Blog | 02 Oct 2024

Toss-up US elections increase downside risks again for our Q3 IFRS 9 and CECL scenarios

Davina Heer

Economist

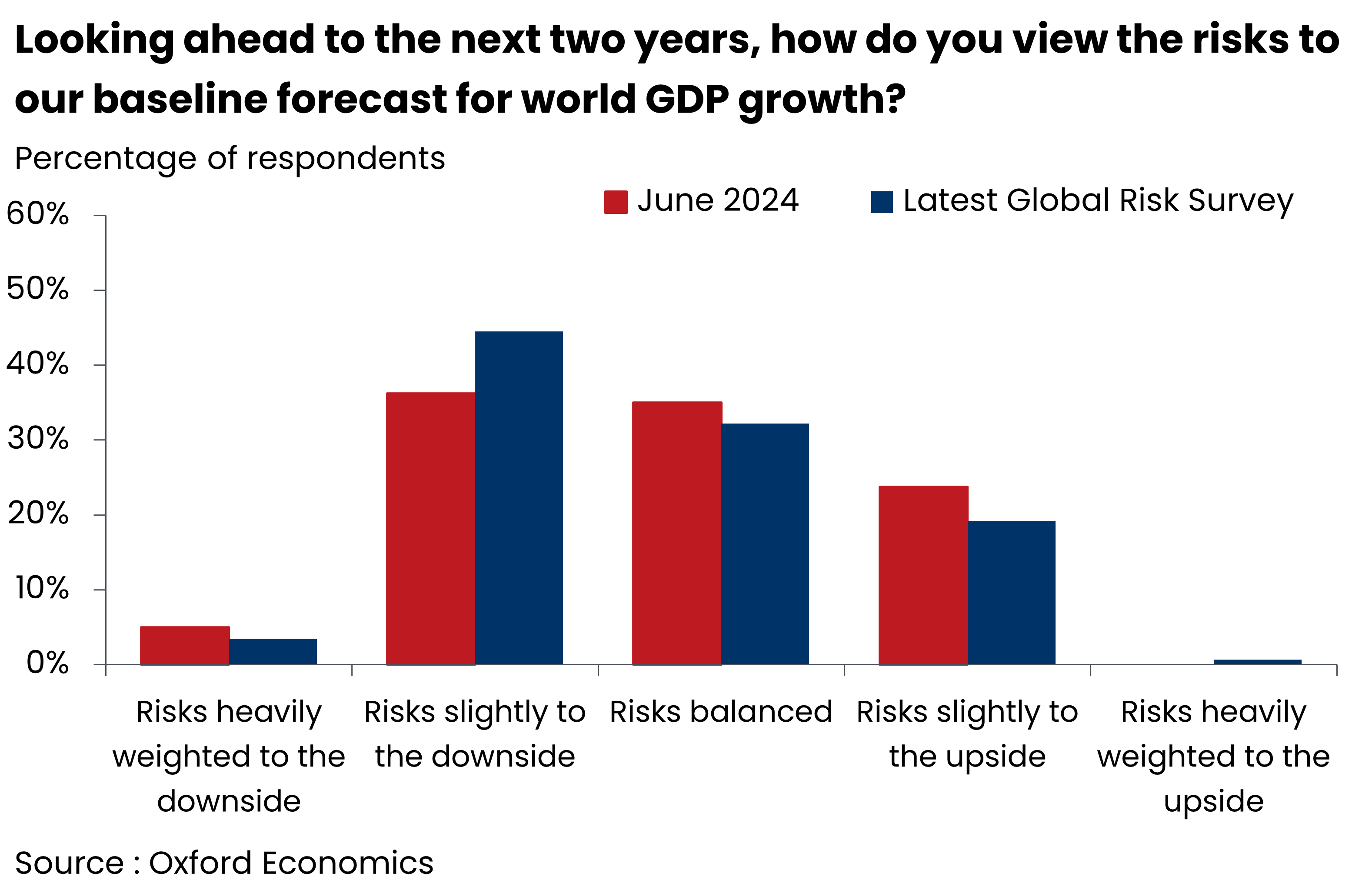

While our short-term outlook for the global economy has largely remained steady over the past quarter, the balance of risks around the base case has become more negative. This is evidenced by the number of clients expressing increased pessimism in their expectations around global growth in our latest Global Risk Survey.

