Blog | 23 Jul 2021

Will travel become less globalised in a post-pandemic world?

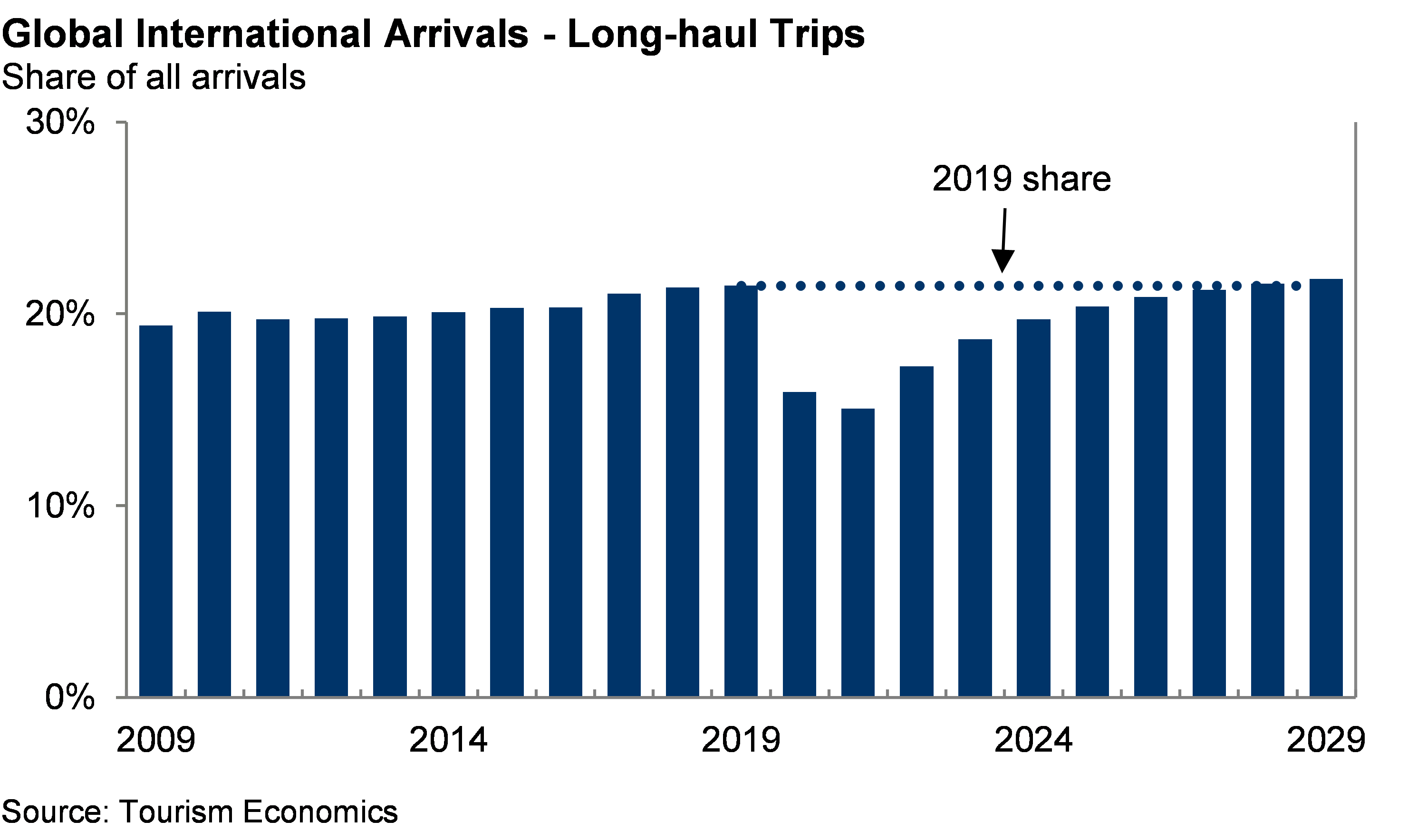

Travel and tourism, like many other industries, had become highly globalised in the years leading up to the COVID-19 pandemic. In 2019 long-haul travel—travel between major regions such as Asia-Pacific and Europe—accounted for more than 21% of all international trips. This was a record high that followed years of steady increase.

In the wake of the pandemic, travel has understandably become far more localised, due to a combination of travel restrictions, transport availability and economic impacts. The share of international trips accounted for by short-haul travel (such as within Western Europe) in 2021 is estimated to have reached its highest in almost two decades due to imposed limits, and consistent with disruption to global supply chains in various industries.

Does this mean that travel will become less globalised as a result of the pandemic? The answer, perhaps not surprisingly, is temporarily yes. Tourism Economics’ baseline projections suggest long-haul travel will not recover to its pre-pandemic share of international tourism until 2028. This recovery timeline reflects international travel restrictions in the near-term, and the subsequent hit to global economic conditions. While we don’t envision a permanent dampening of global long-haul travel in our baseline, the longer that restrictions remain in place and travel is limited, the greater the delay in the predicted timeline for a recovery to pre-pandemic conditions.

Does this mean that travel will become less globalised as a result of the pandemic? The answer, perhaps not surprisingly, is temporarily yes. Tourism Economics’ baseline projections suggest long-haul travel will not recover to its pre-pandemic share of international tourism until 2028. This recovery timeline reflects international travel restrictions in the near-term, and the subsequent hit to global economic conditions. While we don’t envision a permanent dampening of global long-haul travel in our baseline, the longer that restrictions remain in place and travel is limited, the greater the delay in the predicted timeline for a recovery to pre-pandemic conditions.

