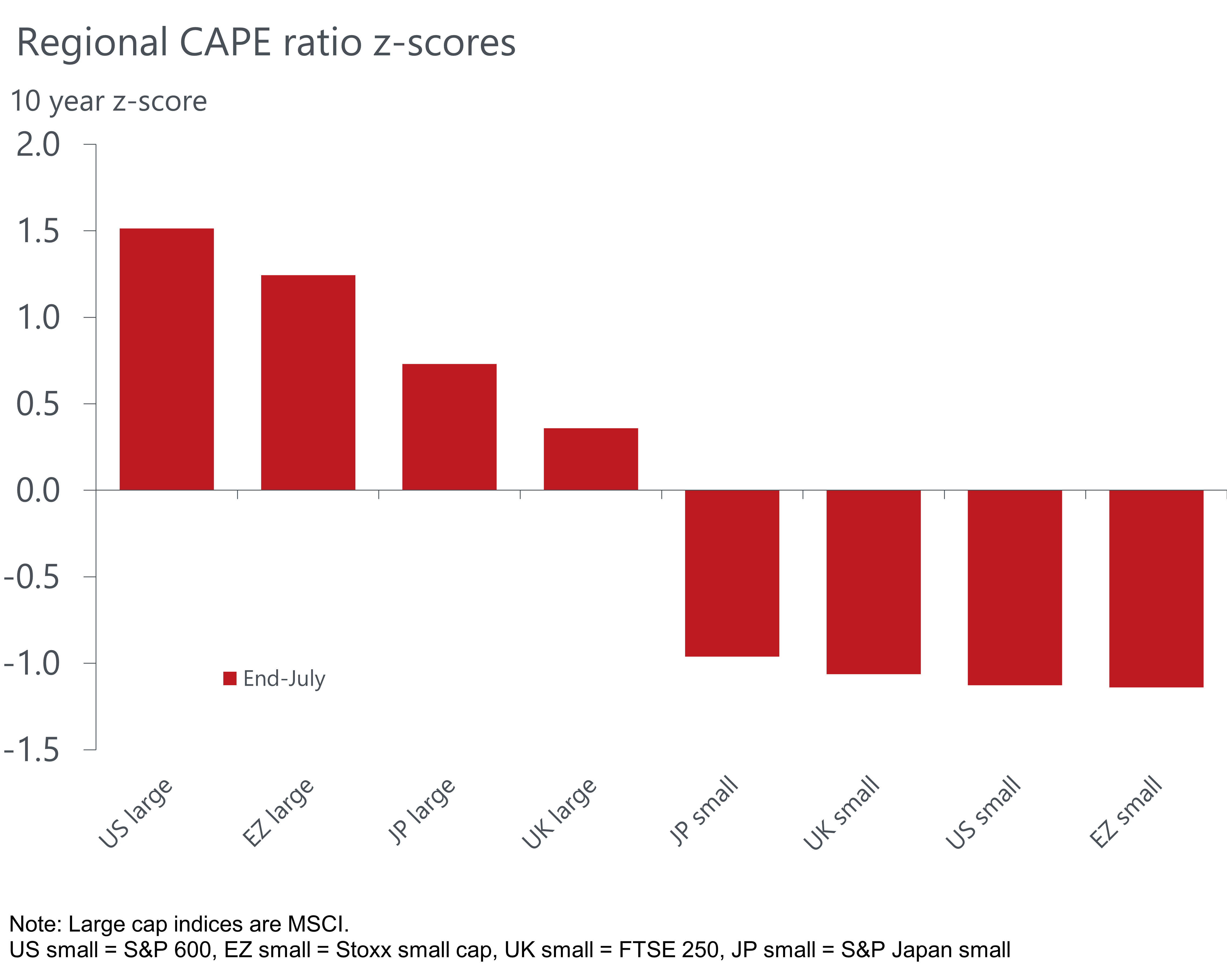

Beyond the support from these fundamental drivers, small caps should also benefit from their low starting valuations. Small-cap stocks continue to trade on exceptionally cheap valuation multiples compared to large caps, with sentiment in the large-cap tech space looking particularly stretched. As the global economy heads for a soft landing and investors rotate away from expensive tech names, we think small caps are likely to be the relative beneficiaries.

Authors

Alessandro Theiss

Director, Financial Modelling and Scenario

+44 (0) 203 910 8009

Alessandro Theiss

Director, Financial Modelling and Scenario

London, United Kingdom

Alessandro supports clients across the globe with a broad range of macro-financial consulting work. Projects span the modelling of returns across different asset classes, building bespoke economic models for clients and the development of narrative-based and statistical macroeconomic scenarios. Alessandro also oversees Oxford Economics’ IFRS 9 and CECL services which support clients with calculating expected losses. Previously he worked as a Senior Economist within Oxford Economics’ Global Macro team, forecasting the Chinese economy and writing research publications for the Global Macro Service.

Before joining Oxford Economics in 2013, he gained work experiences in the research department of Deutsche Bank in the Economic and European policy issues team and at the Investment Bank division of UBS in the economic research team for Switzerland.

Daniel Grosvenor

Director of Equity Strategy, Macro Forecasting & Analysis

+44 (0) 203 910 8106

Private: Daniel Grosvenor

Director of Equity Strategy, Macro Forecasting & Analysis

London, United Kingdom

Daniel is an equity strategist, responsible for developing our equity views across countries, sectors and investment styles. He joined Oxford Economics from HSBC, where he spent a decade working within their global equity strategy team, in both London and Hong Kong.

Tags:

Related Reports

Click here to subscribe to our asset management newsletter and get reports delivered directly to your mailbox

Indirect climate risk in financial analysis

Strategy Key Themes 2025: Opportunities amid heightened uncertainty

Gold rush will lose steam, but still a good strategic bet

Economics for Asset Managers

Read more of our analysis and reports on asset management and economic outlook.

Read more: Economics for Asset Managers