Blog | 20 Jun 2023

Semiconductor downturn may be near a trough, but the near-term recovery is far from robust

Abby Samp

Director, Industry Subscription Services

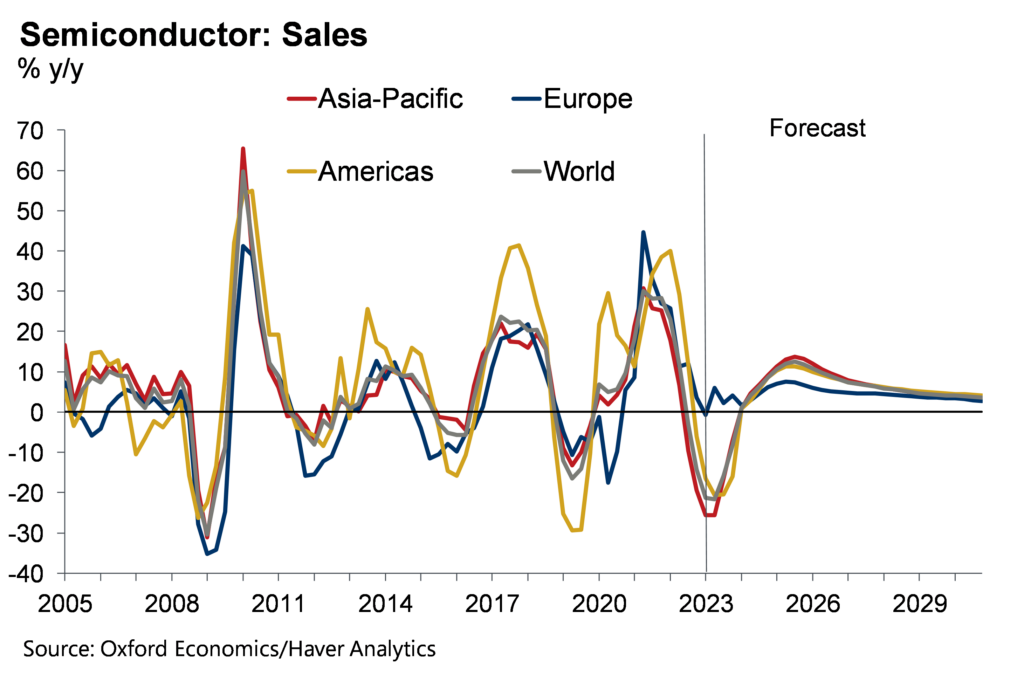

After suffering an extended period of steep declines, we believe that the downturn in semiconductor sales may finally be nearing an end. The latest figures do show that the ongoing downturn in semiconductors deepened in early 2023. In April, the Semiconductor Industry Association reported global semiconductors fell 21.6% year-on-year, the steepest annual decline since the global financial crisis. The sector has been hit by a combination of weak end-use demand, a crash in cryptocurrency prices, new supply coming on stream, and inventory accumulation during the semiconductor shortage in 2021.

However, although end-use demand for traditional electronic goods such as PCs and smartphones remains weak, anecdotal evidence points to demand starting to pick up soon as computing devices bought during the pandemic are replaced. We have added semiconductor sales by region (for the Americas, Europe, Japan, China, Asia-Pacific, and World) in the latest update to our Global Industry Service. Our forecasts show global semiconductor sales reaching a trough in Q2 this year, before returning to growth in the second half of the year.

Nonetheless, we are unlikely to see a strong acceleration in growth in the near term. The inventory adjustment is taking longer than previously expected, according to TSMC, and the boost from the replacement cycle in electronic goods may be muted due to weak market demand. Moreover, the automotive sector—previously a bright spot for chipmakers—is likely to soften in the second half of this year. Overall, we expect a 16.9% decline in global semiconductor sales in 2023 with growth of just 5.1% in 2024 (see chart).

Medium-term outlook more robust

Despite the near-term slowdown, high-powered chips will be an important driver of manufacturing and productivity growth in the medium-term. Structural moves towards automation, the increase in the digital economy, and shifts in mobility and connectivity will drive continued demand chips. Already, Nvidia’s market capitalisation rose above $1 trillion on the success of its GPU chips used in AI computing, the A100 and its successor the H100, and going forward, high-powered chips will be key to driving the AI revolution. We expect global semiconductor sales growth to accelerate in 2025-2026 before settling near its average over the last decade of 5%-6% per year.

Author

Abby Samp

Director, Industry Subscription Services

+44 203 910 8008

Abby Samp

Director, Industry Subscription Services

London, United Kingdom

Abby is the Director of Global Industry Subscription Services, where she oversees service developments, helps shape the global industry overview and monitors and updates the forecast for the high-tech sector. Abby manages developments to Oxford Economics’ Global Industry Model (GIM), has extensive experience in modelling and scenario-based project work.

Abby has a BASc in Economics from McGill University in Montreal, where she graduated with great distinction and received the Hubert Marleau prize for top marks in economics. She also holds an MSc in Econometrics and Mathematical Economics from the London School of Economics and Political Science, where she graduated with distinction.”

Tags:

You may be interested in

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More

China decoupling – how far, how fast?

Economic decoupling from China is ongoing, but the latest evidence suggests that, especially outside the US, the process is gradual and piecemeal. Trade decoupling may be slowly spreading from the US to other advanced economies, however surveys suggest foreign investors' attitudes to China improved slightly in 2023, though they are still more negative than a few years ago.

Find Out More

The socio-economic impact of TikTok in Australia

This report provides the results of our economic modelling of TikTok’s economic contribution to the Australian economy, as well as the findings of survey research into TikTok’s users and Australian businesses. It looks at the real world impacts users report as well as the diversity of TikTok’s online communities.

Find Out More

US metros to see decelerating growth in the medium term

We forecast stable GDP growth across most US metros in 2024, followed by decelerating growth over the subsequent four years. All of the top 50 metros are forecast to see real GDP growth in 2024 as well as continued but slower growth through 2028.

Find Out More