Blog | 01 Apr 2021

Working from home — but only for those who have the space?

Lawrence Harper-Scott

Senior Economist

The coronavirus pandemic has realigned home and work life across the world. Lockdowns have forced many employers and their workers to embrace remote working. But now, with vaccine rollouts underway, one of the most important questions is to what extent this will continue post-pandemic. It is a topic we have addressed before in a recent blog post and research briefing, and which we expect to be returning to in the future.

One factor that might offer some insight into the future of remote working is the average living space of homes. People’s desire and willingness to continue working from home for at least part of their week is likely to differ greatly between those who live in large homes with plenty of space, and those living in small flats, sharing rooms, and with no outdoor space. This is something that clearly differs from one country to another, and from city to city.

One of the arguments in favour of working from home is that it improves the quality of life of employees by reducing hours spent commuting, allowing more time for leisure and rest. But this clearly relies on the assumption that our homes are comfortable environments where employees want to spend more time.

The availability of consistent data on average living space is unfortunately limited, but there are some things we can certainly say. For example, densely populated Asian cities such as Tokyo and Hong Kong tend to offer more limited living space than their European and North American peers. The average living space per person in Tokyo is roughly two thirds that of Paris or London.

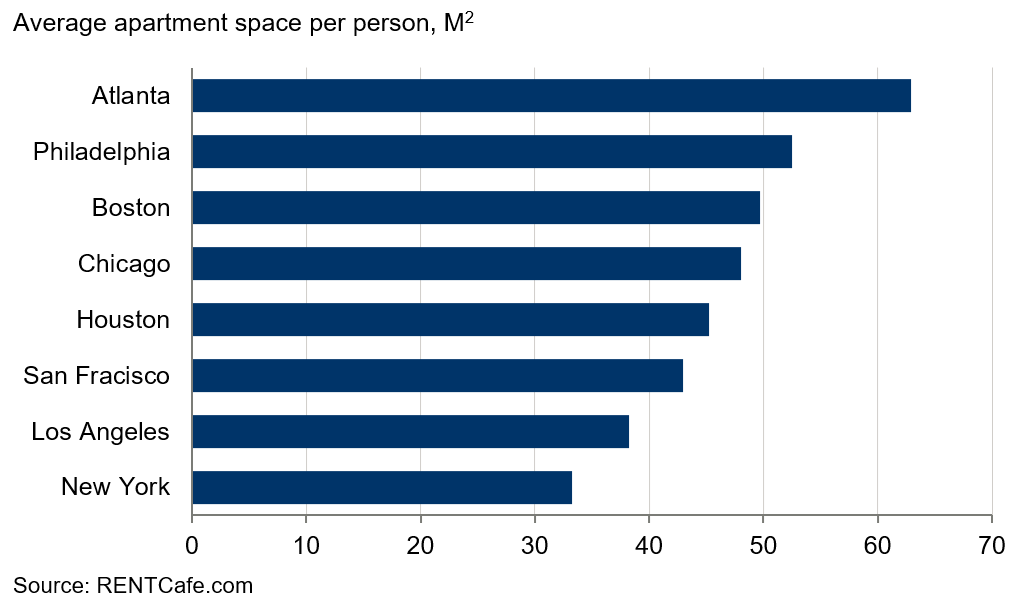

Within global regions, the available data suggests that floor space tends to be smaller in the largest cities. According to RentCafe, average apartment space per person in New York and Los Angeles is 33m2 and 38m2 respectively, well below that of Houston (45m2), Boston (50m2) or Philadelphia (52m2). And although direct comparisons are difficult—because some sources measure living space (which doesn’t include bathrooms and hallways) as opposed to floor area—the data suggests that a similar pattern is true for Europe. According to Eurostat, living space per person in Frankfurt, Milan, Stockholm and Zurich is larger in each case than in Paris.

Within global regions, the available data suggests that floor space tends to be smaller in the largest cities. According to RentCafe, average apartment space per person in New York and Los Angeles is 33m2 and 38m2 respectively, well below that of Houston (45m2), Boston (50m2) or Philadelphia (52m2). And although direct comparisons are difficult—because some sources measure living space (which doesn’t include bathrooms and hallways) as opposed to floor area—the data suggests that a similar pattern is true for Europe. According to Eurostat, living space per person in Frankfurt, Milan, Stockholm and Zurich is larger in each case than in Paris.

One possible implication of this difference in home space is that it may change the competitiveness of cities. If cities want to attract highly skilled knowledge workers, for example, and if those workers will need to work from home for some of their week, then cities where home space is larger may have a competitive advantage going forward.

Of course there are other factors, such as home broadband speed and commuting times, which will undoubtedly influence our decisions about where to live and work in the future. And the scale advantages and attractions of big cities such as New York, Hong Kong and London will still be there. But maybe the balance is about to tilt, even if only slightly.

Tags:

You may be interested in

Post

Amid disruption, what can US office learn from retail?

We examined the disruption of generative AI at the US county level. We identified several metros – Atlanta, Denver, New York, San Francisco, and Washington DC – that had at least one county with the highest percent of displaced workers from AI.

Find Out More

Post

Leading through the great disruption: How a human-centric approach to AI creates a talent advantage

The Oxford Economics' and Adecco Group’s Business Leaders research investigates the changing world of work from the executive perspective. Our research focuses on the impact on talent strategy of Artificial Intelligence (AI) and Generative AI (GenAI).

Find Out More

Post

Thriving beyond boundaries: Human performance in a boundaryless world

In collaboration with Deloitte, Oxford Economics surveyed 1,000 global executives and board leaders in order to understand their perspectives on emerging human capital issues.

Find Out More