Blog | 13 Oct 2023

What’s missing in the crisis resolution debate? China’s side

Gabriel Sterne

Head of Global Emerging Markets

Stricken sovereigns are suffering as China and the Western-dominated IMF Board engage in a titanic wrestling match over crisis-resolution architecture. It’s a massive problem that could be a destructive force for decades.

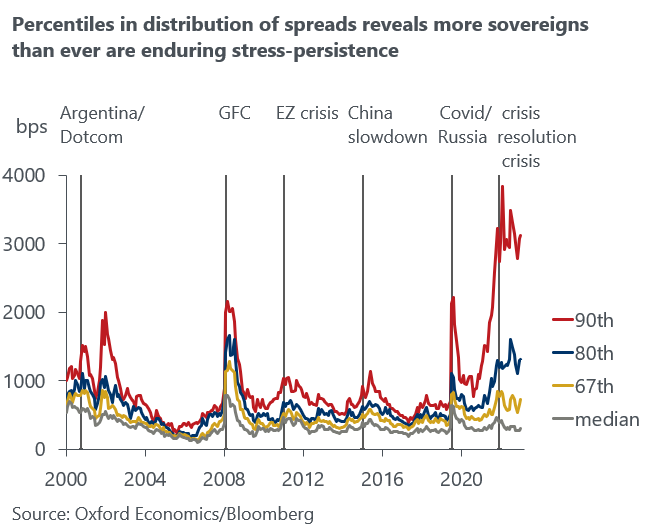

More sovereigns than ever are stuck with limited refinancing options. Since March 2020, on average more than 30% of sovereigns have endured spreads of greater than 600bps (Chart 1). That’s snowballing territory; at those spreads it’s too expensive to redeem bonds that mature, so the refinancing issue could get worse.

First, a recap on a key source of deadlock. The IMF cannot lend to a crisis-afflicted government unless debt is sustainable, so it needs financing assurances that creditors, including China, will provide debt relief. China has dragged its feet in providing these assurances and the IMF has refused to use its lending into official arrears framework to overcome China’s intransigence for fear of upsetting one of its major shareholders.

There has been plenty written about it on these pages, including here, here, and here. But in considering the arguments there’s one thing that almost all commentary has missed: China has a strong case to feel wronged.

It’s well documented that China has contributed to the problem via flaws in lending policies. This includes cases where its lending did not factor in sufficient debt sustainability implications and onerous penalty clauses included in secretive loan contracts; and an intransigent approach to debt restructuring. Also, the diversity in the nature of Chinese lenders has added to the complexities of restructurings.

Other official lenders also have blemished lending records, of course, but let’s not go there now.

China’s perspective

The less-told side to the story is that China also has good grounds to view existing crisis resolution traditions as outdated, unfair, and discriminatory.

The most obvious flaws relate to weaknesses in the case for treating multilateral project lenders (for example the World Bank and Regional Development Bank) as senior in debt restructurings (i.e., exempt from taking haircuts). By contrast bilateral (government-to-government) lending is expected by long-standing precedents to participate fully in debt relief efforts.

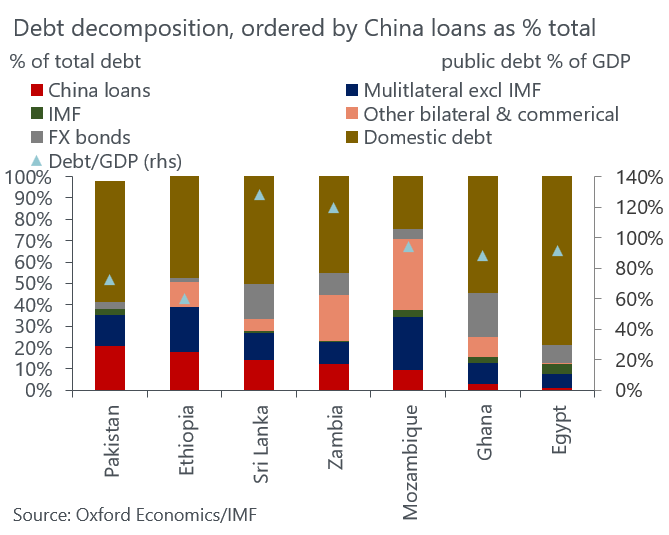

The combined shares of China and multilaterals in total debt is very big in plenty of sovereigns; it’s a problem that has to be solved (Chart 2).

It’s never really made sense to treat loans differently just because one is a loan from a collective purse of various governments, whereas the other is a loan from a single government.

The most common case in favour of multilaterals not suffering haircuts is that it’s good to keep concessional development loans flowing, even during a crisis. But that could be done via the long-established “cut-off point” in debt restructurings, which dictates that loans granted after that date are not subject to the restructuring.

