Blog | 02 Feb 2022

The cost of achieving net zero housing will add to inequalities in the UK

Tim Lyne

Associate Director, Cities & Regions

The UK’s housing market suffers from yawning regional inequalities over both the condition and price of homes—and the challenge posed by the need to reduce greenhouse gas emissions from domestic property threatens to further accentuate those divisions.

Housing accounts for almost a third of UK CO₂ emissions, so hitting the UK Government’s target of net zero greenhouse gases by 2050 will require a major improvement in the energy efficiency of the country’s housing stock. In 2019 the UK’s Climate Change Committee (CCC) said the overall target would not be met without the near-complete elimination of greenhouse gas emissions from UK buildings. And since 80% of homes in the UK in 2050 are likely to be ones that are already built, retrofitting and insulating these will have to be the main focus of any efforts. According to the CCC, the cost of insulation alone will be £55 billion at today’s prices.

As a first step, the UK government wants all homes to meet a minimum level of energy efficiency by 2035. London currently has the highest proportion (38%) of its housing stock meeting that ‘C’ standard or higher, followed by the South East. In contrast, just 29% of the housing stock in the West Midlands achieves that level. This alone means different challenges for different regions.

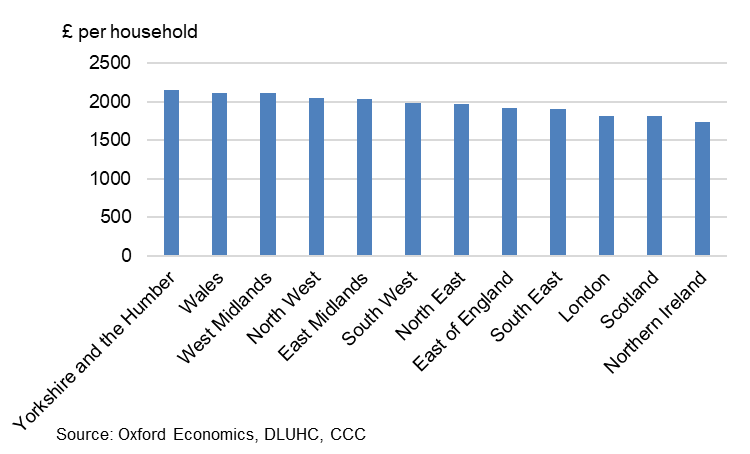

But the cost of change will also vary, according to such factors as the existing age and condition of the housing stock. Analysis by Oxford Economics shows that the level of investment required across different regions of the UK will differ enormously. As the chart below shows, households or landlords in Yorkshire and the Humber, Wales, and the West Midlands face the highest bills for retrofitting, while those in Northern Ireland, Scotland, London and the South East will have to stump up the least.

Average cost of energy improvements per household by region

Furthermore, some of the UK’s least efficient housing is located in areas with lower levels of household income. Residents of these more inefficient properties are already likely to be paying higher energy bills than they would if their properties were improved. Yet they may be less able to afford to pay for renovation work.

This situation is likely to get worse. Our forecasts indicate that household incomes are likely to grow more slowly over the next decade in some of the areas that already have both relatively low incomes and the least energy-efficient homes. Examples include Gwynedd in Wales and Pendle in the North West. A key issue will be whether homeowners, tenants, and landlords will be willing and able to pay these costs.

To offset the highest costs falling on those least able to pay, the UK government must devote serious attention to offsetting the different regional cost burdens of improving domestic energy efficiency, to avoid accentuating regional inequalities and undermining its own ‘levelling up’ agenda.

This problem is not unique to the UK—there are also large variations between nations. Oxford Economics’ new index of real estate obsolescence suggests that Nordic countries are best placed within Europe in terms of the scale of housing challenge, while Central and Eastern European countries such as Czechia and Estonia have the steepest hills to climb. But for all nations everywhere, the time to start is now.

Tags:

You may be interested in

Post

US wealth effects are packing a larger punch than ever

Wealth effects proved to be a quite reliable tailwind to consumer spending this cycle.

Find Out More

Post

Greenomics – Series 2 | Ep. 1 | Shades of green: Retail investors’ sustainability preferences

Climate change is a threat multiplier – disrupting ways of life, threatening food sources, and fundamentally changing the environment in which we live. In this episode we explore the potential impacts of climate change on vulnerable communities, from increased migratory and conflict pressures to the unique relationship between Indigenous populations and nature. Sarah Nelson is joined by three of the team from Oxford Economics who have been working to understand the profound social implications of these factors, Shilpita Mathews, Beatrice Tanjanco, and Ilana Gottlieb.

Find Out More

Post

Housing affordability lowest in Greek, Danish, and German cities

House prices across Europe have soared over the past decade, especially in cities. During this time, incomes in Europe have not kept pace with house price hikes on average, squeezing the purchasing power of homebuyers in many European cities.

Find Out More