Blog | 06 Aug 2021

Three ways supply chains are evolving (for the better) following the pandemic

For most product-based businesses, the supply chain problems that have defined the Covid-19 era are not going away quickly. Executives must still place bets on consumer demand and the availability of key components a year or more into the future instead of the six-month (at most) lead times common before the pandemic.

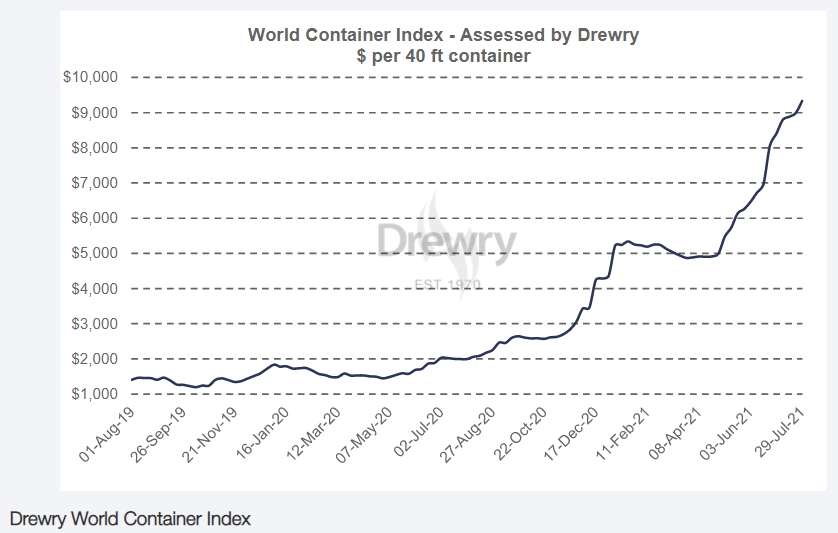

Many are facing a looming shortage of microchips, gumming up supply chains for goods ranging from automobiles to refrigerators. And costs for other basic materials—like lumber and steel—can be brutally high: Many companies are buying hard-to-find components on the spot market for 25% more than wholesale, while dealing with skyrocketing shipping container costs, which have more than quadrupled over the past year. And all of this is made worse by ongoing labor shortages in manufacturing and logistics across the globe.

Oxford Economics has conducted several large-scale, global studies analyzing executive perspectives and expectations regarding global supply chains. While challenges will no doubt persist in the short term, our research provides a picture of the evolving post-Covid supply chain. Thankfully, it’s not all about short-term survival. Here are three upside trends we expect to become permanent following the pandemic.

- Many companies have sharpened their focus on making their supply chains sustainable. One of the most meaningful shifts we are seeing in our research is a growing emphasis on environmental responsibility. In a recent research program with SAP, we surveyed 1,000 supply chain executives from larger companies worldwide (more than $500m in revenue). We found that a strong majority of executives have mature attitudes toward supply chain sustainability—and report meaningful progress.

There was some handwringing early in 2020 about how the pandemic would derail sustainability investments. In fact, a survey of supply chain executives we conducted for EY late last year found the opposite to be true: While a majority (57%) said they experienced moderate or major disruptions to their supply chains during the pandemic, 85% said ESG and sustainability initiatives are now an even bigger part of their supply chain strategies. - Purchasing decisions are less about transactions and more about relationships. Another big—and likely permanent—change is a deepening of the supplier-buyer relationship. Here, smaller organizations may hold a distinct advantage over larger ones. For a recent study with the Consumer Technology Association, we spoke with several small and mid-size association members to see how they managed the pandemic-era supply chain.

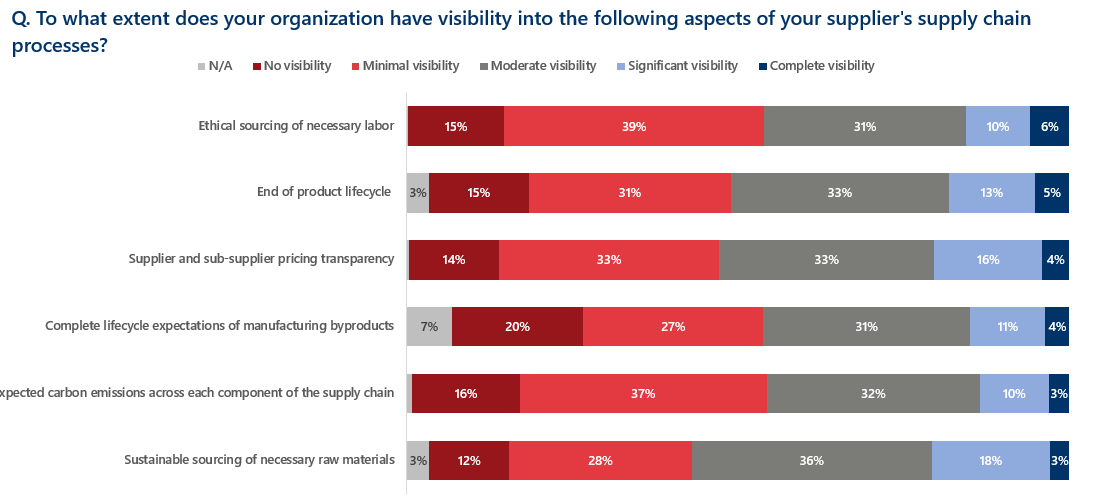

Some are sending staff overseas to monitor factories, working more closely with their vendors, and buying components on the spot market if necessary. Others are calling their suppliers daily to ensure an uninterrupted flow of goods. This contrasts with findings r from our recent SAP study and its predecessor, which suggests that for larger companies visibility into supplier processes remains a major blind spot.

Large organizations would do well to learn from their smaller counterparts. While they may have many more suppliers to manage, they must forge deeper connections with them to avoid interruptions—and to ensure sustainability metrics are met. - “Just-in-time delivery” will shift to “just-in-case inventory.” The third major shift is a tweaking of the just-in-time inventory model. The pandemic continues to show how shortages in products and components can back up supply chains for months. But due to changes in financial management, warehousing, and logistics over the past decades, holding lots of excess inventory is not feasible either. Supply chain executives must find a middle ground as they come out of the pandemic, and a majority (60%) of the supply chain executives in our survey for EY say they are focusing on spare capacity over just-in-time inventory.

But how can executives find this Goldilocks zone? The executives we talked to for CTA are updating their demand forecasts on a near-daily basis. “We are trying to figure it out as we go along. Literally every day we are strategizing and reallocating resources as needed to ensure we have enough product coming out of our factory,” said one manufacturer of high-end headphones. The larger manufacturers in our recent survey for SAP may be tipping their hand—more than a quarter are already using advanced technologies in their supply chain planning process. Using the terabytes of real-time data at their fingertips, manufacturers can use machine learning to constantly update detailed, accurate demand forecasts.

Most of the supply chain executives participating in our research programs are still struggling to emerge from a reactionary mode—but they have adapted well to this evolving paradigm. One impact of the pandemic should be supply chains that are more transparent, resilient, and dependable.

Tags:

You may be interested in

Post

Oxford Economics ranks top in the FocusEconomics Analyst Forecast Awards 2024

Oxford Economics has once again been recognized as one of the top performers in the 2024 FocusEconomics Analyst Forecast Awards.

Find Out More

Post

Oxford Economics Launches Global Cities Index

Oxford Economics is proud to launch the Global Cities Index, a ground-breaking initiative that offers evaluation of the world's 1,000 largest urban economies.

Find Out More

Post

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More