European struggles are slowing the global industrial upturn

By Dominic Dobryniewski

- Europe’s industrial recession continues to take its toll: the EU’s industrial output expected to shrink by 0.7% in 2024, a significant downgrade from our previous forecast of 0.1% growth, with a key reason being the lingering effects of previous interest rate hikes by the European Central Bank (ECB).

- While Europe struggles, the US is projected to see a 1.9% growth in industrial output in 2024, bolstered by recovering sectors like automotive and high-tech. Meanwhile, China is on track to experience a robust 5.5% growth in industrial output this year, but with momentum slowing on the way to next year.

Europe’s industrial recession is set to continue to be a key drag on global industrial output growth this year, as continued drops in German output and less positive momentum elsewhere, partially attributed in part to the impact of previous interest rate hikes, have dashed hopes for even modest European growth in 2024.

Our latest forecasts for the global industrial sector, based on September data, show that the EU’s industrial output will shrink by 0.7% this year, a massive downgrade from our previous forecast of 0.1% growth. Not only has the recession been deeper than previously anticipated, but we have also pushed back the speed and scope of the recovery—it tentatively looks like EU value-added industrial output bottomed out in Q1 but gains since then have been marginal at best and certainly below expectations.

ECB’s rate cut is here, but not enough to save the day

The main culprit we see for Europe’s decline is the impact of past monetary policy tightening by the European Central Bank, which raised rates from zero to 4.0% between July 2022 and September last year, although it has ordered two cuts since then, with the most recent one announced on Sep 12th. The impact of the interest rate hikes of the past years has been somewhat obscured by high backlogs in typically interest-sensitive sectors like capital goods, construction, and automotive sectors that helped power production despite waning new demand. However, that support is now fading, and the true scope of the hit to interest-sensitive sectors is becoming clearer. As such, we have cut our forecast for the eurozone’s industrial growth in 2025 to 2.7% from 3.0%. While the ECB’s pivot to interest rate cuts should help turn the tide, it will take time for the positive impacts to be felt. Just like when interest rates were coming up, there is a substantial lag between rates changing and the effects being felt in the real economy.

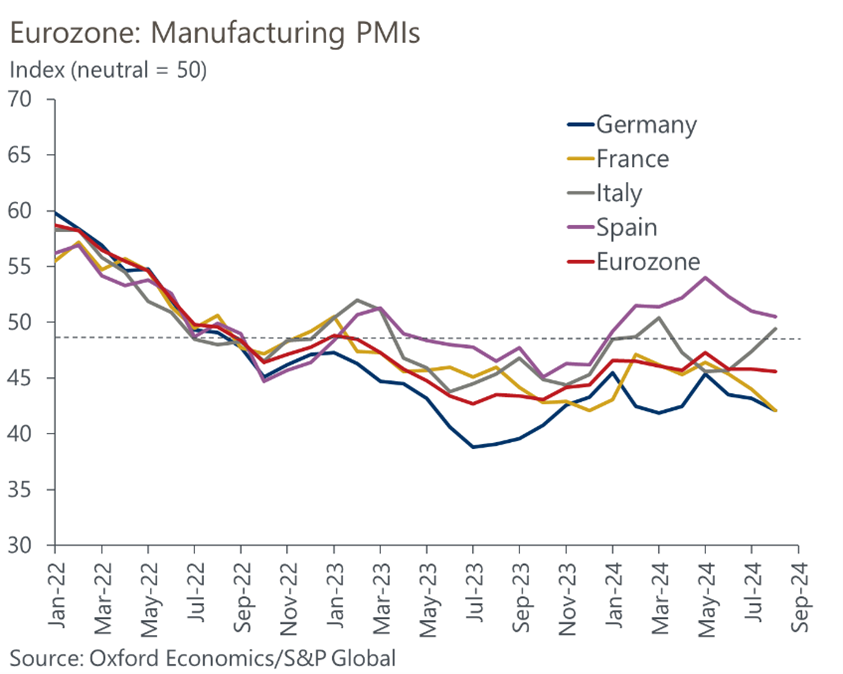

The industrial rebound does not seem to be materialising as quickly as we had forecast, with monthly industrial production figures in Germany in particular yet to find a bottom. As Fig 1. shows, sentiment in major eurozone economies such as France, Germany, and Italy have been trapped in contractionary territory for almost two years. While there have been various fits and starts of recovery in terms of survey responses, it has thus far always been followed by a collapse back to negative territory.

Fig. 1: Eurozone manufacturing sector continues to decline

The EU struggles while the US and China grow

The poor outlook for European industrial output offsets positive signs in the other major global economic powers, with the United States’ industrial output forecast to grow by 1.9% in 2024 while China is expected to enjoy a relatively strong whole-year industrial growth of 5.5% this year.

Bolstered by a strong start to 2024, Chinese industrial production grew solidly in the first two quarters—about 1.1% in each—supported by strong goods export growth, which helped make up for sluggish domestic consumption. The external support should fade over the coming quarters as export growth slows, which will weigh on industrial output. Indeed, monthly growth has already been slowing on a year-on-year basis, which we expect will continue into 2025, setting the stage for a notably slower industrial expansion.

Unlock exclusive economic and business insights—sign up for our newsletter today

We forecast US value-added industrial production increasing by approximately 1.9% this year, above 2023’s levels. Higher interest rates are still dragging on capital goods sectors like mechanical engineering and electrical machinery, but the drag is lessening, and so growth is gaining momentum and should be fully back by 2025. Automotive and high-tech sectors, in particular semiconductors and telecommunications equipment, are standing out as growing more strongly.

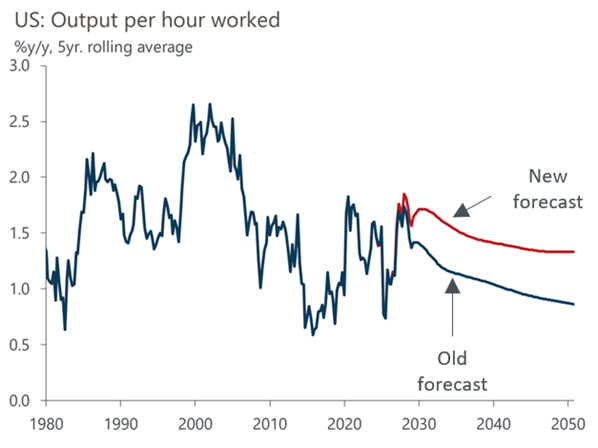

The US’s industrial economy is set to move further ahead of its rivals over the coming decades. We have recently revised our view about the long-run prospects of the US economy: we now expect higher productivity growth through 2050, due in part to the adoption of new technologies like generative AI. As Fig. 2 shows, our forecast has raised the average growth rate output per hour worked significantly through 2050. Our analysis of the sectoral implications of this productivity shift is ongoing, and we expect to publish research in the coming months laying out which sectors are poised to benefit the most. Our initial view is that while the service sectors will gain more from these changes, parts of industry, for example electronics production, should also benefit.

Fig. 2: Significant increase in forecast growth in productivity

Download the full report for in-depth insights

The analysis forecasts in this blog are backed by our Global Industry Service, which provides forecasts and insights for over 100 sectors in 77 countries. To unlock the power of these industry insights for your business, request a free trial by clicking here.

Tags:

Related Reports

European struggles are slowing the global industrial upturn

Global enterprise tech spend pushed by secular, pulled by cyclical