Industrial recovery on the way in the second half of next year

This year’s sluggish industrial momentum—the weakest annual growth outside of a major global recession since 2000—will likely carry over into H1 2024. While we believe interest rate hikes are mostly over, interest-sensitive sectors are being weighed down by the cumulative impact of past hikes, which combined with a weaker global economy is creating headwinds for industry.

What you will learn:

- EU industrial production has now declined for four consecutive quarters. Not only are energy intensive industries still depressed, but destocking and weak demand are increasingly taking a toll.

- While we continue to expect that US industrial output will shrink in Q4 and Q1 as interest sensitive sectors come under pressure and automotive production strikes create volatility, we now think the contraction will be very mild given the context of relatively robust consumer demand and our latest forecast that the economy as a whole will skirt a recession.

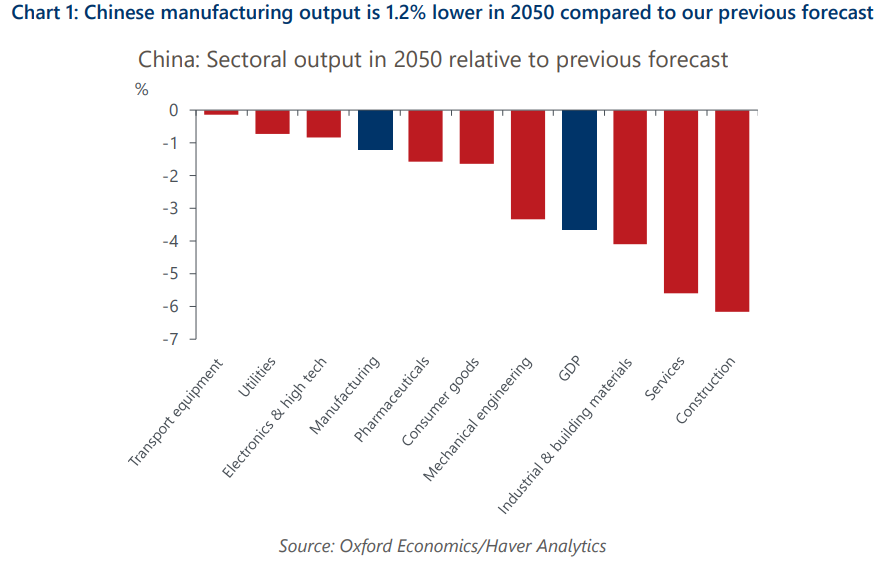

- We have downgraded our industrial growth forecast for China alongside our downgrade of GDP. The downgrades reflect our view that the residential construction and investment-led growth model is increasingly on the wane amidst overcapacity and the ongoing house price correction.

- China’s large proportion of total global industrial production (about 30% in 2022) has therefore caused a downward level shift to our long-term global industrial production forecast, which is now 0.8% lower by 2050 than previously.

Tags:

Related Posts

Post

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More

Post

The socio-economic impact of TikTok in Australia

This report provides the results of our economic modelling of TikTok’s economic contribution to the Australian economy, as well as the findings of survey research into TikTok’s users and Australian businesses. It looks at the real world impacts users report as well as the diversity of TikTok’s online communities.

Find Out More

Post

Why we believe the industry cycle in the Eurozone is finally turning

Even though incoming hard data on eurozone industry is still downbeat, leading indicators suggest that we're at a turning point. We expect favourable cyclical and structural tailwinds will now take over, and industry output to accelerate through this year to 2% y/y growth by Q4.

Find Out More