Blog | 02 Sep 2022

In the teeth of a real estate price correction as debt costs rise

Mark Unsworth

Director, Real Estate Economics

Global commercial property prices were barely affected by the pandemic despite the fall in output and changes in the structure of the economy, such as the heightened demand for goods over services and increased home working. But higher interest rates in the wake of the pandemic are changing this picture and bringing a belated impact back to commercial property markets. High debt costs suggest a pricing correction is needed, with US industrial real estate to move 13% lower and European office properties 12.5% lower according to our estimates, based on the best buildings in gateway markets.

Central banks continue to aggressively tighten policy rates with price pressures rife across goods and services, suggesting that a rapid return to price stability is unlikely despite commodities making their way back to multi-year averages. Significant regional disparities do exist, though, with natural gas prices that are more than 10 times higher in Europe than in the US. Nonetheless, the global economy is now likely to be slowing under the strain from higher rates and inflation.

This has meant the cost of debt for a real estate acquisition has significantly increased since the start of the year, as interest rate swaps have increased alongside the margin a lender applies to a real estate loan (as the probability of default rises in a worsening economic environment).

Real estate is a slow-moving beast, with few property agents willing to move their prime yields since the Ukraine-Russia war without clear evidence of a shift in market pricing. Pricing expectations between buyer and seller have widened over recent months, causing transactional activity to slow. According to MSCI Real Capital Analytics, the annual investment volume was down 19% y/y and 24% y/y in Europe and Asia Pacific respectively in the second quarter, while remaining stable in the US. A period of price discovery set to take place during the second half of the year will ultimately provide more transactional evidence to support a repricing at the prime end of the market.

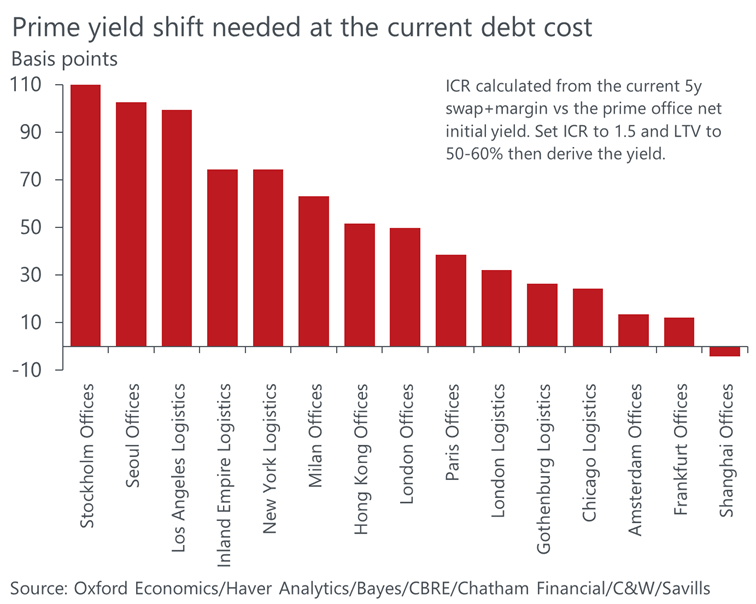

Our global analysis continues to suggest the prime segments of select European and Asia Pacific offices, alongside US industrial are most exposed to a pricing correction, with Stockholm and Seoul offices, as well as Inland Empire, Los Angeles, and New York logistics warehousing leading the way.

Assuming a loan that’s 50% to 60% of value and at a low-risk interest coverage ratio, investors require a 26% price correction for the Stockholm office market, taking prime yields to 4.2%, up 110 bps from the current prime yield. A 25% correction is needed for the Los Angeles logistics market, with prime yields moving out by 100 bps to 4%. Also in Europe, the Milan and London office markets require prime yields to correct by 65 bps and 50 bps. In the Asia-Pacific region, we estimate that the office markets of Seoul and Hong Kong should see a pricing correction of 25% and 15% respectively, a big shift from no correction implied just three months ago.

Author

Mark Unsworth

Director, Real Estate Economics

Mark Unsworth

Director, Real Estate Economics

London, United Kingdom

Mark is responsible for the UK and European Real Estate Economics Service having joined Oxford Economics in 2021 following 6 years at Cushman & Wakefield as Partner – Head of EMEA Forecasting. At Cushman, Mark led the quarterly city-level property forecasting service, produced pan-European property market consultancy reports and authored a range of content on cyclical and thematic issues. Prior to that Mark spent 7 years at GIC Real Estate as an Assistant Vice President in their Global Research & Strategy team focussing on European market analysis, investment strategy and asset allocation.

Tags:

You may be interested in

Post

The impact of Trump’s presidency on US commercial real estate

The policy implications from a second Trump presidency are expected to affect US commercial real estate (CRE) through curbed immigration, tax cuts, and increased tariffs. However, CRE's relative pricing to bond yields will probably most influence values in the short term.

Find Out More

Post

The case for higher transaction volumes in 2025 and beyond

Global CRE transaction volumes are near decade lows, but a convergence of powerful trends is set to ignite a strong rebound.

Find Out More

Post

Global Asset allocation boosts industrial, raising concentration risk

Based on our analysis, most investors are likely to allocate heavily towards industrial and away from offices over the next five years.

Find Out More