It’s the size of China’s lending rather than geopolitics that has exposed faultlines

The standard IMF argument is that if only China joined forces with the Paris Club of Official bilateral creditors, everything would be fine. That’s a major motivation for the Common Framework. It also underpins the frustration with slow progress expressed by the IMF MD, Kristalina Georgieva.

The crisis resolution fault lines have been accepted for decades by governments in part because the extra haircuts required by bilateral creditors as a result of multilaterals avoiding them tends to average out over time and across sovereigns– western Governments dominated both bilateral lending and shares in the IMF.

Such arguments that “it all comes out in the wash” apply less when lenders such as China make up such a significant share of total debt. The status quo would imply that China will, on average, provide significantly more debt forgiveness than other governments in proportion to exposures, given other governments’ shares in multilateral institutions.

It’s not fair on China.

A solution is not difficult to design

The blanket approach of allowing all multilateral lenders to dodge haircuts no longer works; it just inflicts more pain on other creditors, delays restructurings, and creates moral hazard. It’s time for crisis resolution to take more account of loan characteristics, and less of the nature of lender characteristics.

If haircuts are to differ across creditors, they could be graded via objective criteria that include how concessional was the original loan.

And to keep money flowing to stricken sovereigns, it would be fairer and more efficient to offer a new lending option on a case-by-case basis as part of a debt-restructuring menu for all creditors, similar to the approach in various important historic cases. The present value contribution could be designed to be similar.

But pessimistic outcomes are more likely

The more likely long-term scenarios involve extended pain. We’ve attached subjective probabilities to each.

Scenario 1: Status quo persists (20%-40% weight). The Zambia restructuring offers a template for smoother crisis resolution. In this scenario, China caves in and accepts its status as junior to multilaterals, realising it’s not ready to act as an alternative to the IMF and World Bank. However, one of the lessons expertly drawn in a recent article on these pages is that China is strongly resisting the Zambia deal setting a precedent.

Scenario 2: Major reform in resolution architecture (0%-20%). Crises become easier to resolve as the IMF overcomes institutional reticence and lends into Chinese arrears, and seniority rules are reformed to improve inter-creditor equity. This is one for the optimists. Recent experience suggests the IMF and World Bank will challenge China only behind closed doors and will cling to their privileges provided in the existing frameworks.

Scenario 3: The system slowly decays (40%-60%). We attach the most probability to a scenario in which China adopts a pragmatic, yet resentful approach that keeps the system barely functioning with painfully slow restructuring negotiations.

The existing system decays further as it’s discredited by moral hazard-related actions. For instance, it’s crazy that loans from the Central American Bank of Economic Integration are senior even though they were used by El Salvador to perform a buyback boondoggle.

Over time, though, China increasingly channels its loans via various new multilateral organisations that it dominates, thereby slowly converging on seniority equivalence with other multilaterals. Multilateral loans become such a large share of total debt that it’s impossible to exclude them from restructurings.

Scenario 4: A bifurcated world of crisis resolution fractures the IMF business model (20%-40%). It’s possible a growing number of economies eschew the Fund and other multilateral financing in favour of China. This could be gradual, such as a country like Ethiopia turning to China because the Common Framework is too hard to access.

But the process could snowball quickly should China lend to a government that defaulted to the Fund. For example, if a country in Zambia’s position got so weary of waiting for the fruits of the Common Framework that it gave up on the multilateral option and turned to China instead.

Of course, the outcomes can overlap, so they don’t necessarily sum to 100%. Either way, the more likely path will be long and troubled. None of which is good news for crisis resolution.

Author

Gabriel Sterne

Head of Global Emerging Markets

Private: Gabriel Sterne

Head of Global Emerging Markets

London, United Kingdom

Gabriel delivers macro-economic products tailored for corporates and financial markets, as head of a team that integrates EM macro and strategy views. In recent years he has published wide-ranging research including on stagflation risks, monetary policy credibility, global savings, demographics, Covid scarring, risks and resilience in emerging markets, and sovereign crisis resolution. He joined from investment banking boutique Exotix in May 2014, following 20 years of public sector experience, including at the Bank of England and International Monetary Fund.

Tags:

You may be interested in

Post

The latest export from China is … deflation

We expect Chinese export price deflation to provide a helpful tailwind in the struggle to bring EM inflation back to target.

Find Out More

Post

Cross Asset: Closing our tactical long on gold, but we’re still bullish

The strength of the recent gold price rally has defied even our already bullish expectations and we think prices are vulnerable to a price consolidation in the short term. As a result, we close out our tactical long position on gold that we opened in October last year.

Find Out More

Post

How Asia’s supply chains are changing | Techonomics Talks

Global supply chains have continued to expand, despite talk of deglobalization and nearshoring. US and Japan have started to de-couple from China, but other G7 countries grow more dependent on Chinese inputs. Several "hotspots" are emerging across Asia with multiple winning formulas.

Find Out More