Turbulence for interest-sensitive sectors in eye of rate hike storm

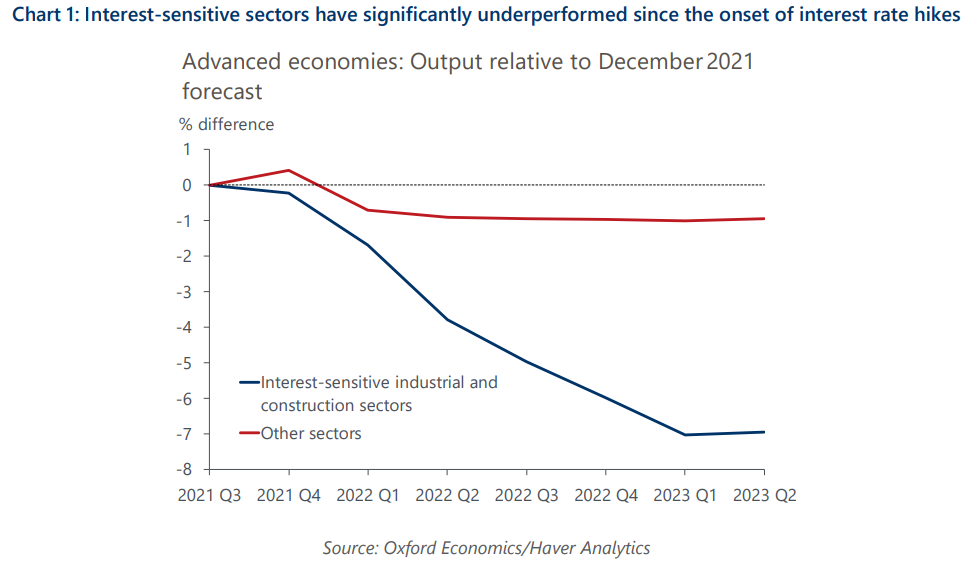

Much of the recent industrial underperformance in advanced economies is consistent with a slowdown triggered by the monetary policy shock that started in December 2021, our analysis shows. This reinforces our view that interest-sensitive sectors that have been struggling will continue to perform particularly poorly in the coming quarters as we enter the period of peak negative economic impact from interest rate increases at the end of 2023 and beginning of 2024.

What you will learn:

- We classify interest-sensitive sectors as those that are capital-dependent, capital-intensive, or related to such sectors. Using this method we identify utilities, extraction, residential construction, various manufacturing sectors including mechanical engineering, industrial & building materials, and metal products, as well as R&D and ICT as potentially interest-sensitive.

- Of the capital-intensive and capital-dependent sectors, only transport equipment, which has had idiosyncratic growth drivers over the past 18 months, and the service R&D and ICT sectors, which have high return on investment, have been performing strongly either in absolute terms or relative to our pre-interest rate hike forecast. We expect momentum in these to fade in next year, particularly in transport equipment.

- We do not expect structurally higher interest rates to materially impede industrial growth in the medium to long run. Historically the level of interest rates has not corresponded with structurally higher or lower sectoral growth as consumers and businesses adjust to the new equilibrium. However, we do not see higher growth kicking in meaningfully until the latter half of 2024 and start of 2025.

Tags:

Related Posts

Post

Electrical Machinery & Apparatus: Global Industry Forecasts

Discover the latest insights into the global electrical engineering & apparatus outlook with our new chartbook.

Find Out More

Post

Risks to US industry from election skew to the downside

Our baseline forecast is for some form of divided government that will not alter the current trajectory of industrial growth. If either side achieves a governing trifecta and fully implements its agenda there are, however, differences: the growth consequences are mostly negative under former president Trump and mostly positive (albeit very marginal) under Vice President Harris.

Find Out More

Post

Quantifying the hit to industry from a second Trump presidency

Using our Global Industry Model, we have modelled the sectoral impacts of two scenarios in which former President Donald Trump returns to the White House and Republicans gain full control of congress.

Find Out More