Blog | 22 Nov 2022

Policymakers must be honest about the winners and losers of clean energy transition and building a green economy

Felicity Hannon

Associate Director, Climate Scenarios & Macroeconomic Modelling

Greening the global economy – an Arup / Oxford Economics advisory perspective series

The transition to a world of net zero carbon emissions will require fundamental shifts in the structure of the global economy, not least in the way that firms in the energy, transport, and construction sectors—to name just three—go about their business. The macroeconomics of this clean energy transition are highly uncertain, as we explored in our recent award-winning essay, “Can the Clean Energy Transition Boost Global Growth?”, and are made more challenging by the need to make assessments over long time frames.

Advocates of green economic development have argued that the trillions of dollars of annual investment needed for the clean energy transition will boost jobs and growth, through increased domestic demand or reduced imports of fossil fuels. Indeed, our joint analysis with Arup concludes that the disruption caused by the net zero transition will create vast new markets for green goods and services, worth $10.3 trillion by 2050. However, greater investment will only generate increased domestic inflationary pressure unless the transition helps to boost the potential output of the economy.

It is also important to consider where investment in a green economy will come from. Carbon taxes are seen as a key element of the decarbonisation strategy because they offer the opportunity to generate government revenues to fund the energy transition. They also capture the social cost of greenhouse gas emissions and thereby incentivise agents to quickly shift to low carbon produces and use less energy.

Nevertheless, carbon prices can generate inflationary pressures, which reduce real disposable incomes and profits. This can leave stringent mitigation scenarios as essentially a zero-sum solution, whereby the boost to investment is effectively financed by consumers. The economic impact and political success of mitigation policy also depends on its design. For instance, if carbon taxes fall predominantly on poor households (i.e. a regressive tax) then the economic impacts are likely to be greater because poorer households have a higher marginal propensity to consume.

Furthermore, we find that carbon pricing – either through a tax, regulation, or an emissions trading scheme – carries the risk of a negative supply shock as carbon-intensive capital is scrapped. The longer the lifespan of capital in an industry, the greater its exposure to the risks of a delayed transition. This is especially true in the power sector, where power plants typically have lifespans of 30 to 45 years.

A factor that could help to ease the supply-side constraint is innovation and technological progress. Several decades of well-directed investment could help to make aggregate supply endogenous to aggregate demand. Such a technological leap forward is not impossible but will not be easy and does suggest there needs to be a concerted policy effort to foster the necessary supply-side response.

There are also long-term economic benefits associated with the clean energy transition from slower global warming and the associated lower frequency of natural disasters. Most research suggests these benefits are concentrated in hotter developing economies and the second half of the century.

In the face of such uncertainty and complexity over long-term time horizons, climate scenario analysis is a vital tool to prepare policymakers and business leaders for the future. Our latest Global Climate Service scenario analysis suggests that if we are to transition to net zero carbon emissions over the next three decades there must be a fairly punchy impact on technological progress and innovation – roughly equivalent to 0.5% of global GDP levels by 2050 – to offset the negative supply shock from higher energy prices.

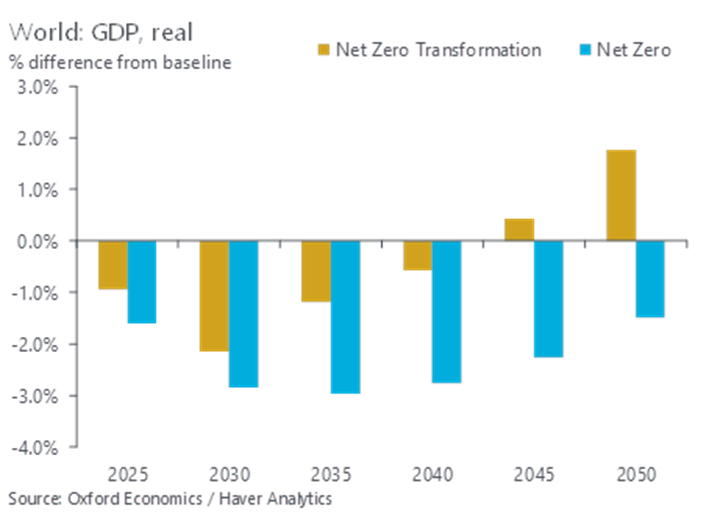

This is nicely illustrated by our upside Net Zero Transformation scenario. While the initial shock of mitigation policy produces a sharp short-term uptick in inflation in this scenario, it decays rapidly in the Net Zero Transformation scenario due to a lower carbon price trajectory and the supply-side benefits of higher equilibrium investment and innovation. As a result, global growth rises close to 2% year-on-year by 2050, some 0.2-0.3ppt higher than our baseline that governments deliver on their stated policies. In levels terms, this brings world GDP 1.8% above the baseline. In contrast, our original Net Zero scenario, which does not assume any positive supply-side shocks, sees higher inflation erode real incomes, lowering world GDP 2.8% below baseline levels in 2040 and ends at 1.5% below baseline levels in 2050.

We also find that the best way to dampen this capital depreciation channel is to act early because it would allow us to take advantage of the natural investment cycle. Early action will also help to manage the inflationary pressures because it will require less aggressive mitigation policy and allow more time for consumers and producers to transition away from taxed products.

Achieving a net zero and carbon neutral world by 2050 is the defining challenge of our age. It relies on many partners working together to shoulder great costs, and to do so as equitably and efficiently as possible. It is important for policymakers to be honest about the challenges businesses, investors, and consumers will have to face if we are to halt global warming on the sort of timescales scientists are telling us is necessary.

Indeed, delegates to the COP27 climate summit in Sharm El-Sheikh have in the last couple of weeks been grappling with the crucial issue of how to finance the transition to net zero and the creation of a green economy. Both governments and economists need to be up-front about the trade-offs involved and design policy accordingly.

Source: James Nixon and Felicity Hannon (2022), “Can the Clean Energy Transition Boost Global Growth?”. This essay was the winner of the 2022 Rybczynski Prize, awarded by the Society of Professional Economists.

This is the third in a series of articles by Oxford Economics that will be released in the run up to the launch of our report, undertaken in conjunction with Arup, on the Green Economy.

If you would like to read the full paper

click on the button below

Tags:

You may be interested in

Mapping the Plastics Value Chain: A framework to understand the socio-economic impacts of a production cap on virgin plastics

The International Council of Chemical Associations (ICCA) commissioned Oxford Economics to undertake a research program to explore the socio-economic and environmental implications of policy interventions that could be used to reduce plastic pollution, with a focus on a global production cap on primary plastic polymers.

Find Out More

How Canada’s wildfires could affect American house prices

The Northern Hemisphere is now heading into the 2024 fire season, having just had its hottest winter on record. If it is anything like last year, we can expect to see further impacts on people, nature, and global markets.

Find Out More

Beyond assumptions – the dynamics of climate migration

Millions of people have already been displaced because of environmental shocks, but many aspects of climate migration remain poorly understood. This confusion has led to oversimplified assumptions about its causes and effects – in reality, it’s more complicated and has many nuances.

Find Out More

Greenomics – Ep. 9 | The nature of Travel & Tourism

A discussion of the crucial role of climate-ready buildings in the global push towards a net-zero future. They delve into sustainable construction practices, the importance of regulations, retrofitting existing buildings, and behavioural changes to create environmentally friendly homes. The conversation also touches on the economic challenges and choices associated with transitioning to sustainable living.

Find Out More