Blog | 18 Jan 2023

Climate risks are severe, but a new ‘green economy’ offers a $10.3tr opportunity

James Lambert

Director of Economic Consulting, Asia

New year, same old problems—but worse. The warmest January day ever was recorded in at least eight European countries on New Year’s Day, according to a climatologist who tracks extreme temperatures.

If a new year is a time for resolutions, then 2023 should clearly be the moment for business leaders and investors to seize the opportunity and put into action the measures needed to help tackle this environmental emergency.

Experts across academia, business, government, the international community, and civil society are clear about the scale of the threat. The annual Global Risks Perception Survey by the World Economic Forum, the international thinktank, shows that the failure to tackle the threat to our climate and natural world make up the top four of its 10 most severe global risks over the coming decade.

While failure to mitigate climate change tops the list, this is followed by failure to adapt to the changing climate, natural disasters and extreme weather events, and biodiversity loss and ecosystem collapse. “Climate and environmental risks are the core focus of global risks perceptions over the next decade—and are the risks for which we are seen to be the least prepared,” it warned.

Three pillars of opportunity

On the same day that the WEF revealed its grim poll findings, a diverse team of experts at Oxford Economics and Arup published new analysis into the opportunities the world’s transition to a greener economy would represent for businesses and investors prepared to make the changes needed.

Our joint report with Arup, The Global Green Economy: capturing the opportunity, acknowledges the devastating impact on the lives and livelihoods of millions of people around the world from the huge damage from worsening climate trends. But it also provides objective economic analysis about the opportunities implied by the transition to a “greener” global economy.

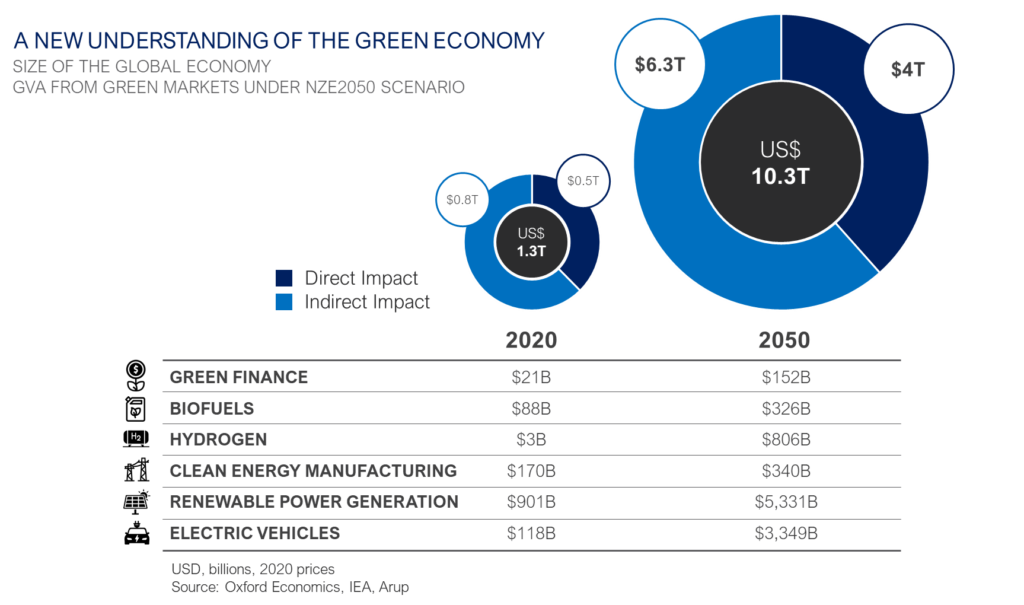

The report estimates that the transition to a net zero emissions environment by 2050 will create new industries worth $10.3 trillion to the global economy by that same year. This is the equivalent of 5.2% of global GDP in that year.

It identifies three pillars of opportunity that will translate across all sectors of the economy—commercial prospects arising from industry disruption, the emergence of new green markets for carbon-neutral goods and services, and productivity gains from climate change mitigation.

