Blog | 25 Feb 2021

Will overtourism be a problem again?

Growing year-on-year for the past decade, increasing global tourism activity has contributed significantly to economic growth and development, accounting for 10% of global GDP in 2019. This can only be a good thing, right?

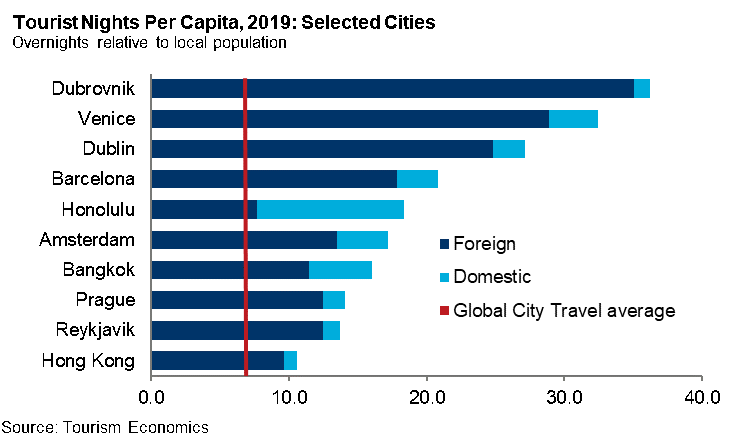

For the most part, yes. But in the years before the pandemic, some popular destinations began experiencing overtourism. By ranking the top cities of the Tourism Economics’ Global City Travel service, we see that some of the most visited—such as Dubrovnik, Amsterdam and Venice—are some of the most affected by this phenomenon. The pandemic has temporarily put a pause on travel, but when it inevitably recovers, will overtourism return as well?

Unlike the benefits associated with tourism—such as increased GDP and job creation—negative effects aren’t as easy to quantify. For example, one growing problem in many cities before the pandemic was the increased demand for real estate by property investors and wealthier tourists. The consequent inflationary effect on rent, house prices and other commodities has gentrified those areas, forcing locals to relocate into other parts of the city or region—or elsewhere entirely. This trend has been particularly observable in Venice and Barcelona where residents have had to leave the city centres to find more affordable housing or to access amenities that have disappeared and been replaced by tourist-themed shops and facilities.

Unlike the benefits associated with tourism—such as increased GDP and job creation—negative effects aren’t as easy to quantify. For example, one growing problem in many cities before the pandemic was the increased demand for real estate by property investors and wealthier tourists. The consequent inflationary effect on rent, house prices and other commodities has gentrified those areas, forcing locals to relocate into other parts of the city or region—or elsewhere entirely. This trend has been particularly observable in Venice and Barcelona where residents have had to leave the city centres to find more affordable housing or to access amenities that have disappeared and been replaced by tourist-themed shops and facilities.

There are also significant environmental ramifications associated with large influxes of tourists. Sandal clad feet wear down ancient cobblestones and heritage sites, while congested streets and roads make daily life more time-consuming and costly for residents and businesses. Litter and noise pollution are also by-products of a large tourism industry. In recent years, the negative impacts of tourist arrivals and bad visitor behaviour have led to rising anti-tourism sentiment.

While the COVID-19 pandemic has been a temporary salve for overtourism, it has also revealed how reliant many destinations, jobs and industries are on the tourism industry. Around 330 million jobs were supported by the sector in 2019. But international travel collapsed in 2020, with global demand falling an estimated 73% as travel bans, lockdowns and social distancing rules quickly shut down tourist dependant industries such as hospitality and entertainment. Cities once struggling to cope with waves of tourists are now struggling to cope without them, revealing the double-edged sword of this heavy reliance.

Post-pandemic, governments and administrations face a dilemma: Should they prioritise economic recovery at all costs, welcoming back tourists en masse and risking the return of overtourism and its associated problems? Or could the tourism hiatus be used as an opportunity to plan for a more sustainable future for tourism? In recent years, overrun cities have signalled a willingness to move away from intense destination marketing with greater focus on destination management, including particular consideration for sustainability.

Promoting tourism recovery while also seeking to achieve sustainable outcomes will be a significant challenge. Destinations will have to balance the risk of limiting tourism with sustainability policies against continued potential losses. Greater destination management could be achieved by implementing or increasing tourist taxes to target more sustainable growth. The revenue gained from these taxes could help compensate for negative tourism effects, such as increased pollution and pressure on public infrastructure. Encouraging travel “off the beaten track,” clamping down on unlicensed accommodation rentals, and greater fines for anti-social behaviour can also be used in conjunction with taxes to help address the problem.

Tags:

You may be interested in

Post

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More