Blog | 27 Sep 2022

Will Europe’s green future survive Russia’s war in Ukraine?

James Pendlington

Research Manager, Thought Leadership

Russia’s invasion of Ukraine continues to sow economic disruption around the world. One long-term problem the conflict could exacerbate is climate change, as Europe slows its transition from fossil fuels in the scramble for alternatives to Russian energy—though the grim events of 2022 could yet end up accelerating a greener future.

Quitting Russian hydrocarbons in a hurry is a challenge of historic scope, requiring huge shifts to supply lines and infrastructure. But speed is a necessity if the economic response to Russia’s war is to be effective. With winter coming, the first wave of change has to focus on other sources of fossil fuels. That includes coal, which requires extending the life of high-emission power plants previously marked for extinction, and increased investment in natural gas production.

What happens after that will be vitally important. If Europe can use this period of flux to intensify its focus on renewable energy, then the long-term outlook gets brighter. But here again the European Union and countries across the continent will have to move quickly to avoid disaster.

Europe is addicted to fossil fuels from Russia. Over 40% of the EU’s gas imports are from Russia, and for some European countries, such as Estonia, Finland and Bulgaria, it’s nearly 100%; the huge German economy relies on Russian gas for half of its gas imports. Russia is also the EU’s main supplier for crude oil (27% of imports) and coal (47%), with European countries spending around €57 billion on its oil in the first 100 days after the February invasion.

The wartime goal has been to find other suppliers. In June the EU imported more Liquified Natural Gas (LNG) from the US than from Russia for the first time. The European Parliament recently included investing in gas in a list of environmentally sustainable economic activities, albeit only if used to transition from coal or oil.

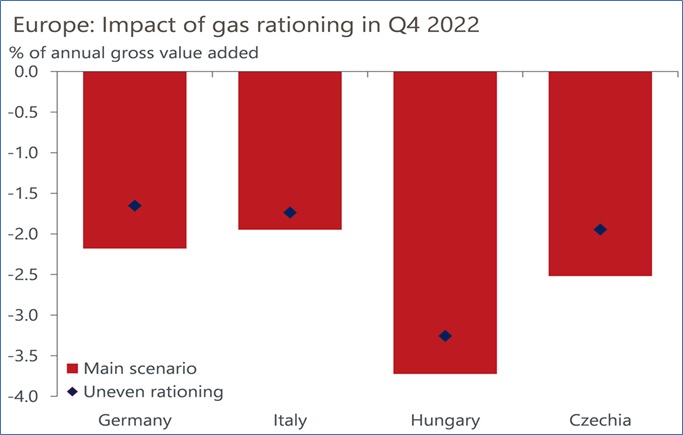

The transition is causing real economic pain, with gas prices skyrocketing as supplies have tightened, and potential rationing in the winter looms ahead. In late August the UK announced it expects a spike in home-heating costs by October, raising—in the words of The New York Times—“the specter of a humanitarian crisis in one of the world’s richest countries.”

Limited gas supplies will take a big economic toll

Source: Oxford Economics/Eurostat, Eurozone: Gas rationing to have severe impact on EU economies, July 2022

None of this is great for Europe’s green agenda. What remains to be seen is whether positive steps can be achieved with the Russia-Ukraine war still ongoing. In May, the EU presented a plan called “REPowerEU,” which accelerates previous commitments on the green transition by aiming for independence from Russian fossil fuels by 2030. Where will the replacement power come from?

One critical step will be the electrification of heating networks (a topic covered in our research with Accenture), which could shift demand to renewable sources (electric heat pumps are three times more efficient than gas heat). In the UK, where 85% of homes are connected to the gas network, this will be a mammoth challenge. The UK government has recently launched the first phase of heat pump rollout programmes, part of the £320m Heat Networks Investment Project, with a stated aim of 600,000 installations per year by 2028.

Nuclear power is another option, both the construction of new plants and extending the lifetimes of reactors slated to be decommissioned. The European Parliament has voted to classify investment projects in nuclear power as green, although climate activists remain divided on the subject.

The REPowerEU plan also calls for more rooftop solar panels, increasing biomethane production, developing infrastructure for increased hydrogen imports, cutting red tape for renewables projects, and ongoing decarbonisation through electrification. None of this will be quick or easy, but all of it is essential.

EU funding is already being disbursed across Europe. €1.8 billion in clean-tech energy grants will go to projects in Bulgaria, Finland, France, Germany, Iceland, The Netherlands, Norway, Poland, and Sweden. €1.7 billion will support biomethane production plants in Italy. €2.98 billion is being spent in Germany to promote green district heating. €4.2 billion is earmarked for Slovakia to increase its share of renewable energy sources.

Whether this rate of investment will be sustained in the face of growing recessionary pressures remains to be seen, with Oxford Economics research suggesting the risk of a recession in the Eurozone is mounting. Even under the best of circumstances, summoning the political will and massive funding needed to realize Europe’s green goals will be an enormous challenge. It is a challenge the world needs Europe to meet.

Author

James Pendlington

Research Manager, Thought Leadership

+44 (0) 7340 166 468

James Pendlington

Research Manager, Thought Leadership

London, United Kingdom

James is a Research Manager within the Thought Leadership team and has been with Oxford Economics since November 2020.

James’ work mainly covers strategy and operations but also spans projects covering technology and finance for clients such as Accenture, EY, Cognizant, and YouTube.

Prior to joining Oxford Economics, James worked for Walker Books on the other side of the river to our Westminster office, in Vauxhall. James has a BA (Hons) in Economics from the University of Sheffield.

Tags:

You may be interested in

Post

Promising trends signal optimism for the hotel sector

The global travel recovery took great strides in 2023, with some destinations already reporting a full recovery back to pre-pandemic levels. Trends continue to suggest further growth in tourism activity going into this year, signalling optimism for the hospitality sector going forward. But risks stemming from inflation, geopolitical tensions and climate change will persist.

Find Out More

Post

How inflation eroded governments’ debts and why it matters

The supply-shocks era represented the first time in a generation where inflation significantly eroded the real value of global public debt. For EMs, the erosion averaged 3.7% of GDP between 2020 and 2023; the average for advanced economies (AEs) was twice that (7.3% of GDP).

Find Out More

Post

Leading through the great disruption: How a human-centric approach to AI creates a talent advantage

The Oxford Economics' and Adecco Group’s Business Leaders research investigates the changing world of work from the executive perspective. Our research focuses on the impact on talent strategy of Artificial Intelligence (AI) and Generative AI (GenAI).

Find Out More