Blog | 27 May 2021

Will GCC countries be economies of the future or old oil ghost countries?

The sustainability of hydrocarbon revenues among Gulf Cooperation Council (GCC) economies has been a major concern for decades, prompting a plethora of policies, visions and reforms focused on economic diversification. Undoubtedly, oil will continue to play an important role in the foreseeable future, even as demand for hydrocarbons is set to run out of steam and weaken from current levels, consistent with the gradual transition towards renewable energy, in line with the Paris Agreement to achieve net carbon zero by 2040.

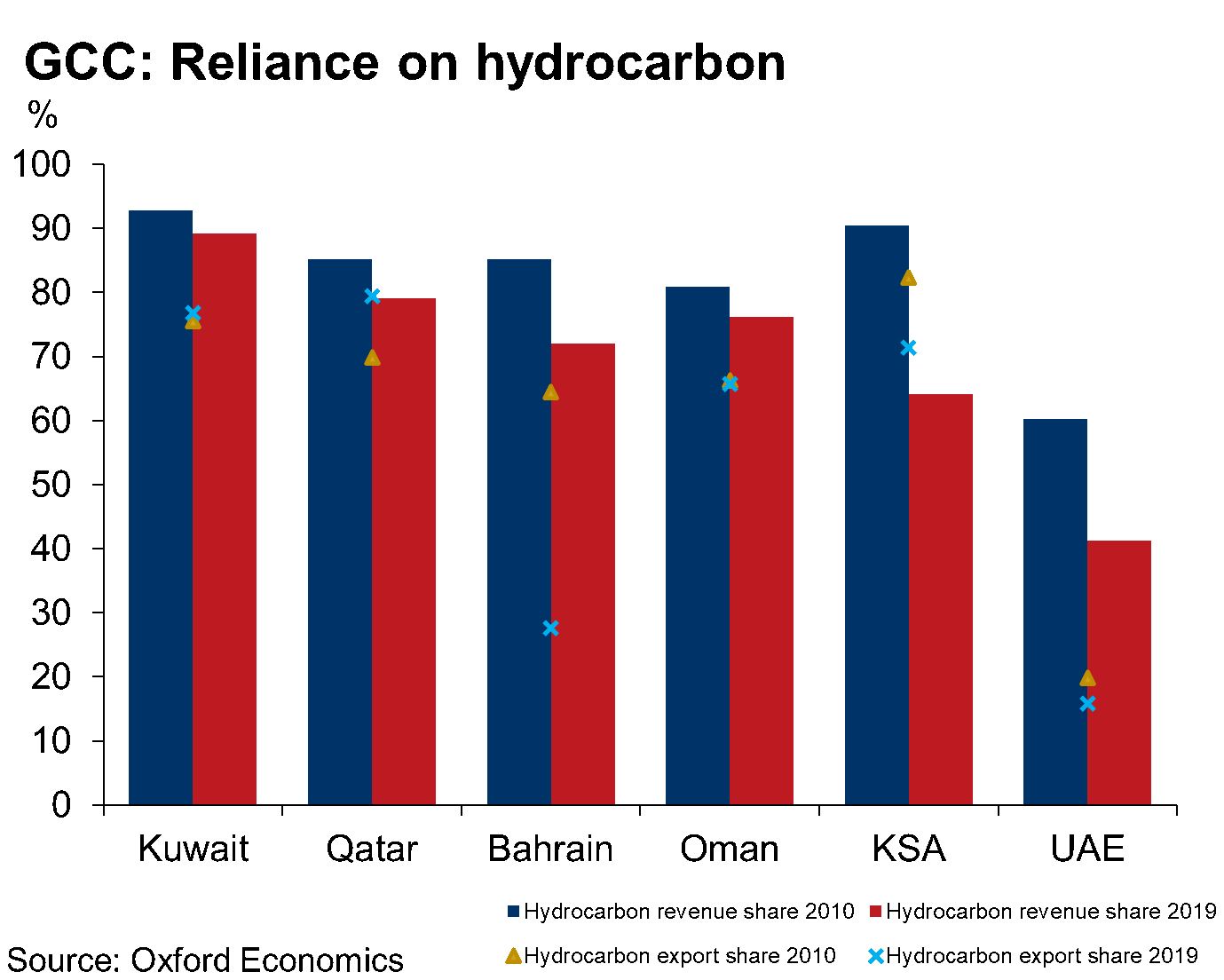

Oil extraction remains vital given its direct contribution to GDP. Oil and gas production represent over 40% of GDP in GCC countries with the exception of the UAE and Bahrain. More alarmingly, transfers of hydrocarbon revenues indirectly support the region’s non-oil activity, which accounts for over 70% of total revenues in GCC countries except Saudi Arabia and the UAE. Sectors such as refining, chemicals, food and metals and power generation capacity are designed to take advantage of access to cheap oil and gas, while the ever-expanding tourism sector, reliant on long-haul visitors, is also relatively oil-intensive.

