Blog | 31 Oct 2022

Valve and actuator firms must brace for slowdown after price-driven spike

Alexandra Hermann

Lead Economist, Asia Macro

The state of the market for valves and actuators is often seen as a bellwether for the state of the industrial economy. Against that backdrop our latest forecasts contain some worrying signals.

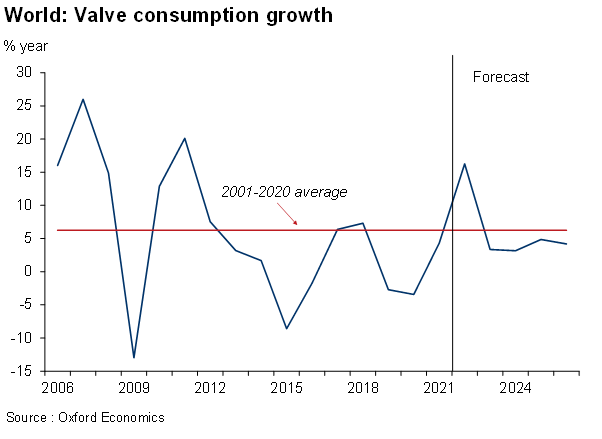

Global nominal growth in demand for valves is set to slow to 3.4% next year, following an expected spike of 16.3% in 2022. This year’s forecast is exaggerated by the spike in prices thanks to record-high inflation, so it is more significant that 2023’s growth is set to underperform last year’s outturn of 4.3%. A similar downbeat picture can be seen for actuators, where a forecast of 3.8% growth in 2023 underperforms this year’s 15.7% rise and only marginally outperforms 2021 growth of 3.3%. Those strong figures for 2022 are misleading as they are not adjusted for record-high inflation, disguising a deteriorating outlook for volumes across most regions. In the US, for instance, producer price inflation for valves and related equipment has been running at 12% for this year through to September. Most worryingly, the long-term outlook for both categories indicates annual growth of around 4.1%—far behind the 6.2% average level since the turn of the millennium.

Behind this slew of numbers is a now familiar story—the economic shocks of the Ukraine war and the spike in energy prices seen this year that now threaten to push the world economy into recession. We envisage global GDP growth will slow from 2.9% this year to 1.5% in 2023. Key drivers of the pessimistic outlook are sectors in industrialised economies most affected by high inflation and monetary policy tightening. In addition, the energy crisis has weighed on key valve- and actuator-consumers, particularly in Europe.

The chemicals sector is one such example where skyrocketing prices for oil and gas—which serve both as a source of energy and feedstock—have caused production drops. We also expect a deceleration in power generation as extreme gas price levels, which feed through to wholesale and in turn retail electricity prices, reduce power demand from both industry and households.

The advanced economies will see the greatest pain. We expect a sharp slowdown in North American growth in 2023 as a combination of faster rate hikes by the US Federal Reserve, stickier inflation, and a weaker labour market drag on its economies next year. European valves demand growth is forecast to drop below 2% next year as the region continues to cope with high energy prices and recession.

However, this gloomy outlook does have a silver lining. We believe growth will resume as these shocks start to dissipate through 2023, thanks to robust expansion in emerging markets. Sanctions-related damage to the Russian economy has been smaller than initially expected, while China is expected to rebound as the economy emerges from Covid-19 lockdowns. Indeed, we expect a return to double-digit growth in Asia in 2022. This is mainly driven by a strong outlook for the Indian market; valve and actuator demand growth is forecast to steadily accelerate over the 2024-2026 horizon.

While there may be some bright spots, the global slowdown points to a more restrained “new normal” for the valve and actuator sector after the more buoyant era in the early years of this century.

Author

Alexandra Hermann

Lead Economist, Asia Macro

+44 (0) 203 910 8042

Alexandra Hermann

Lead Economist, Asia Macro

London, United Kingdom

Alexandra is a Lead Economist on the Industry team where she is responsible for sectoral forecasts for the chemicals and pharmaceuticals industry and helps develop the team’s view on the global industrial outlook. She has also supported macroeconomic consulting projects such as developing scenario analyses for Accenture. Her role also involves contributing to bespoke industry consulting projects across a range of sectors such as chemicals, machinery, and energy.

Prior to joining Oxford Economics, Alexandra worked as an economic consultant for Cornerstone Research for over two years. At Cornerstone Research, she was involved in conducting qualitative research and quantitative analyses to support expert testimony in high-stakes litigation cases across a variety of sectors including energy, pharmaceuticals, and financial markets. Alexandra holds an MPhil in Economics from Oxford University and a BSc in Economics from the University of Mannheim. Alexandra is fluent in English and German.

Tags:

You may be interested in

Post

How inflation eroded governments’ debts and why it matters

The supply-shocks era represented the first time in a generation where inflation significantly eroded the real value of global public debt. For EMs, the erosion averaged 3.7% of GDP between 2020 and 2023; the average for advanced economies (AEs) was twice that (7.3% of GDP).

Find Out More

Post

Weak world trade still a drag on global growth

World goods trade declined in 2023, reversing the trend of 2022. This development points to the resumption of the decade-long pattern of slow global trade growth relative to GDP. Recent trade trends imply downside growth risks for 2024 and the longer-term outlook still looks to be one characterised by 'slowbalisation', especially with protectionism a rising issue.

Find Out More

Post

UK life sciences are set for growth, but challenges remain

The life sciences industry makes a major contribution to the UK economy. One in every 121 employed people in the UK works in the sector, which in 2023 contributed over £13 billion to the national economy.

Find Out More