Ungated Post | 07 Aug 2020

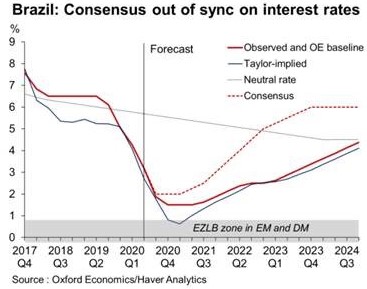

Chart of the week: Why ending the easing cycle in Brazil now would be a mistake

Innes McFee

CEO

This week the Banco Central do Brasil (BCB) lowered the Selic rate to 2.00%. Although our baseline scenario is for further rate cuts in the coming months, our Taylor rule suggests that rates should go even lower, between zero and 1%. We continue to believe the BCB will eventually be forced to cut rates again in the coming months and it won’t need to hike by as much as markets currently price in.

Tags:

You may be interested in

Post

Oxford Economics announces a leadership transition for the next phase of growth

Oxford Economics, the world’s leading economic forecasting and advisory firm, announced today the appointment of Innes McFee as its new Chief Executive Officer, effective 4th December.

Find Out More

Post

Oxford Economics launches enhanced Real Estate Economics Service

Oxford Economics is pleased to unveil its enhanced Real Estate Economics Service, now covering 100 global cities.

Find Out More

Post

Oxford Economics Acquires Majority Stake in Alpine Macro

We're excited to share that Oxford Economics has acquired a majority stake in Alpine Macro, a prominent global investment research firm based in Montreal, Quebec, Canada.

Find Out More