The growing importance of energy efficiency in home buying decisions

- With around 16% of the UK’s total emissions coming from residential housing, improving energy efficiency is crucial to reaching the country’s net-zero target by 2050.

- Our research explores the growing importance of Energy Performance Certificate (EPC) ratings of UK homes. Our proprietary analysis shows that homes with a higher EPC rating sell at a premium.

- Cost is the largest barrier to preventing improvements. Government programs like the Energy Company Obligation (ECO) have not been effective enough.

What is an EPC certificate? Energy Performance Certificates (EPC) are a measure of energy efficiency of UK residential buildings. We have developed a proprietary dataset to estimate the impact of energy efficiency on UK residential property prices. Novelly, we have linked together the price paid data from the Land Registry with the Energy Performance of Buildings Register from the UK Government. Using econometric analysis on a dataset containing 11 million registrations, we estimate the impact of an EPC rating on the UK residential property price.

Buyers are willing to pay more for homes with high EPC rating

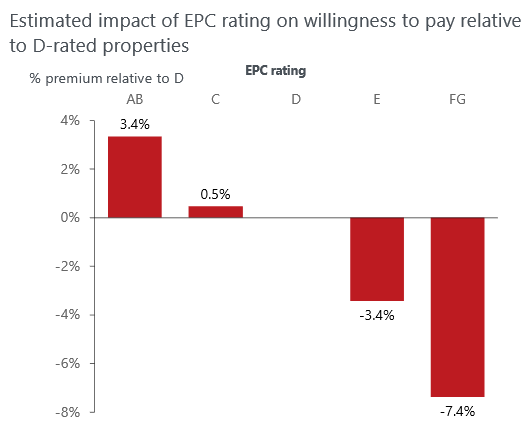

Our analysis of house prices by EPC rating shows that willingness to pay increases with a higher EPC rating of a home. We find that consumers are willing to pay 3.4% more for a high energy-efficient home (A or B rated) compared with Band D, as shown in the Chart, highlighting that energy efficiency is now an important factor in home-buying decisions.

Households are willing to pay more for a home with a higher EPC Band on average

Our dataset also highlights the impact of owning a less energy-efficient home. Consumers expect meaningful discounts on properties with poor energy performance, with homes rated F or G typically selling for 7.4% less compared to D-rated properties. Even homes with a Band E rating see a notable decrease in value, with households willing to pay 3.4% less for Band D homes on average.

Our results suggest that households typically don’t differentiate much between average energy efficiency ratings, with a Band C rating commanding a more modest premium of 0.5% over Band D properties. This comes in contrast to homes with high energy efficiency (A or B ratings) that tend to command higher premiums, while those with very low efficiency (F or G ratings) often see reduced willingness to pay from homebuyers.

More efficient homes also mitigate consumers’ exposure to climate risk. The latest English Housing Survey reports that over a quarter (28%) of households who moved in after the introduction of EPCs claimed the EPC influenced the purchase of the property. This data supports our own research showing energy efficiency is important.

Mitigating climate risk will become even more important if energy costs rise to phase out fossil fuels as the UK works towards its net-zero target. Improving energy efficiency in homes can therefore offer a buffer against these higher costs, providing financial relief to households while supporting environmental objectives. This freed-up disposable income can then be used elsewhere or saved, bringing benefits to the wider economy.

Unlock exclusive economic and business insights—sign up for our newsletter today

Cost is the largest barrier to preventing improvements

Upgrading insulation, installing double glazing, or putting in a new heating system is expensive. Many people are put off by the upfront costs, even if they know these improvements will save money in the long run. Indeed, the ONS reports that over one in three adults reported cost was the reason they were not considering energy improvements. Another challenge is the lack of skilled workers. Improving energy efficiency requires skilled labour, and there simply aren’t enough trained professionals to meet the demand. This skills gap is slowing down progress and needs to be addressed if the UK is to meet its efficiency targets.

Government programs like the Energy Company Obligation (ECO) have not been effective enough. The most substantial improvements in the efficiency of the UK housing stock occurred last decade, with the share of A to C-rated dwellings only increasing by two percentage points more recently in the two years to 2022.

The new Labour administration has targets in place, but ambition requires more action. However, the Government is already grappling with an additional circa £22 billion in unexpected spending for 2024-25. A recent audit of spending plans suggests the need for fiscal consolidation in the upcoming Autumn Budget making it unlikely that the Chancellor will allocate new funds for energy efficiency. As a result, achieving near-term energy efficiency targets seems doubtful without further government support.

Market forces have a role to play. As we have shown with our proprietary analysis, people are willing to pay more for energy efficiency. Further proof of the increasing desire to mitigate climate risk are so-called green mortgages. Green mortgages offer benefits such as lower interest rates, cashback incentives, and higher borrowing limits for homes in the top EPC Bands. These specialised products have become more popular in recent years now offered by major lenders.

With around 16% of the UK’s total emissions coming from residential housing, improving energy efficiency is crucial to reaching the country’s net-zero target by 2050. In the near term, the new Labour administration faces fiscal constraints and must set out a realistic pathway to achieve its climate goals. Clear communication is essential, both in setting targets and raising awareness of the importance of energy efficiency. While progress has been made, the UK still has a long way to go to achieve the necessary reductions in energy use.

Download the full report for more in-depth insights

Oxford Economics is the world's foremost independent economic advisory firm. Our economic model provides a rigorous and consistent structure for forecasting and testing scenarios, addressing questions on a wide range of economic topics including the economic impacts of climate change policy, (e.g. energy efficiency standards). Click here to learn more about how we can support you with our Climate Change Consulting.

Tags:

Related Reports

Inside the UK’s Data Centre Boom: Why London Still Dominates—and what comes next

As AI accelerates and global tech companies commit billions to new cloud and data-centre projects in the UK, the country is cementing its role as a leading AI hub.

Find Out More

The UK’s data centre boom: growth trends, drivers, and the rising power challenge

The UK is experiencing a remarkable growth in its digital infrastructure. Data centres—the facilities that house the servers and computing equipment powering everything from cloud storage to artificial intelligence (AI)—are expanding at an unprecedented rate and fuelling energy demand.

Find Out More

Powering the UK Data Boom: The Nuclear Solution to the UK’s Data Centre Energy Crunch

The UK’s data centre sector is expanding rapidly as digitalisation, cloud computing, and artificial intelligence (AI) drive surging demand for high-performance computing infrastructure.

Find Out More

Productive finance in action: the economic footprint of Allica Bank’s lending

Our latest report measures the economic footprint of Allica Bank’s lending across the UK.

Find Out More