Oil extraction remains vital given its direct contribution to GDP. Oil and gas production represent over 40% of GDP in GCC countries with the exception of the UAE and Bahrain. More alarmingly, transfers of hydrocarbon revenues indirectly support the region’s non-oil activity, which accounts for over 70% of total revenues in GCC countries except Saudi Arabia and the UAE. Sectors such as refining, chemicals, food and metals and power generation capacity are designed to take advantage of access to cheap oil and gas, while the ever-expanding tourism sector, reliant on long-haul visitors, is also relatively oil-intensive.

The Covid-19 pandemic highlighted the pitfalls of over-reliance on oil for growth. A global economic slowdown induced by the pandemic pushed Brent crude prices down from $64 pb at the start of 2020 to a low of $23 pb in April 2020, amplifying the need for sustainable diversification. The IMF estimated that unless GCC countries undertake substantial fiscal and economic reforms, their foreign reserves will be depleted by 2034 with the pandemic likely to have shortened this timeline.

The GCC region is yet to escape this turbulent phase with both the fiscal balance and current account balance shifting from surplus to deficit. Even with oil prices at $70 pb, several GCC economies will struggle to meet fiscal break-even levels, sharpening the urgency of the search for new sources of revenue. Further oil price volatility will limit diversification efforts.

The decline of the US Rust Belt serves as a reminder of the consequences of failing to diversify and adapt adequately. The region’s failure to implement the right-to-work state policy until 2012, while most of the south-eastern states had the laws in place since the 1950s, highlights its complacency. Oil booms in towns like Williston, North Dakota in 2012 swiftly vanished when oil prices plummeted in 2015, causing the industry and the regional population to disappear. The GCC isn’t there yet, but complacency in capitalising on the latest oil price surge risks a similar outcome for the Gulf.

