Exploring the implications of higher pension contributions

Many households fail to save adequately for retirement. This unique study, commissioned by Royal London, assesses the impact of higher pension contributions on both pension savings and UK economic growth.

Download PDF

Background

Automatic enrolment has transformed employee participation in workplace pensions in the UK since 2012. The move from an ‘opt-in’ to ‘opt-out’ approach has led to a doubling of the take-up in the private sector in just a few years.

However, there is widespread acceptance that the policy remains unfinished business, with contribution rates well below where they need to be to secure a ‘moderate standard’ of living for most people in retirement.

Royal London commissioned Oxford Economics to evaluate the potential benefits of implementing reforms that could increase the mandated minimum contribution in private sector defined contribution schemes. This study assesses the impact of reform options at the macroeconomic and household levels.

The Challenge

Royal London wanted to carry out a comprehensive study to equip policymakers with the essential insights to formulate effective policies.

This included assessing the impact at both the household and macroeconomic levels to ensure a comprehensive examination of impacts, which previous studies have overlooked by focusing solely on one level or the other.

In addition, the study was required to evaluate both the beneficial effects of policy alterations and any associated trade-offs. The evidence from this study would help drive the discussion around the long-term approach to improving the standard of living for those who retire and address any trade-offs that may occur.

The Solution

Oxford Economics was uniquely able to undertake this study, as we could leverage our proprietary models, which allowed us to simulate the behaviours of households and understand the impact on the wider economy in the medium-to-long term.

The household analysis

Underpinning this element was a proprietary household model that provides a deep dive into UK household finances. Using this model, we were able to identify who would be impacted and the extent of the policy impact. Subsequently, this analysis enabled us to assess the changes to household pension savings from higher pension contributions and benchmark their adequacy for a moderate standard of living in retirement.

In addition, the model enables the analysis to identify types of households that may struggle to afford higher pension contributions―an important consideration for any potential policy reform.

Assessing the macroeconomic impact

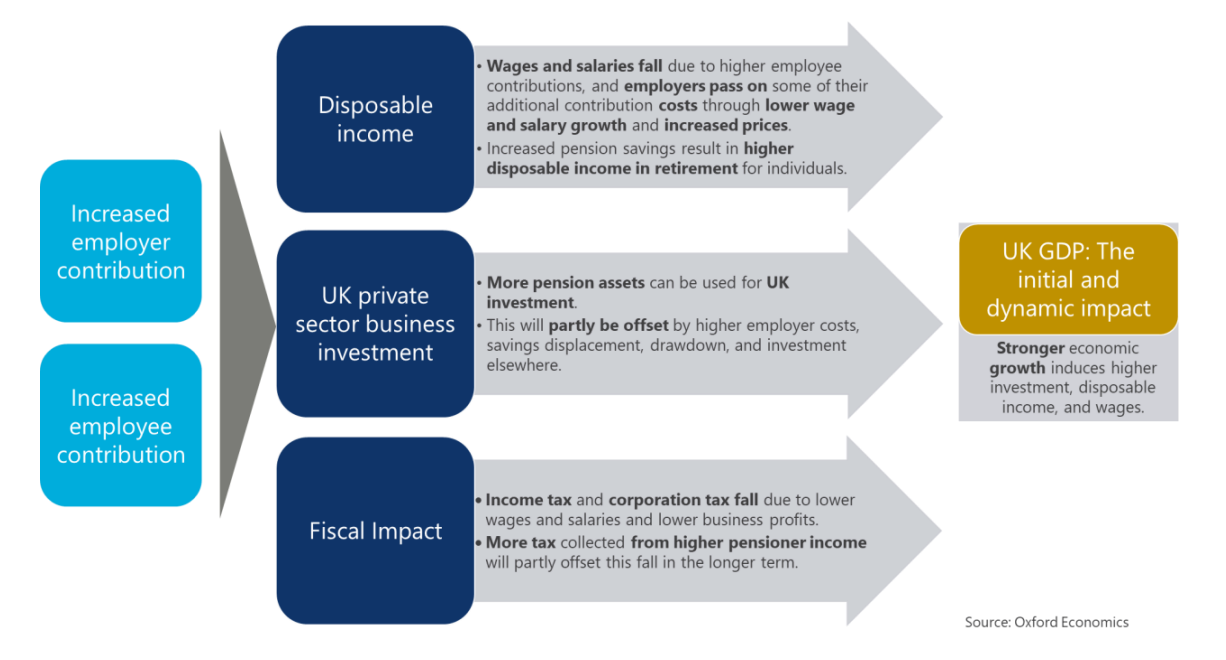

For this element of the study, we aggregated the household impact to the national level and evaluated the wider economic impact using our Global Economic Model (GEM). This best-in-class economic forecast and scenario tool considers the interconnections in the UK economy and enables us to quantify both the initial and any subsequent impact of the policy. For example, stronger economic growth stemming from a rise in pension contributions, induces higher investment, disposable income, and wages―further boosting economic growth over time. This interconnectedness gave the client a crucial holistic understanding of the total impact of the policy changes.

