Ungated Post | 07 Jan 2021

Democrat-controlled Senate favors a Biden-lite agenda in 2021

With Democrats winning the two Georgia Senate runoff races, they will hold a “soft” 50-vote majority. Control of the Senate will allow President-elect Biden to enact more of his ambitious fiscal agenda while boosting prospects for more fiscal stimulus and more rapid economic growth in 2021-22.

We expect additional fiscal stimulus will come in two forms. Congress will likely pass, on a bipartisan basis, additional stimulus checks totaling $1,400 per person on top of the $600 checks passed at the end last year. Thereafter, President Biden will attempt to pass some of his spending and tax proposals via the budget reconciliation process requiring only a simple majority.

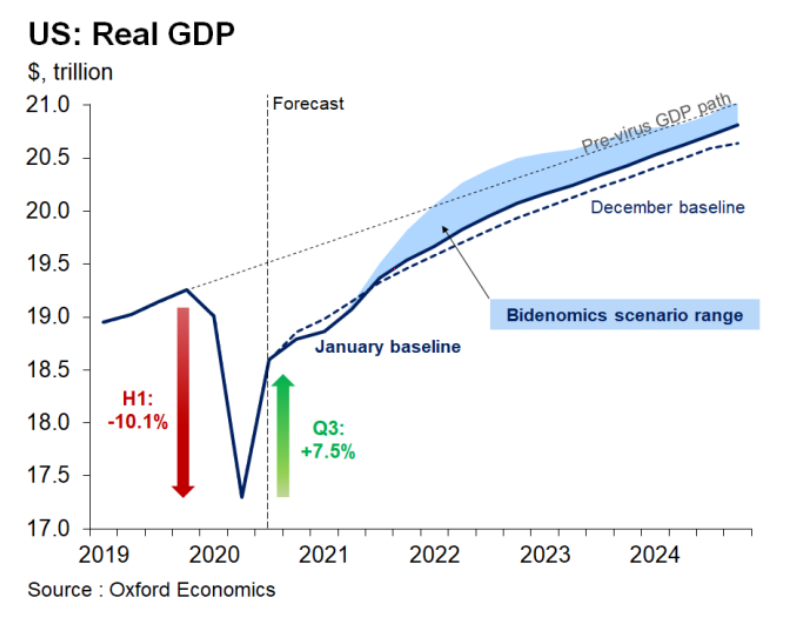

The third round of stimulus checks should lift GDP by 0.7%. We forecast real GDP growth will average 4.3% in 2021, following an anticipated 3.4% contraction in 2020. While worsening health conditions will weigh on growth in the near-term, policy risks appear tilted to the upside with real GDP likely to advance around 3.9% y/y in Q4 2021, versus 3.2% y/y in the December baseline.

Any potential boost from a Biden-lite scenario will depend on the timing, size and composition of the final package. Our pre-election scenario analysis showed that Bidenomics could lift real GDP growth by around 1.2ppts.

Tags:

You may be interested in

Post

Oxford Economics announces a leadership transition for the next phase of growth

Oxford Economics, the world’s leading economic forecasting and advisory firm, announced today the appointment of Innes McFee as its new Chief Executive Officer, effective 4th December.

Find Out More

Post

Oxford Economics launches enhanced Real Estate Economics Service

Oxford Economics is pleased to unveil its enhanced Real Estate Economics Service, now covering 100 global cities.

Find Out More

Post

Oxford Economics Acquires Majority Stake in Alpine Macro

We're excited to share that Oxford Economics has acquired a majority stake in Alpine Macro, a prominent global investment research firm based in Montreal, Quebec, Canada.

Find Out More