Why we lowered our China medium-term growth forecasts

The combined large shocks from years of regulatory uncertainty, the prolonged zero-Covid policy, and a housing correction have undermined China’s supply-side potential more than we previously anticipated. We have therefore cut our estimates of China’s future potential GDP growth rates.

What you will learn:

- Despite slowing, we still expect China’s economy to eventually converge with the US in GDP size by the mid-2030s. However, the bigger challenge for policymakers in the coming years is growth sustainability.

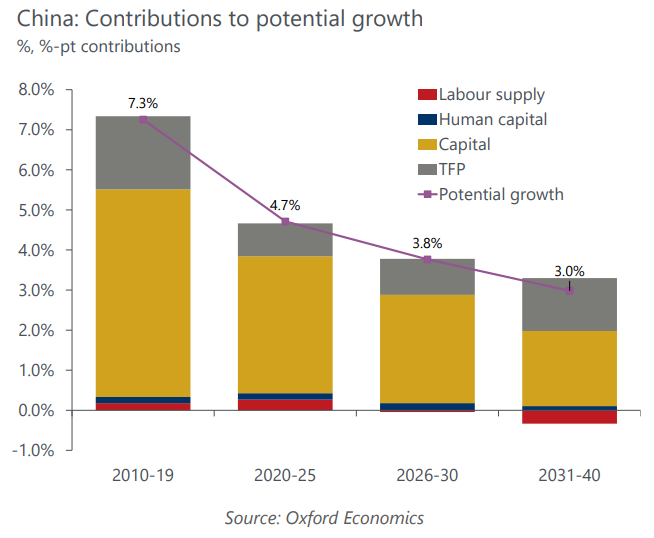

- As the economy rebalances slowly towards a consumption-driven growth model – so a moderation in the contribution from capital – and amid a decline in the working age population, the outlook for China’s trend growth depends to a large extent on raising total factor productivity (TFP). Our base case assumes that continued reforms and the uptrend in R&D spending drive a recovery in TFP in the coming decades.

- The risks to our already-cautious forecasts are still moderately skewed to the downside, particularly if the pace of capital accumulation slows more than we anticipate. Geopolitical tensions leading to more restricted access to technology will also pose a risk to productivity growth.

Tags:

Related Posts

Post

The latest export from China is … deflation

We expect Chinese export price deflation to provide a helpful tailwind in the struggle to bring EM inflation back to target.

Find Out More

Post

Cross Asset: Closing our tactical long on gold, but we’re still bullish

The strength of the recent gold price rally has defied even our already bullish expectations and we think prices are vulnerable to a price consolidation in the short term. As a result, we close out our tactical long position on gold that we opened in October last year.

Find Out More

Post

How Asia’s supply chains are changing | Techonomics Talks

Global supply chains have continued to expand, despite talk of deglobalization and nearshoring. US and Japan have started to de-couple from China, but other G7 countries grow more dependent on Chinese inputs. Several "hotspots" are emerging across Asia with multiple winning formulas.

Find Out More