Ungated Post | 14 May 2020

US Cities, Metro and Counties Outlook 2017 – 2021

A well-functioning, modern infrastructure is central to economic development and to quality of life. From the roads and railways needed to transport people and goods, to the power plants and communications networks that underpin economic and household activity, to the basic human need for clean water and sanitation, infrastructure matters to people and businesses everywhere.

However, there have been relatively few attempts to track and monitor infrastructure investment across countries and sectors. This has made it difficult to predict how, where and when investment is most needed.

Over the last year or so we have been working with the Global Infrastructure Hub to address this knowledge gap. Our study seeks to estimate how much the world needs to spend on infrastructure in the years to 2040, and in which countries and sectors this investment will be required. The granularity the study provides is unique: it collates data and creates forecasts for seven sectors in 50 countries, over a period of 25 years.

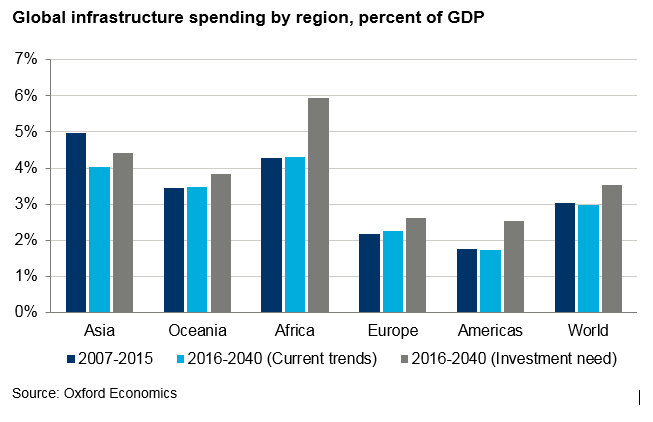

We estimate global infrastructure investment needs to be $94 trillion between 2016 and 2040. This is 19 percent higher than would be delivered under current trends, and is an average of $3.7 trillion per year. To meet this investment need, the world will need to increase the proportion of GDP it dedicates to infrastructure to 3.5 percent, compared to the 3.0 percent expected under current trends.

We find that Asia will dominate the global infrastructure market in the years ahead as it does at present. And we also find that just four countries account for more than half of global infrastructure investment requirements to 2040: China, the US, India and Japan. Comparing our forecasts of infrastructure need to what would be delivered under current trends enables us to estimate the infrastructure investment ‘gap’. We find that this gap is proportionately largest for the Americas and Africa.

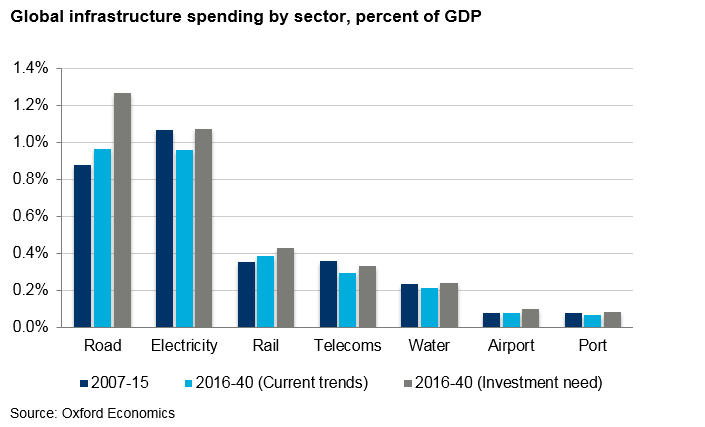

Electricity and roads are the two most important sectors―together they account for more than two-thirds of global investment needs. The investment gap between the two scenarios is greatest in the roads sector, where investment needs are 31 percent higher that would be delivered under current trends. The gap is also relatively large for ports and airports.

We also developed separate models to estimate the costs of meeting the UN Sustainable Development Goals (SDGs) for universal access to drinking water, sanitation and electricity by 2030. To meet these objectives, the total global infrastructure investment need to 2030 would be some $3.5 trillion higher than in our main scenario, equivalent to an additional 0.3 percent of world GDP.

To read the full report please click here

Tags:

You may be interested in

Post

Oxford Economics Expands Regional Presence with the Launch of Japanese Website

Oxford Economics, the world’s leading independent economic advisory firm, is excited to announce the launch of its new Japanese website. This important milestone reflects our ongoing commitment to broadening our presence in key regional markets and strengthening our ability to provide localised, high-quality economic insights to businesses and decision-makers in Japan.

Find Out More

Post

Oxford Economics Invests £2 Million in The Data City to Drive AI-Powered Business Intelligence

Oxford Economics is pleased to announce a £2 million investment in The Data City, a UK based cutting-edge real-time company classification platform.

Find Out More

Post

Oxford Economics Launches Megatrends Scenarios Service

Oxford Economics releases its first Megatrends Scenarios service, providing critical insights into the future of the global economy.

Find Out More