The Result

The research provided the client with a comprehensive study to drive the discussion around the approach to improving the standard of living for those who retire. While we illustrated the long-term benefits of higher pension contributions in terms of a potential boost to GDP and improved adequacy of pension savings, we also identified the potential trade-offs from the policy changes. Showing the delicate balance involved in raising pension contributions was important to enable informed decisions for any potential policy reform.

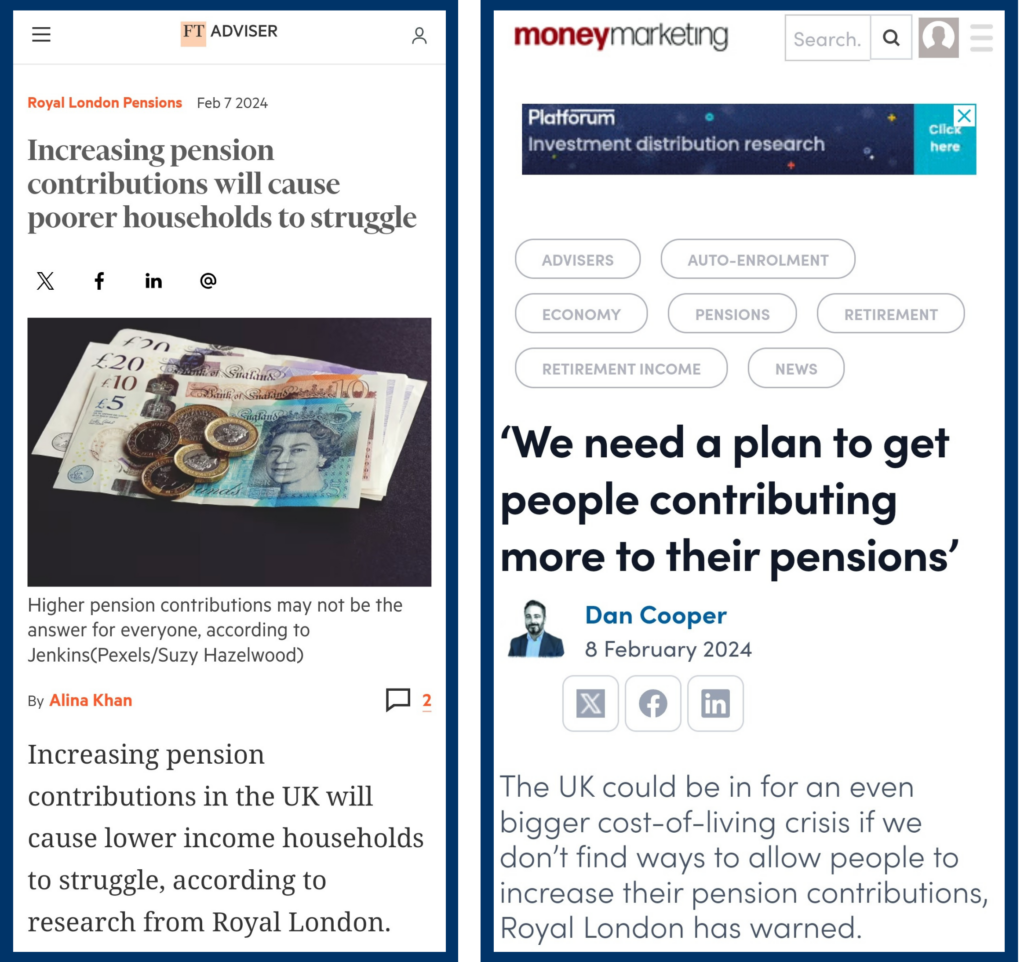

The report was launched during an in-person event organised by Royal London and amplified using our social media platforms. This helped generate significant press interest, including FTadviser and Money marketing.

Contact us to explore how we can help you

Economic Consulting Services

Economic Impact

Quantifying the economic, social, and environmental impact of government policies, new investments, technological innovations, industries, and companies at a global, national, or local level.

Find Out More

Bespoke Forecasting and Scenarios

Supporting strategy, policy, and risk appraisal with quantitative analysis tailored to your organisation.

Find Out More

Cities and Regions Consulting

Understand the consequences of global, national and local events on cities and regional economies.

Find Out More

Global Economic Model

Our Global Economic Model provides a rigorous and consistent structure for forecasting and testing scenarios.

Find Out More