However, responses to a range of thematic questions included in the survey indicate that the increase in perceived downside risk is specific to localised factors. For example, more than two-fifths of respondents now cite a second Trump presidency as their top downside risk to the global economy, up from one-third in our June survey. Furthermore, the probability of a renewed trade war following a Republican victory across all branches of government has risen from 16% in our June survey to 20% in the latest survey update.

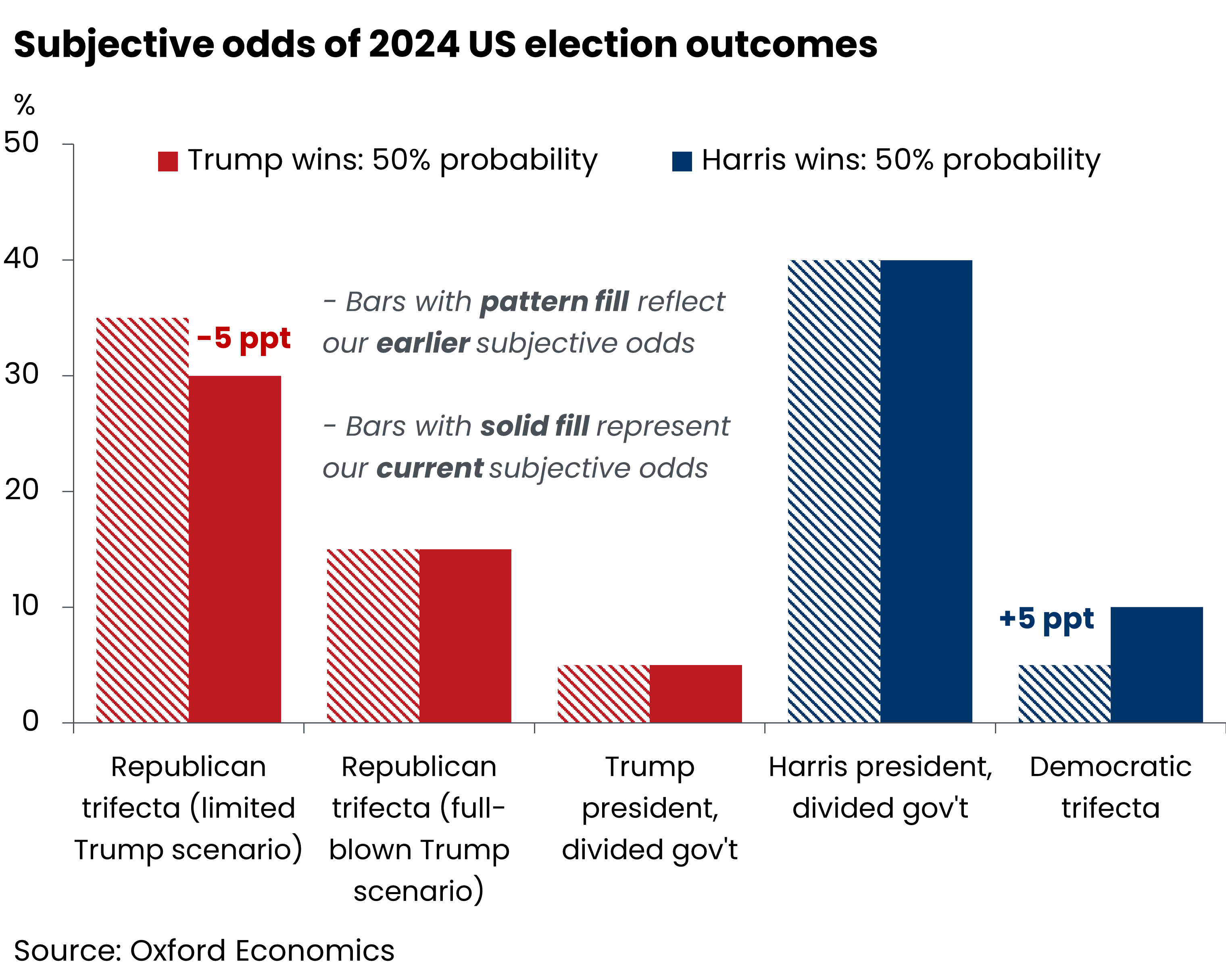

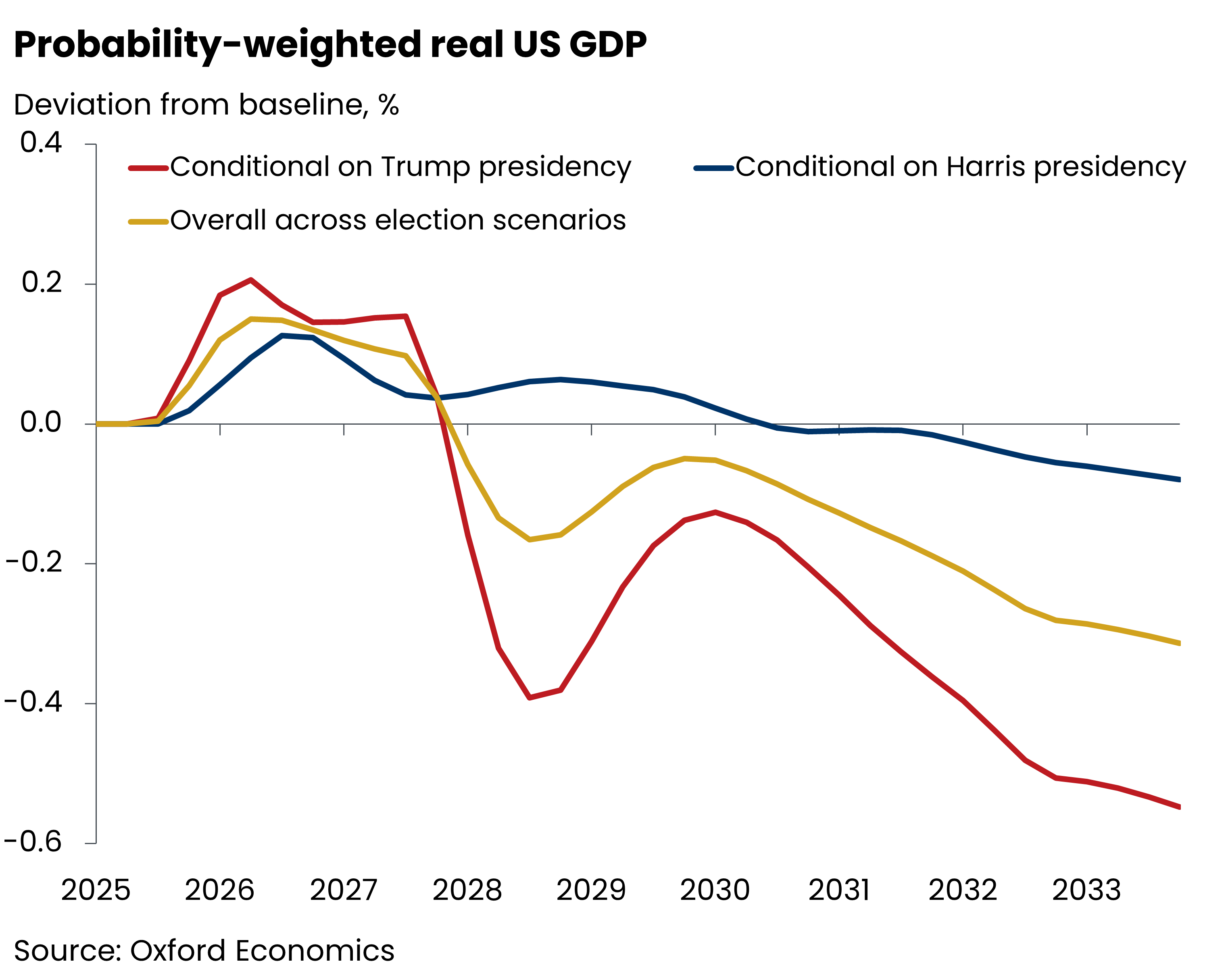

Our subjective odds assigned to the US election outcomes have shifted to a toss-up between Harris and Trump, highlighting the extreme uncertainty surrounding this election. However, knowing who will sit in the White House for the next four years, and what the likely composition of Congress will be, is pivotal to inform the expected direction of change of the baseline forecast. This is evidenced by our scenario analysis where we model the stated policy programmes.

Within a year of the inauguration of the new US President, our modelling finds noticeable divergences in expected economic projections, reflecting the importance of the details of an extension to the expiring provisions of the 2017 tax law. Further ahead, a Trump presidency is likely to introduce a negative deviation from our baseline forecast, driven by restrictions to immigration and targeted tariffs on China and the EU.

These findings support our assessment that downside risks are now more concentrated in the US and countries that could face higher tariffs if Trump secures a second win. Meanwhile, other geopolitical concerns remain more limited in scope. For example, despite the conflict between Israel and Hamas continuing to disrupt shipping, its overall impact on global economic growth is expected to remain minor. On the other side of the distribution, upside risks to our baseline forecast remain somewhat general in scope based on the responses to our latest survey. Expected upside risks are principally focused on the positive spillovers from more substantial monetary policy loosening, followed by increased US fiscal stimulus and gains from AI-driven productivity.

