Recent Release | 05 Sep 2023

Logistics: Delivering a solution to the UK’s productivity puzzle

Economic Consulting Team

Oxford Economics

Oxford Economics have found that restoring the UK’s position as a global leader in logistics could boost UK GDP by £3.9 billion by 2030.

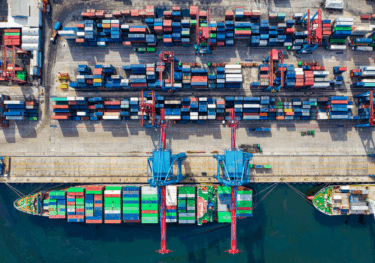

Logistics forms the backbone of modern commerce and trade, spanning road, rail, water and air – ever innovating to become increasingly efficient, using technology and data to integrate processes, systems and transport modes, and to decarbonise fleets and warehouses. Logistics is a sector creating opportunities across the UK and linking the UK to the global trade network.

However, the UK’s position in the World Bank’s Logistics Performance Index (LPI) has deteriorated significantly in the last decade, falling from fourth in 2014 to joint-19th in 2023.

We estimate that if the UK returned to the top-10 of the LPI rankings by 2025, it would boost productivity, boosting GDP in 2030 by £3.9 billion (0.13%) in today’s prices, consistent with a increase in average annual household disposable income of £80 in 2030.

If the UK rises to the top of global rankings by 2025, productivity could be higher by 0.27% by 2030, adding £7.9 billion to GDP in today’s prices, which would translate into an increase in average annual household disposable income of £160. The amount of taxes generated through the increased economic activity in this scenario could finance the annual salaries of more than 40,000 nurses or secondary school teachers in the UK.

The experts behind the research

Our Economic Consulting team are world leaders in quantitative economic analysis, working with clients around the globe and across sectors to build models, forecast markets and evaluate interventions using state-of-the art techniques. Lead consultants on this project were:

Henry Worthington

Director, Economic Consulting

Laura Spahiu

Econometrician, Economic Impact

Anubhav Mohanty

Associate Director, Economic Consulting

Harry Pickford

Economist, Economic Impact

Tags:

Related Services

Global Key themes 2026: Bullish on US despite AI bubble fears

We anticipate another year of broadly steady and unexceptional global GDP growth, but with some more interesting stories running below the surface.

Find Out More

US Bifurcated ꟷ Economic backdrop deepens racial disparities

Black and Hispanic households have experienced more inflation than other groups since the reopening of the economy from the pandemic lockdowns. Although there've been many phases of high inflation, some have disproportionately hurt these minority groups, such as the jump in energy prices following Russia's invasion of Ukraine, with the ensuing surge in rental inflation further setting them back.

Find Out More

China and AI underpin stronger global trade outlook

Global trade is set for a stronger-than-expected rebound, supported by lower US tariffs, continued AI-driven investment, and China’s renewed export push. Our latest forecasts show upgrades to both nominal and volume trade growth in 2025–26, even as legal uncertainty surrounding US tariff mechanisms and evolving geopolitical dynamics pose risks to the outlook.

Find Out More

US Shipping freight rates on track to stay low in 2026

Our supply chain stress index moderated in September as import volumes continue to decline following front loading activity earlier this year. High frequency data shows that this trend has kept up in Q4, meaning port congestion is unlikely to become a concern.

Find Out More