Recent Release | 07 Jun 2023

The future of trade and B2B payments

Macro Consulting Team

Oxford Economics

Cross-border trade and business payments are shifting in real time. To help identify opportunities amid volatility, this new report by Convera and Oxford Economics offers insights into how global trade will evolve in coming years.

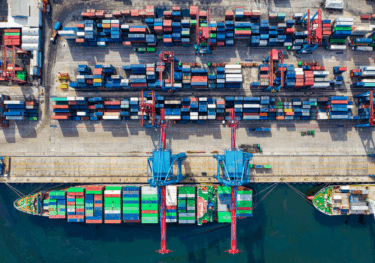

Global trade has remained remarkably resilient in recent years despite significant disruptions from the pandemic, war, and a shifting geopolitical landscape. Going forward, trade will remain an engine of global economic growth, but there will be a reconfiguration of the global trade landscape to adapt to emerging geopolitical, economic, and environmental realities.

B2B relationships are, and will continue to be, a critical component of global trade growth, supported by enablers such as currency exchange. Government policies will be key in this area. However, any products and technologies that help to simplify and reduce cross-border frictions will also play a pivotal role in driving healthy global trade.

The experts behind the research

Lloyd and Padmasai, members of the Macro Consulting team, a group of world leaders in quantitative economic analysis, working with clients around the globe and across sectors to build models, forecast markets and evaluate interventions using state-of-the art techniques.

Lloyd Barton

Associate Director, Macro Consultancy

Padmasai Varanasi

Senior Economist, Macro Consulting

Tags:

Recent trade-related reports

Global Key themes 2026: Bullish on US despite AI bubble fears

We anticipate another year of broadly steady and unexceptional global GDP growth, but with some more interesting stories running below the surface.

Find Out More

US Bifurcated ꟷ Economic backdrop deepens racial disparities

Black and Hispanic households have experienced more inflation than other groups since the reopening of the economy from the pandemic lockdowns. Although there've been many phases of high inflation, some have disproportionately hurt these minority groups, such as the jump in energy prices following Russia's invasion of Ukraine, with the ensuing surge in rental inflation further setting them back.

Find Out More

China and AI underpin stronger global trade outlook

Global trade is set for a stronger-than-expected rebound, supported by lower US tariffs, continued AI-driven investment, and China’s renewed export push. Our latest forecasts show upgrades to both nominal and volume trade growth in 2025–26, even as legal uncertainty surrounding US tariff mechanisms and evolving geopolitical dynamics pose risks to the outlook.

Find Out More

US Shipping freight rates on track to stay low in 2026

Our supply chain stress index moderated in September as import volumes continue to decline following front loading activity earlier this year. High frequency data shows that this trend has kept up in Q4, meaning port congestion is unlikely to become a concern.

Find Out More