Blog | 10 Oct 2023

Shift of business tech spend accelerates towards internet and cloud

Victoria Tribone

Economist, Industry

Recent revenue performance of the tech sector tells a consistent story of industry’s leaders and laggards and confirms Oxford Economics’ forecasts for a significant shift within spend on enterprise technology as it enters a new era after the strong quarter century leading up to the pandemic.

Spending shifts from telecommunications to internet & cloud

Over the last 25 years, the composition of the private sector’s spend on tech has evolved significantly. The private sector’s share of spending on IT services grew by 14 percentage points between 1997 and 2021. Inflation adjusted spending grew by 7% annually as the prices of custom and own account software fell but not as precipitously as those of other products such as pre-packaged enterprise software.

Internet and cloud services saw its share of total tech spending increase by 8 percentage points over that 25-year period, despite being the only product whose price level has increased during the same time. Growth was fuelled by strong annual growth of 8% in the private sector’s inflation adjusted spend on internet and cloud services.

Internet & cloud leads revenue growth

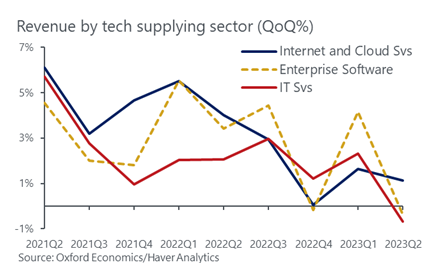

So far in 2023, the internet and cloud services category, along with IT services, has emerged as the strongest performing in the post-Covid era, despite a slowdown in revenues seen over the past year in all tech product areas.

Revenues from the internet and cloud sector reaccelerated in H1 2023, while other areas showed further weakness. Looking ahead, we expect the gains to continue, with spending on internet and cloud services being able to avoid an outright contraction during the forecast US recession in H1 2024.

Revenue for the IT services sector has grown 2% on a quarterly basis throughout 2022 and Q1 2023, but the second quarter of 2023 surprised to the downside with revenues contracting -0.7%. We expect this weakness to translate into a mild slowdown in spending, hitting a trough with a -0.9% contraction in Q1 2024 in line with the forecast recession.

The performance of enterprise software is mixed, as this sector is particularly sensitive to recent layoffs in the tech and finance sectors. Similar to IT services, we expect a mild slowdown in purchases of enterprise software, with a contraction in spending coming in Q2 2024. The private sector’s share of spending on IT services grew by 9 percentage points with inflation adjusted annual growth of 10% as once expensive capital investments in pre-packaged software has become cost effective and more readily available.

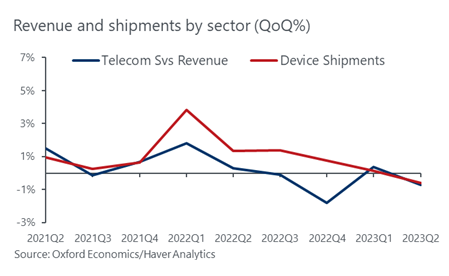

Telecommunications posts worst revenue growth

Performing the worst is telecommunication services, which averaged zero quarterly revenue growth throughout 2022 and H1 2023. We expect spending on telecommunication services to contract by -0.1% y/y in 2024 continuing the longer-term trend of de-prioritization within firms’ budgets. Revenues from telecommunications and electronic devices have been weak for over a year, and thus continuing a long-term decline in these products’ share of enterprise tech spend (Fig. 2).

The 27 percentage point decline in the relative spend on devices is driven by productivity gains in the manufacture of devices that has allowed the devices to become relatively cheaper. The decline in prices has allowed for steady annual growth of 7% in the private sector’s inflation adjusted spend on devices. Despite being moderately deflationary as well, telecommunication services’ share of total tech spend fell by 4 percentage points as businesses directed funds towards higher-value investments in IT services, enterprise software, and internet & cloud services.

Author

Victoria Tribone

Economist, Industry

Victoria Tribone

Economist, Industry

New York, United States

Our Industry Consulting service tailors bespoke industry solutions and insights to meet your needs, contact us to learn more.

Tags:

You may be interested in

Post

KPMG M&A Outlook 2026: Between Uncertainty, Resilience, and Seizing Opportunities

Discover how Germany’s M&A landscape is evolving – with a focus on growth, AI and post-merger value creation.

Find Out More

Post

Powering the UK Data Boom: The Nuclear Solution to the UK’s Data Centre Energy Crunch

The UK’s data centre sector is expanding rapidly as digitalisation, cloud computing, and artificial intelligence (AI) drive surging demand for high-performance computing infrastructure.

Find Out More

Post

Are humanoid robots creepy?

Some very smart people are betting that machines shaped like humans will do much of our household and factory work for us in the near-ish future. But hurdles remain.

Find Out More