Blog | 06 Dec 2023

Higher interest rates will catch up with the automotive industry in 2024

Nico Palesch

Economist

Amidst a backdrop of weak global industrial production since the end of 2022, automotive production and transport equipment generally have stood out in Europe and the United States as a manufacturing sector with a relatively stellar growth performance.

In the US, transport equipment manufacturing growth was 4.0 percentage points higher (5.4%) in 2022 than manufacturing as a whole (1.4%), and year-on-year growth in the first quarter of 2023 was a whopping 6.6% higher. In Europe, particularly in industrial heartland Germany, transport equipment growth has almost single-handedly kept industrial production from falling as the energy crisis, low demand, and higher interest rates have in turn pushed output in other key industrial sectors lower.

This sectoral strength is perhaps surprising in an environment where interest rates have gone up and other interest-sensitive sectors have underperformed. It is well-known that demand for cars—durable goods most often purchased on credit—tends to fall when higher interest rates make auto loans more expensive. Our research has also shown that transport equipment is vulnerable to interest rate increases on the supply side as well. This is because the sector is both capital-dependent, as transport equipment purchases are a key destination for investment, and also capital-intensive, meaning that the ratio of investment needed relative to output is high to maintain, modernise, and expand production facilities.

What has been powering growth in automotive industry?

So what has been powering growth in the sector? As with many features of our current economic landscape, the answer is rooted in the experience of the Covid-19 pandemic. Transport equipment generally and car production specifically were heavily impacted by supply chain disruptions, most prominently by the shortage of semiconductors. Unlike many other sectors, there is no ready substitute for demand for new cars except for used cars (which helped contribute to extremely high demand and inflation in that segment), and so when new cars were not being produced this ended up creating high order backlogs, low inventories among dealers, and pent-up demand amongst consumers. Once supply chains normalised and semiconductor shortages cleared, car producers took full advantage of the strong demand, helping result in the high production growth of the past quarters.

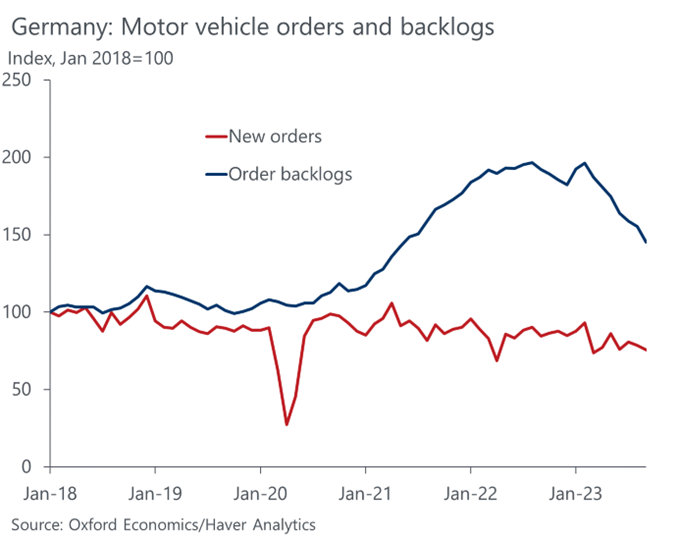

However, the sources of this growth always meant that it would prove to be temporary. There are only so many cars desired but not produced during the pandemic, only so many order backlogs to be filled, and only so many dealer inventories to be rebuilt. High production has helped bring down order backlogs, as Fig. 1 shows for Germany.

Fig. 1. New German car orders are falling as the backlog of work is fading

Combined with the expected fall in normal car demand amidst a weak demand, the high-interest-rate environment is informing our view that the overperformance of automotive manufacturing is poised to fade in the coming quarters, leading to a strong slowdown in growth. Indeed, in our latest forecasts we expect that growth in transport equipment across the advanced economies will go from about 9.7% in 2023 to just 1.7% in 2024. This will help contribute to weak industrial growth, as a key pillar of strength in 2022/2023 fades. The latest European industrial data foreshadow this: the stagnation in European industrial production that had persisted for much of 2022 and early 2023 has given way to declines, helped along by a turn in momentum in motor vehicles, which went from growth to contractions mid-way through the year.

To find out more about how other interest-sensitive sectors are faring in the current environment, download our full report.

Author

Nico Palesch

Economist

+44 203 910 8000

Nico Palesch

Economist

London, United Kingdom

Nico is an Economist within Oxford Economics’ Global Industry Service where he is responsible for monitoring and forecasting developments in the transportation & logistics sector, writing industry-related reports and research notes on sector-specific and cross-sector themes and issues, overseeing and expressing the house-view on industrial developments in our monthly publications, and working on bespoke consulting projects.

Nico holds a BSc Joint Honours Political Science and Economics from the University of Ottawa and an MSc Economics from the London School of Economics and Political Science, achieved with distinction.

Tags:

You may be interested in

Post

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More

Post

The socio-economic impact of TikTok in Australia

This report provides the results of our economic modelling of TikTok’s economic contribution to the Australian economy, as well as the findings of survey research into TikTok’s users and Australian businesses. It looks at the real world impacts users report as well as the diversity of TikTok’s online communities.

Find Out More

Post

Why we believe the industry cycle in the Eurozone is finally turning

Even though incoming hard data on eurozone industry is still downbeat, leading indicators suggest that we're at a turning point. We expect favourable cyclical and structural tailwinds will now take over, and industry output to accelerate through this year to 2% y/y growth by Q4.

Find Out More