Blog | 18 Mar 2022

Central banks walk a thin line in setting policy rates

Ben May

Director, Macro Forecasting & Analysis

While the initial fears were that the pandemic might lead to economic scarring in the form of permanently lower activity, the biggest scars for now appear to be higher prices. As a result of price pressures and Russia’s attack on Ukraine, 2022 is likely to see inflation and central bank policy tightening on a scale that would have been unimaginable six months ago. But can central banks engineer a slowdown in inflation without dragging economies well below trend growth – or possibly even into recession?

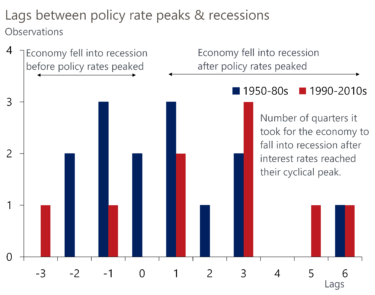

While central banks have generated soft economic landings in the past, more often than not it has been the effort by central banks to contain inflation that’s put the final nail in the coffin of the economic recovery. Recessions typically tend to kick off close to policy rates peaking (Chart 1), reflecting the fact that it’s hard to set the economy on a gentle glide path downwards. Encouragingly, though, during the modern inflation-targeting era, the gap between policy rates peaking and economies contracting has lengthened and expansions have become extended, suggesting that policymakers have become more adept at managing the business cycle.

Chart 1: Recessions normally occur close to policy rates peaking

But there are at least five reasons why central banks may find it highly challenging to deliver a soft landing this time around:

- Unexpectedly high inflation: The high starting point of inflation makes it harder for central banks to look through further upside inflation surprises. In that respect, Russia’s war on Ukraine could not have come at a worse time.

- Heightened uncertainty about the key drivers of inflation: The pandemic has unleashed major supply and demand shocks whose durability is uncertain, making it even harder to plot a path for both demand and supply – and thus inflation.

- Stepping into uncharted territory: Many shocks that have been unprecedented in size (such as supply chain bottlenecks) or nature (the build-up of enormous excess savings in the lockdown), adding to the uncertainty around the likely path for the economy.

- The reversal of quantitative easing (QE): Despite its use as a policy tool, the effect of QE and its key transmission channels remains a subject of debate. Many central banks have committed to shrinking their balance sheet, but the spillover effects are highly uncertain.

- What’s next for fiscal policy: Interventionist fiscal policy has proven beneficial during the pandemic, but the shift will make it harder to gauge the extent to which fiscal policy is tightened in the future. This makes the waters murkier still for central banks.

Overall, we think that much of the pickup in inflation is due to pandemic-related factors and energy shocks that should ease over the coming quarters, albeit gradually. Assuming the inflation generation process has not permanently and fundamentally shifted, this easing, combined with a weakening recovery, should be enough to ensure that policymakers don’t have to – and won’t – drive their economies into recession to get inflation back towards target. But central banks face a tougher job than any of their inflation-targeting predecessors to deliver a soft landing for the global economy.

Tags:

You may be interested in

Post

Eurozone markets are at the mercy of war

The war between Russia and Ukraine continues to dominate headlines and financial markets. The daily news flow coming out of the region is causing large swings in energy prices and European equity markets, as investors move back and forth from optimism to pessimism regarding a potential resolution of the conflict.

Find Out More

Post

Russia-Ukraine war adds to the risks facing global real estate

The global economic outlook has deteriorated, with downside risks threatening global real estate. In this Research Briefing, we share our baseline forecasts, as well as real estate performance under alternative scenarios.

Find Out More