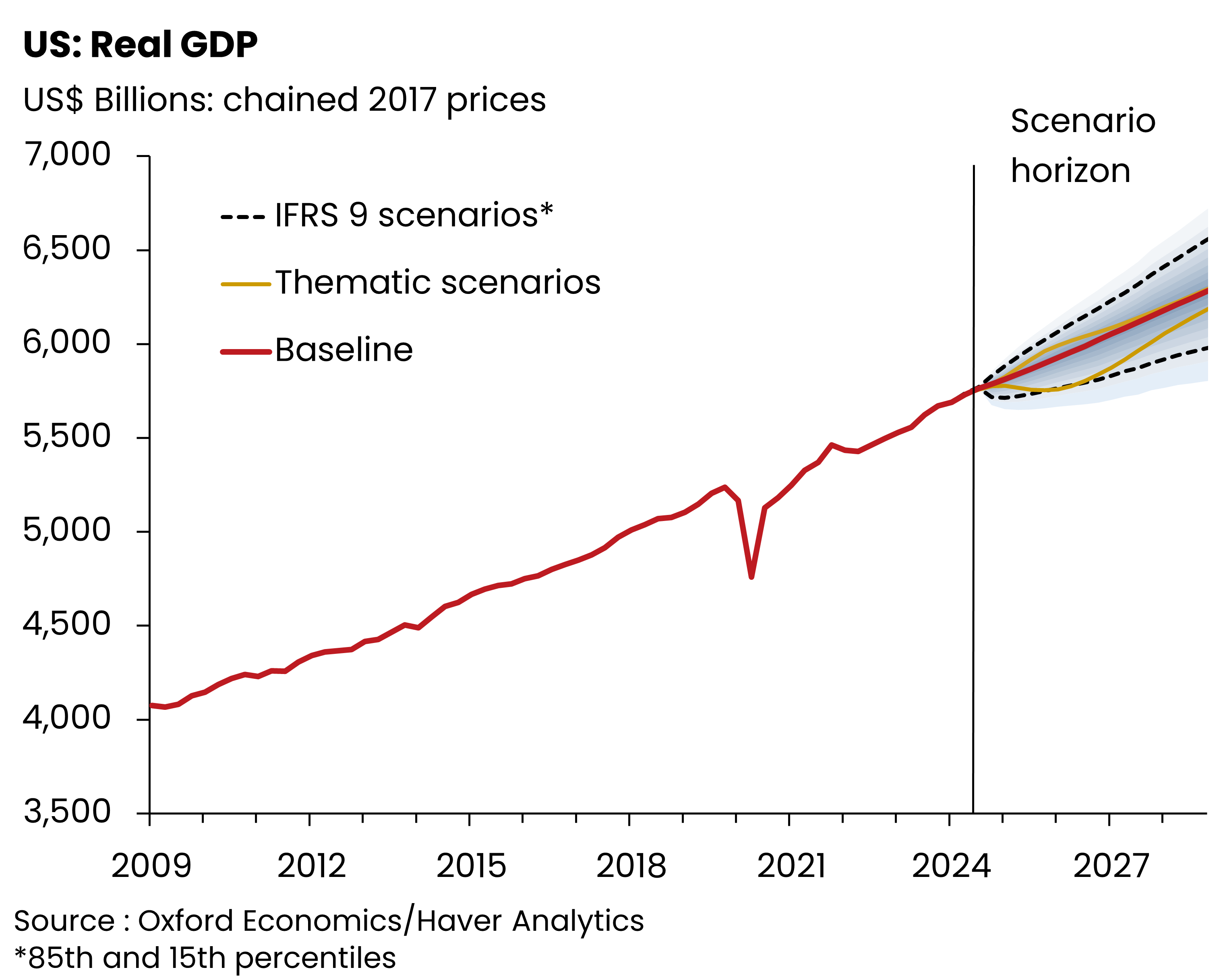

This two-sided uncertainty around the possible impacts from key risks embodies the spirit behind the IFRS 9 and CECL accounting standards. In practice, these regulations require lenders to explore risks to both sides of the baseline and adjust their capital provisions based on the expected losses across these projections. While thematic scenarios such as the US election outcomes are useful to consider, they cannot capture the entirety of the range of possible risks and may introduce a subjective bias in lenders’ provision calculations.

Therefore, although we benchmark against these thematic scenarios, our IFRS 9 and CECL scenarios are developed from uncertainty distributions based on nearly three decades of forecast errors. This sample includes several periods of heightened global uncertainty such as the dot-com bubble, Global Financial Crisis, and the Covid-19 pandemic, which helps to ensure that our uncertainty distributions are representative of the true risks around the base case forecast. As we construct our alternative scenarios at a globally consistent level using our industry-leading Global Economic Model we help clients across the world assess risks over the expected lifetime of their assets.

Click here if you want to learn more about our IFRS 9 service and here for our CECL service.

Author

Davina Heer

Economist

Private: Davina Heer

Economist

London, United Kingdom

Tags:

You may be interested in

Post

US Recession Monitor – Revisions reduce recession risks

Our probability of recession models showed marked improvement in September, reversing much of the recent rise. Against this backdrop, our conviction in our above-consensus GDP growth forecast for 2025 increased.

Find Out More

Post

Infographic: Measuring risk exposure to China-Taiwan tensions

We have developed a globally consistent framework showing cross-country GDP vulnerabilities to an escalation in China-Taiwan tensions, factoring in three key channels of risks: trade exposure to Taiwan and mainland China, wider economic and industry reliance on semiconductors for producing output and price ramifications of shortages and disrupted shipping.

Find Out More

Post

Margins muscle through US supply chains

US business profit margins will remain elevated through 2025, with a boost from higher investments of recent years, despite challenges from slowing growth, less pricing power, and increasing debt cost.

Find Out More