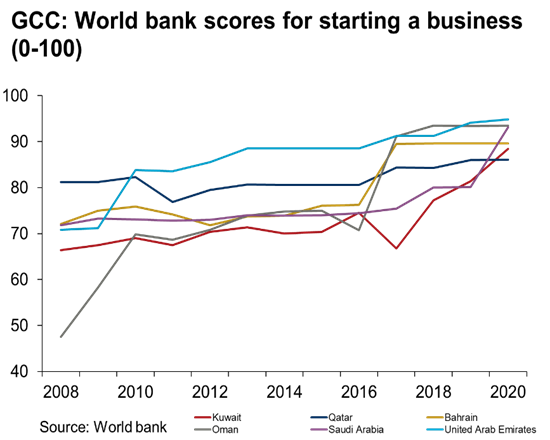

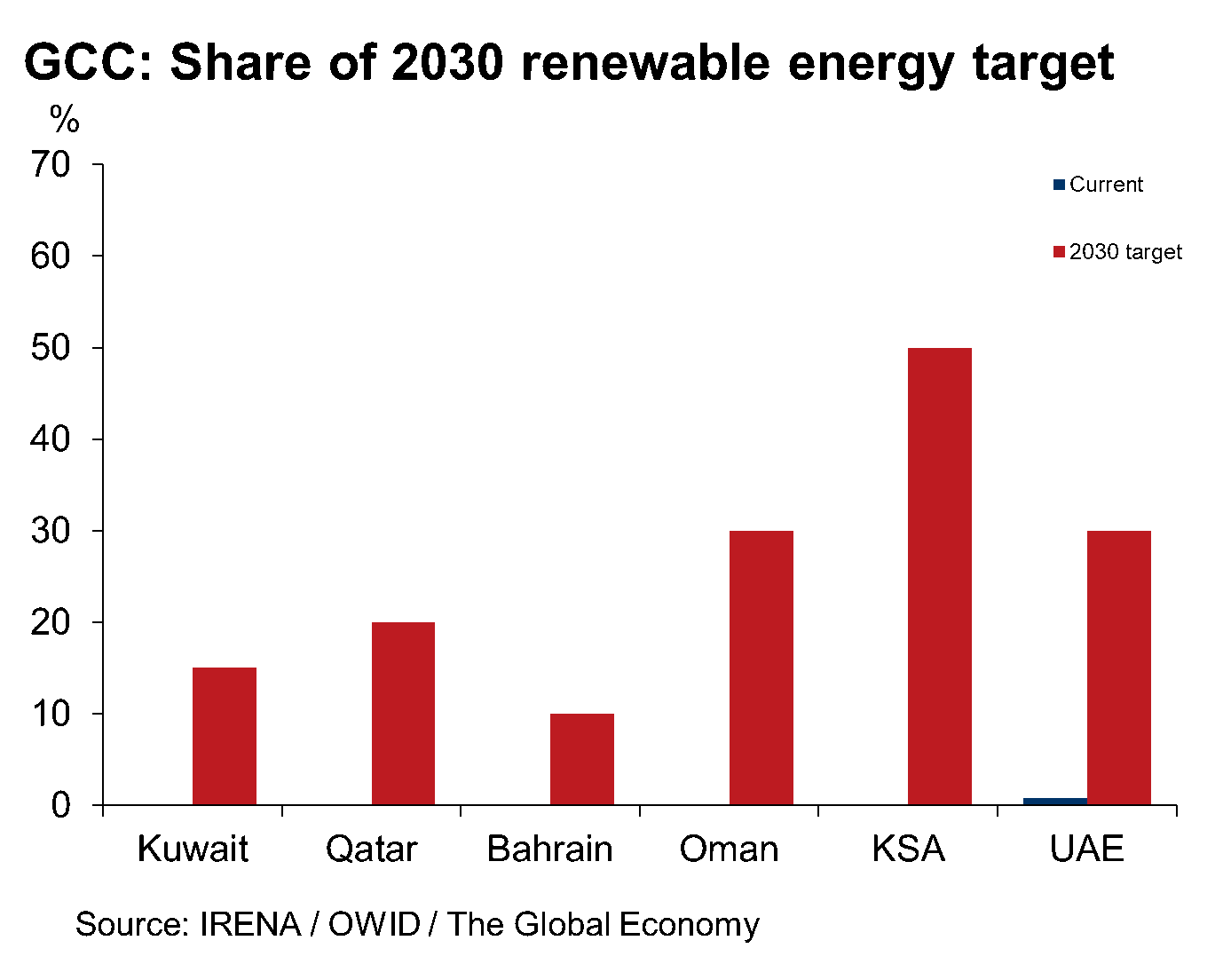

Policy makers have recognised the impending issue and have acted decisively by introducing ambitious diversification policies. Saudi Arabia has already made a bold effort to capitalise on the green hydrogen market. A $5bn energy plant powered by sun and wind is set to supply the planned futuristic city of Neom in 2025. Saudi Electricity Co. raised $1.3bn by selling 5- and 10-year dollar denominated bonds to finance green capital projects last year. Similarly, Qatar National Bank issued its first green bond worth $600m in 5-year senior unsecured notes. The UAE commissioned its first green hydrogen plant this year, which will supply fuel to certain vehicles during the anticipated Expo 2020. Installed solar photovoltaic (PV) capacity is expected to increase four-fold from its current 2.1GW level by the end of 2025. Meanwhile, agencies to support SME development and financing such as Saudi Arabia’s SME Authority, Qatar Development Bank and Oman’s Riyada have been established in recent years and have had a notable impact on the ease of starting a business in those economies.

Policy makers have recognised the impending issue and have acted decisively by introducing ambitious diversification policies. Saudi Arabia has already made a bold effort to capitalise on the green hydrogen market. A $5bn energy plant powered by sun and wind is set to supply the planned futuristic city of Neom in 2025. Saudi Electricity Co. raised $1.3bn by selling 5- and 10-year dollar denominated bonds to finance green capital projects last year. Similarly, Qatar National Bank issued its first green bond worth $600m in 5-year senior unsecured notes. The UAE commissioned its first green hydrogen plant this year, which will supply fuel to certain vehicles during the anticipated Expo 2020. Installed solar photovoltaic (PV) capacity is expected to increase four-fold from its current 2.1GW level by the end of 2025. Meanwhile, agencies to support SME development and financing such as Saudi Arabia’s SME Authority, Qatar Development Bank and Oman’s Riyada have been established in recent years and have had a notable impact on the ease of starting a business in those economies.

Despite encouraging diversification efforts, it remains more challenging for centrally planned economies to achieve the desired change. As oil price surges begin to fade, the GCC will need to reinvest strategically in a post-oil future, resist pressure from citizens for further financial support, align public sector wages and benefits with the private sector, and allocate additional government spending to support job creation. Vision targets are moving GCC countries in the right direction in the transition away from oil and successful implementation may provide the blueprint for other countries striving to diversify from oil.

Despite encouraging diversification efforts, it remains more challenging for centrally planned economies to achieve the desired change. As oil price surges begin to fade, the GCC will need to reinvest strategically in a post-oil future, resist pressure from citizens for further financial support, align public sector wages and benefits with the private sector, and allocate additional government spending to support job creation. Vision targets are moving GCC countries in the right direction in the transition away from oil and successful implementation may provide the blueprint for other countries striving to diversify from oil.

Tags:

You may be interested in

Post

Airport chaos, a software glitch, and the cost of downtime

The tsunami of flight cancellations that followed July’s global tech outage made the costs of computer downtime painfully clear to thousands of stranded travellers. It shows it's more crucial than ever to safeguard whole ecosystems against problems caused by individual failures.

Find Out More

Post

2024 Paris Olympics: Impact on Tourism and Beyond

The Olympics are set to push Paris ahead of France in terms of recovery, with international arrivals into Paris rising to 15% above 2019 levels.

Find Out More

Post

Could the election spark renewed interest in UK-focused stocks?

The UK election has concluded with Labour securing a landslide victory. This result is likely to set the stage for a period of political stability and, combined with signs of a consumer-driven economic recovery, makes domestic-focused UK stocks increasingly attractive.

Find Out More