The opportunity is supported by two main planks: renewable power generation and electric vehicles manufacturing, which account for $5.3 trillion and $3.3 trillion, respectively. The remaining potential is derived from opportunities in clean energy manufacturing, hydrogen, biofuels, and green finance. Opportunities abound along the supply chain of these emergent sectors, too, and in the business ecosystems that will develop around them.

Grabbing the opportunities

The next step is for business leaders and investment houses to identify and invest in those opportunities. Here the progress report is mixed. 86% of companies in a recent Oxford Economics and IBM survey collaboration claimed to have signed up to an enterprise-wide sustainability strategy. But little more than a third of companies from the same study could say they had taken actions to attain their sustainability goals.

As highlighted previously, knowledge of your firm’s place in a changing world means you can act to better manage exposure to risk, identify new opportunities, reduce your environmental footprint, and improve the sustainability of your firm’s activities.

Given the levels of uncertainties, exacerbated by the extended time horizons involved, it’s important that businesses gather the depth, breadth and quality of information necessary to identify all possible impacts and outcomes for the time periods involved and consider and evaluate all possible responses. Yes, there is a need to act fast, but instead of knee-jerk reactions to events and policy changes, good scenario analysis will enable businesses to be proactive over the long as well as the near term. This is especially so for organisations with particularly complex and sticky supply chains.

Governments need to help and incentivise the private sector to take on these opportunities by embarking on a range of reforms and policies—everything from tax breaks for green production to auditing and enforcing environmental standards.

We believe that our analysis provides an original perspective on the commercial prize on offer for those enterprises and industries that move fastest and most capably to meet the demands of transition to a greener economy. As the WEF report says, there is still a window for all actors in the global economy to shape a more secure future through more sustainable behaviour.

The world’s ecosystem is at a tipping point but there is a clear opportunity for the business and financial community to respond to signals from policymakers and the powerful incentives that Oxford Economics and Arup have identified to take action to protect the climate and the natural world.

If you would like to read the full report, The Global Green Economy: Understanding and capturing the opportunity, please click the link below.

Author

James Lambert

Director of Economic Consulting, Asia

+65 6850 0118

James Lambert

Director of Economic Consulting, Asia

Singapore

James is the Director of Oxford Economics’ economic consulting services in Asia.

James moved to this role from Oxford Economics’ London office, where he headed up a team dedicated to exploring the economic impact of technology. He delivered high profile studies on the growth of the digital economy, the impact of automation and the implications for the labour market.

Prior to joining Oxford Economics, James spent over six years in the Government Economics Service. He worked in economics teams of the Cabinet Office, the Foreign and Commonwealth Office and the Department for Transport. There, he gained experience in microeconomic analysis and impact assessment as well as international macroeconomics, economic risk analysis and energy security. In the FCO, James spent three years working on economic issues in East and South East Asia. He also previously worked for the International Labour Organization.

Talk to us

If you would like to talk to one of our experts about these or other sustainability and climate-related topics, please complete the form.

Tags:

You may be interested in

Post

Mapping the Plastics Value Chain: A framework to understand the socio-economic impacts of a production cap on virgin plastics

The International Council of Chemical Associations (ICCA) commissioned Oxford Economics to undertake a research program to explore the socio-economic and environmental implications of policy interventions that could be used to reduce plastic pollution, with a focus on a global production cap on primary plastic polymers.

Find Out More

Post

How Canada’s wildfires could affect American house prices

The Northern Hemisphere is now heading into the 2024 fire season, having just had its hottest winter on record. If it is anything like last year, we can expect to see further impacts on people, nature, and global markets.

Find Out More

Post

Beyond assumptions – the dynamics of climate migration

Millions of people have already been displaced because of environmental shocks, but many aspects of climate migration remain poorly understood. This confusion has led to oversimplified assumptions about its causes and effects – in reality, it’s more complicated and has many nuances.

Find Out More