Recent Release | 11 Oct 2022

The Economic Impact of Buy Now Pay Later in Australia

Economic Consulting Team

Oxford Economics

Oxford Economics was commissioned to measure the economic impact of Buy Now, Pay Later (BNPL) in Australia by the Australian Finance Industry Association.

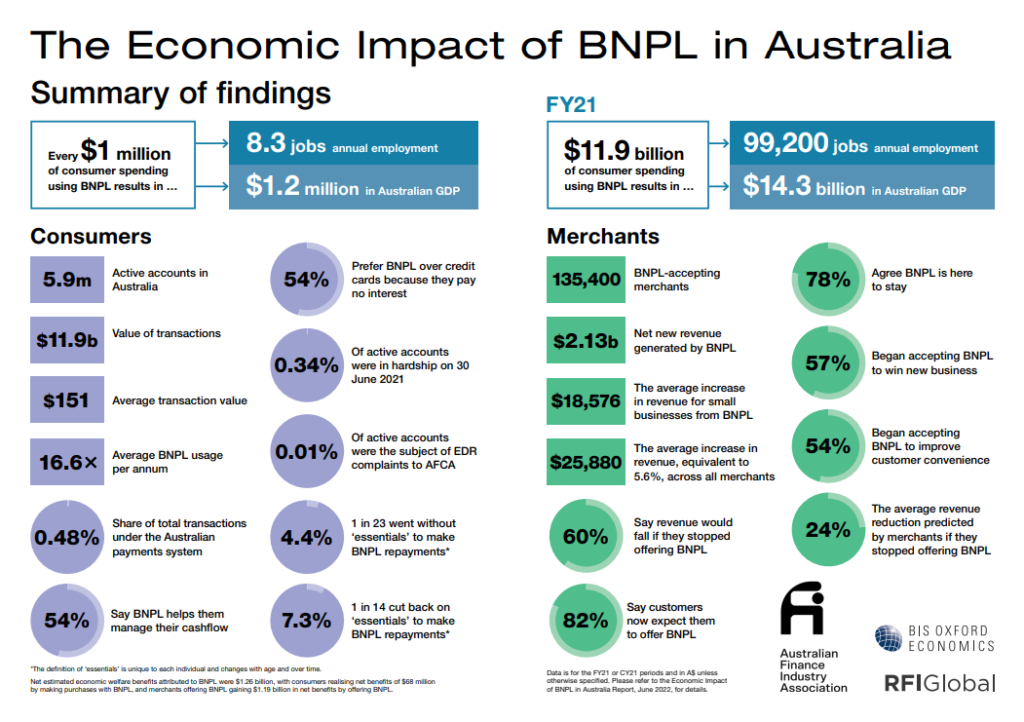

Relying on economic contribution and welfare economics approaches, we find that for Financial Year (FY) 2021, the BNPL industry helped create or retain some 99,200 jobs throughout Australia and contributed $14.3 billion in Gross Domestic Product (GDP) to the Australian economy.

Furthermore, we measure the combined consumer and merchant surplus benefits, or ‘net social surplus’, revealing merchants and consumers have continued to adopt BNPL because it provides advantages to other payment alternatives such as interest and fee savings, and growth in revenue and associated profits for merchants.

About the team

Our Economic Consulting team are world leaders in quantitative economic analysis, working with clients around the globe and across sectors to build models, forecast markets and evaluate interventions using state-of-the art techniques. Lead consultants on this project included:

Andrew Tessler

Head of Economic Impact Consulting, Australasia, OE Australia

Raúl Arias

Senior Economist, OE Australia

You might be interested in

The economic impact of abandoning the WTO

Oxford Economics have been commissioned by the International Chamber of Commerce (ICC) to provide an independent assessment of the economic impact of WTO dissolution. This report details our findings and the assumptions underpinning our analysis.

Find Out More

Global Trade Education: The role of private philanthropy

Global trade can amplify economic development and poverty alleviation. Capable leaders are required to put in place enabling conditions for trade, but currently these skills are underprovided in developing countries. For philanthropists, investing in trade leadership talent through graduate-level scholarships is an opportunity to make meaningful contributions that can multiply and sustain global economic development.

Find Out More

Mapping the Plastics Value Chain: A framework to understand the socio-economic impacts of a production cap on virgin plastics

The International Council of Chemical Associations (ICCA) commissioned Oxford Economics to undertake a research program to explore the socio-economic and environmental implications of policy interventions that could be used to reduce plastic pollution, with a focus on a global production cap on primary plastic polymers.

Find Out More

The Economic Contribution of Mexico’s Audiovisual Industry

This report demonstrates the integral role that the AV industry plays in Mexico's economy by estimating the industry’s domestic economic footprint. The analysis comprises all aspects of the audiovisual industry, including film production, distribution, and exhibition; the production, distribution, and broadcast of television content on free-to-air and pay TV channels; and online video platforms. Our estimates provide a recent snapshot of the audiovisual industry, including impacts at the broader industry level and broken out by sub-sector.

Find Out More