Blog | 27 Oct 2023

The EU’s CBAM needs more bite to change the trajectory of emissions

Manuela Kiehl

Climate Economist, Scenarios & Macroeconomic Modelling

Tightening EU carbon tax policy

The EU’s Carbon Border Adjustment Mechanism (CBAM) is one of the central pillars of the EU’s Fit for 55 Agenda, which envisages reducing the bloc’s net greenhouse gas emissions by at least 55% by 2030 compared to 1990. The policy’s transitional phase took effect at the start of this month. It marks a step towards addressing the internationally scattered carbon tax system by setting a uniform carbon price across domestic and imported commodities.

During the CBAM’s transitional phase, which runs until the end of 2025, EU-based importers of goods covered by the CBAM are solely obliged to “report on the quantity of imported goods, direct and indirect emissions embedded in them”, without incurring any financial liabilities at this stage. From 2026 onwards, purchasing CBAM certificates will be required. This effectively imposes a price on carbon that mirrors the allowance price level of the EU Emissions Trading System (ETS).

The CBAM thereby equalises the price of carbon between domestic products and imports and creates a level playing field for European producers who face a carbon price for their emissions under the EU ETS. This aims to encourage industrial decarbonisation globally and to ensure that the EU’s climate policies are not undermined by production relocating to countries with less ambitious green standards, or by the replacement of EU products by more carbon-intensive imports.

Carbon prices alone are likely insufficient to reach the EU’s climate ambitions

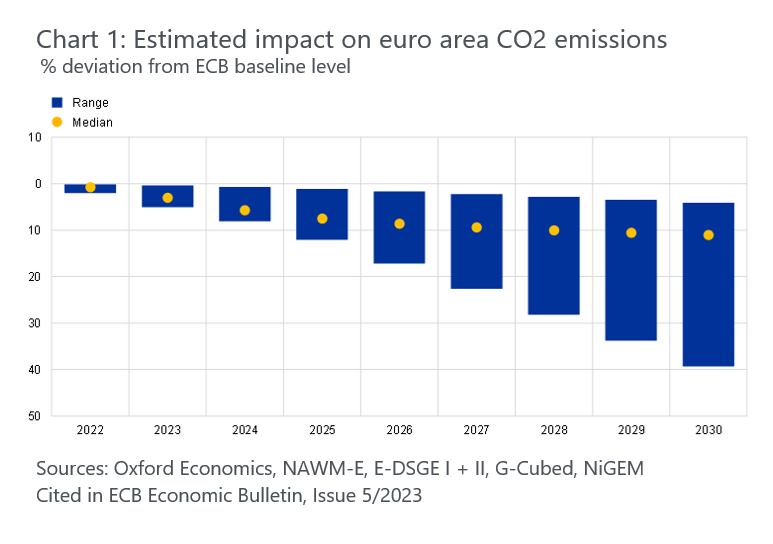

However, recent European Central Bank (ECB) model simulations using, amongst others, the Oxford Economics Global Economic Model, suggest that carbon pricing mechanisms alone are likely insufficient to achieve the EU’s climate goals. The median impact of an ECB carbon price scenario using the International Energy Agency’s net zero scenario carbon pricing pathway, with average euro area carbon prices increasing to €140/tCO2 in 2030, points to a reduction of euro area CO2 emissions of about 11% by 2030 compared to the ECB baseline in which carbon taxes are kept flat at 2021 levels of €85/tCO2 (Chart 1). The results indicate that the carbon pricing levels modelled will likely fail to achieve the EU’s climate targets.

Carbon-pricing must become more ambitious

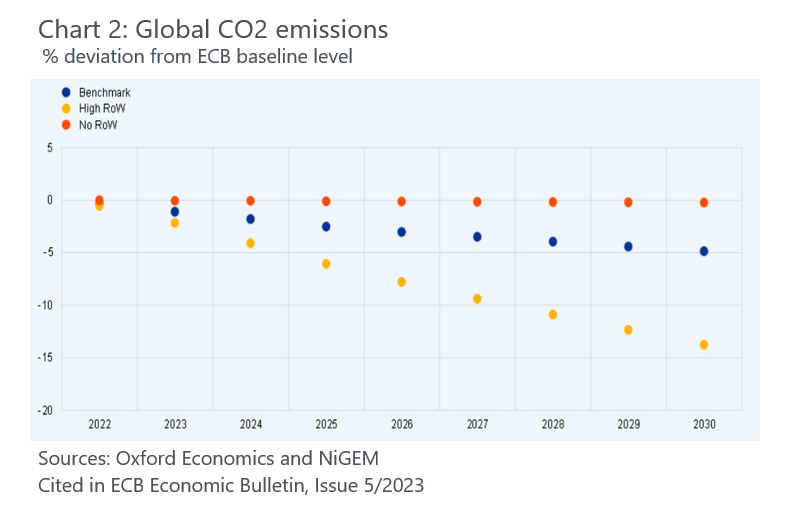

As we have outlined in our previous research, carbon prices remain too low and limited in scope at a global scale. Using Oxford Economics, the ECB compares two different carbon tax scenarios and finds that a scenario with high carbon prices in the rest of the world, “High RoW”, where it is assumed that the world reaches the same carbon tax price as the euro area by 2030, is more effective in reducing global emissions (Chart 2). However, even then, the global CO2 emissions in 2030 are only reduced by about 15% from ECB baseline levels, still falling short of global commitments.

By setting the carbon price of imported commodities equal to the domestic price, the CBAM fails to address the overall low levels of the domestic ETS carbon prices that it is mirroring. The CBAM is also limited in its scope: as our Global Climate Service’s research briefing on the CBAM outlines, items covered by the CBAM represent just 7.8% of the EU’s total imports, and of this, only 31% are imported from extra-EU countries. Furthermore, under the ETS, producers of steel, hydrogen, and aluminium receive compensation for their indirect emissions, like emissions related to the consumption of electricity. Unfortunately, these indirect emissions are not included in the CBAM’s scope. The slow rate at which the CBAM certificates will be introduced and a continued focus on selected industries where carbon pricing applies suggest that the CBAM is not ambitious enough to tackle the urgency of the climate crisis.

Unless higher carbon prices are applied on a broader scale, their impact will be limited. As our Global Climate Service scenario pathways outline, to reach net zero, the carbon price in real terms would need to increase to around US$600-US$700 per tonne of CO2 by 2050 – a far cry from where we are now at US$ 96.3 per tonne of CO2. If climate action today is limited, the delay has the potential to create a highly disruptive transition or could result in an incomplete transition with high physical risks associated with climate damages.

Author

Manuela Kiehl

Climate Economist, Scenarios & Macroeconomic Modelling

+44 (0) 203 910 8007

Private: Manuela Kiehl

Climate Economist, Scenarios & Macroeconomic Modelling

London, United Kingdom

Tags:

You may be interested in

Post

Nature scenarios: What changing environmental risks mean for businesses

Quantifying the economic impacts of nature change means considering double materiality; economic activities can both impact and depend on nature.

Find Out More

Post

Wildfires will be a big issue for LA, but a modest drag on the US

The impact from the wildfires in the Los Angeles area on the US labor market and GDP will be small, potentially shaving 0.2ppts to 0.3ppts off Q1 GDP.

Find Out More

Post

Key climate and sustainability themes for 2025

We expect economic growth to remain modest in 2025, although we don’t think a substantial slowdown is on the way either.

Find Out More