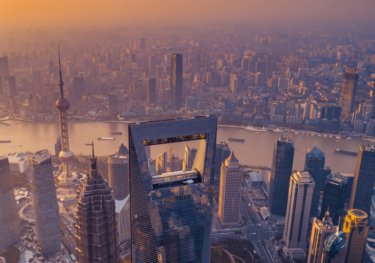

China Economy

In this series, we present our latest analysis on China's economic outlook and its impact on global economy for 2024 and beyond.

China economy: Finding a cyclical floor amid a structural downturn

Almost all China observers agree that the economy is on a structural growth downtrend, citing ageing demographics, diminishing returns to capital, and rising risks of geopolitical tensions that threaten to compound China’s longer-term productivity challenges. The question is: How much of the current slowdown is structural?

Post

Major China cities face prospect of growth downshift

Over the next five years China and its major cities face the prospect of a significant downshift in economic growth. We forecast GDP to grow on average by 4.1% per year across 15 major cities in the years to 2028, down from 7.3% between 2015-2019.

Find Out More

Post

China Key themes 2024 – A slower, but healthier, dragon year

China heads into 2024 with relatively loose policy settings, but private sector sentiment constrained by property pessimism. Policy efforts will reduce left tail risks but we don't expect it will be sufficient to prevent the growth downtrend persisting. Recognizing an upside risk that authorities could instead stimulate their way to a high growth target in 2024.

Find Out More

Post

Why we lowered our China medium-term growth forecasts

The combined large shocks from years of regulatory uncertainty, the prolonged zero-Covid policy, and a housing correction have undermined China’s supply-side potential more than we previously anticipated. We have therefore cut our estimates of China's future potential GDP growth rates.

Find Out MoreSpillovers from a weaker China on global economy

China’s role in the world economy is substantial. It accounts for around 10% of world trade and stock market capitalisation, around 18% of GDP (at market exchange rates), around 16% of world oil demand, and over a quarter of world broad money. Our economists modelled different scenarios to quantify the impacts of a weaker China on global economy.

Post

China decoupling – how far, how fast?

Economic decoupling from China is ongoing, but the latest evidence suggests that, especially outside the US, the process is gradual and piecemeal. Trade decoupling may be slowly spreading from the US to other advanced economies, however surveys suggest foreign investors' attitudes to China improved slightly in 2023, though they are still more negative than a few years ago.

Find Out More

Post

China’s robust industrial performance raises trade tensions

Industrial production in China is forecast to post growth of 5% in 2024, for the second year in a row. Its performance will outstrip the United States and an anaemic expansion in Europe, and raises the prospect of a renewed tensions between East and West.

Find Out More

Post

The latest export from China is … deflation

We expect Chinese export price deflation to provide a helpful tailwind in the struggle to bring EM inflation back to target.

Find Out MoreThe next China?

In response to China’s economic slowdown and rising geopolitical tensions, some businesses are pursuing “China plus one” strategies to reduce supply chains risks. Some are actively searching for “the next China”. We examined some of the most promising candidates and evaluated their potential.

Post

China-India: population size matters, but it’s not all

India appears the economy most like China as it is the only one that can match it in terms of population size. But that's where many of the similarities end – in most other population characteristics the two countries are very different.

Find Out More

Post

The miracle growth story of Vietnam has further to unfold

Vietnam's GDP grew by an average rate of 7% annually in the past three decades, surpassing all its ASEAN regional peers. Although 2023 and 2024 are set to see Vietnam's weakest growth outside of Covid years, we think the pain is short-term.

Find Out More

Post

Nearshoring – China’s loss is not (yet) Mexico’s gain

Mexico is the best-positioned emerging market to gain from "nearshoring." but that does not mean it has seen the greatest benefits. Asian economies and Canada have grown their share of US imports faster than Mexico since the US-China trade decoupling started five years ago.

Find Out MoreSubscribe to our newsletters

Get the latest insights from Oxford Economics, straight to your inbox.

Trusted By