Blog | 19 Apr 2024

The EV market and its role for battery metals prices

Diego Cacciapuoti

Economist

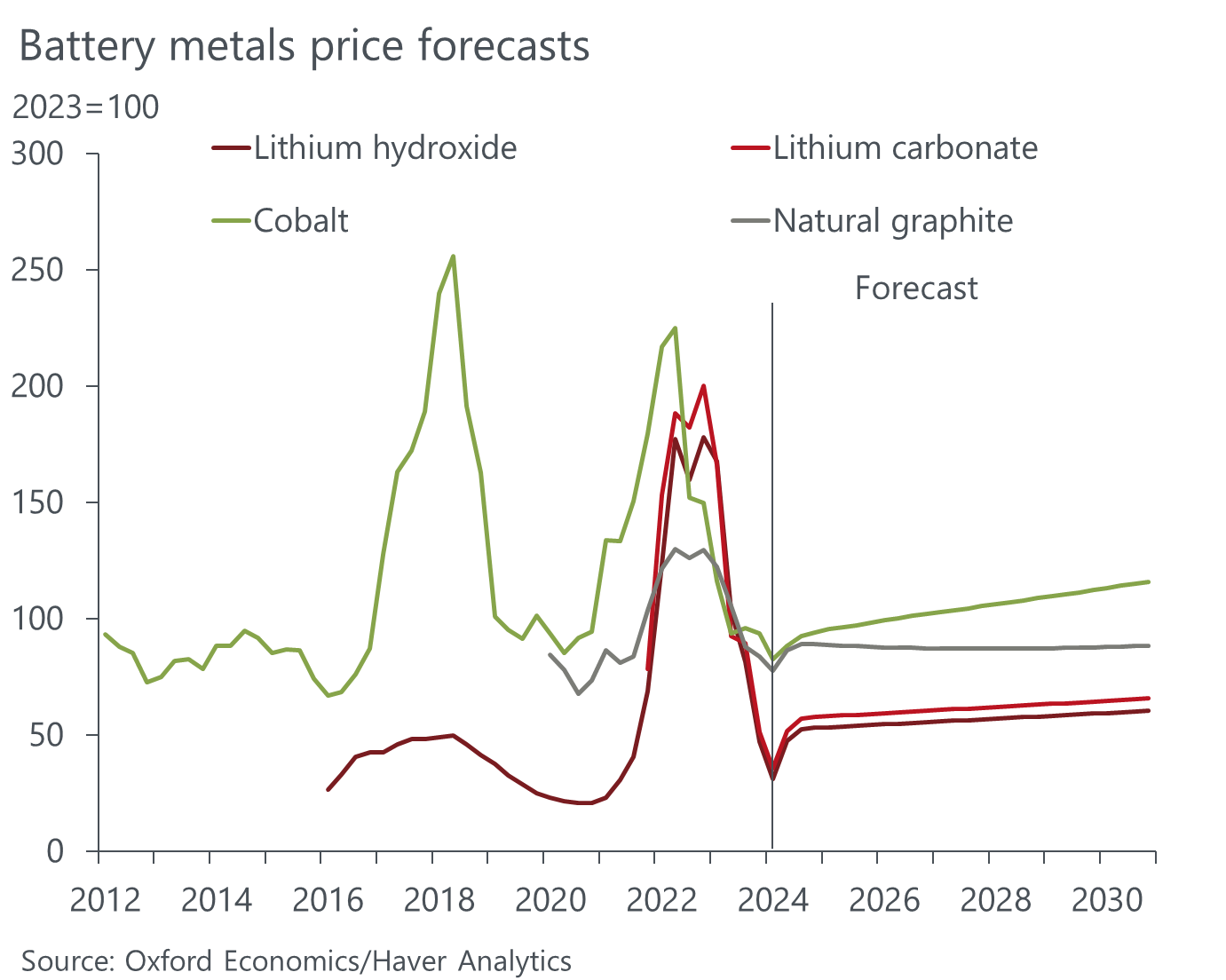

Battery metals prices have collapsed in 2023, with cobalt, lithium hydroxide, and flake graphite prices that fell by 46%, 36%, and 21% y/y, respectively. Oversupplied markets for these metals added to the downward pressure stemming from investors’ concerns about the Chinese EV outlook.

The reason why the Chinese market is so central is that the demand side of these metals – especially lithium and cobalt – is dominated by the production of batteries for electric vehicles (EVs), with batteries accounting for more than 80% of lithium total demand and more than 70% of cobalt’s. Now, when it comes to the EV market itself, the outlook for China is fundamental in driving global expectations, as China in turn dominates this market, accounting for around 60% of total global EV sales in 2022. For this reason, investor sentiment on its macroeconomic outlook has the potential to drive battery metals prices almost completely, and in 2023 with disappointing EV sales Carmakers hit by ‘marked slowdown’ in electric vehicle demand, says Dowlais chief (ft.com)) adding to rapidly growing supply for battery raw materials, prices have been hit by a double whammy.

Now, it is important to clarify that while the EV market has disappointed in 2023 and so far in 2024, its dynamics have largely been positive, meaning that it has slowed down but grown at positive rates. Just slower than anticipated. This, however, has caused battery manufacturers to operate in a hand-to-mouth fashion, disregarding inventories, and causing demand for battery raw materials to remain subdued. In some cases, Chinese manufacturers were even just running through their inventories due to fears of future consumption to disappoint, causing commodity prices to slump. In the meanwhile, also, investment flooded into the battery raw materials mining industry to develop new projects, attracted by the 2022 record high market prices. But this wave of new supply – which has ramped up at record pace in recent years, more than matching the high rate of demand growth –came online during a period of subdued demand and amid uncertainty over the macro-outlook in China, creating this perfect storm for prices.

As we progress in 2024, we think prices have bottomed out as we see evidence that implied inventories along the EV supply chain have returned in line with historical levels and midstream battery manufacturing activity has picked up again suggesting upstream demand for battery raw materials will also bounce back. For this reason, we expect prices to have bottomed in Q1 ’24 and to recover from here onward.

Sign-up now for our upcoming webinar, Field to Mine: Navigating New Horizons in Commodity Markets for a forecast overview of the main commodities we forecast including coverage from our expanded coverage into agricultural commodities and battery metals.

Author

Diego Cacciapuoti

Economist

Diego Cacciapuoti

Economist

London, United Kingdom

Diego is part of the Industry team where he contributes to the forecasting and monitoring of commodities and he is responsible for the monthly precious metals and agricultural price forecasts. Prior to joining Oxford Economics, Diego gained work experience at Record Currency Management and completed an MPhil in Economics at the University of Oxford. Diego is fluent in English, French, and Italian

Tags:

You may be interested in

Post

US Bifurcated ꟷ Economic backdrop deepens racial disparities

Black and Hispanic households have experienced more inflation than other groups since the reopening of the economy from the pandemic lockdowns. Although there've been many phases of high inflation, some have disproportionately hurt these minority groups, such as the jump in energy prices following Russia's invasion of Ukraine, with the ensuing surge in rental inflation further setting them back.

Find Out More

Post

Commodity Key Themes 2026: Softer oil prices and firmer metals

In this report, we outline five key themes that will shape the global commodity landscape in 2026.

Find Out More

Post

Silver, the next generation metal

This report highlights the critical role silver plays in data centres and artificial intelligence (AI), automotive and electric vehicles (EVs), and solar energy photovoltaics (PVs). With these sectors expected to expand significantly over the coming years, we expect future silver demand to be strong.

Find Out More