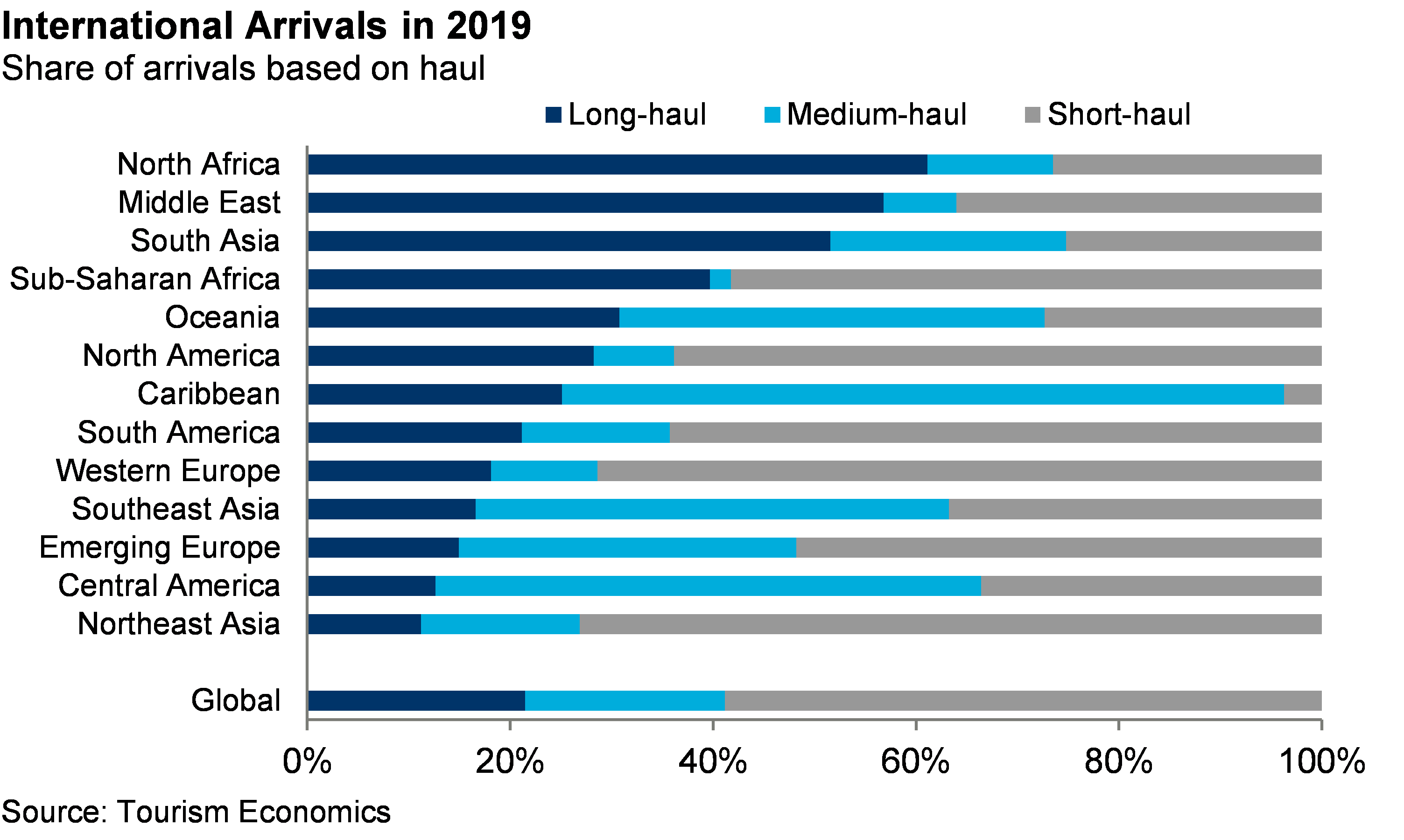

Which regions and countries will be most affected by shifts in travel patterns? Before the pandemic, South Asia, the Middle East and Africa relied most heavily on long-haul source markets, which suggests that these regions are more vulnerable to an increasingly localised travel environment. By contrast, Northeast Asia had the least exposure to long-haul travel, alongside Southeast Asia and Europe.

Considering the question from another angle, destinations that depend more heavily on short-haul travel are likely to see a faster and more stable recovery in inbound tourism, as discussed previously by Tourism Economics. This includes Western Europe, Northeast Asia and the Americas, which can also benefit from substitution of large existing outbound markets.

There is also a role for medium-haul travel, which is expected to recover more quickly than long-haul, but slower than short-haul. Oceania, for example, relies heavily on medium-haul source markets (i.e. those from elsewhere in Asia-Pacific), as does the Caribbean (from other markets in the Americas).

There is also a role for medium-haul travel, which is expected to recover more quickly than long-haul, but slower than short-haul. Oceania, for example, relies heavily on medium-haul source markets (i.e. those from elsewhere in Asia-Pacific), as does the Caribbean (from other markets in the Americas).

Ultimately, our baseline expectations are that travel will not become permanently less globalised due to the pandemic. But the longer the recovery is delayed, the more likely downside risks are to persist. In the meantime, destinations must rely on shorter-haul source markets and the domestic market—including via the substitution of outbound travel to “staycations” and domestic tourism—to support travel and tourism.

Tags:

You may be interested in

Post

MENA – Latest Trends

Our blog will allow you to keep abreast of all the latest regional developments and trends as we share with you a selection of our latest economic analysis and forecasts. To provide you with the most insightful and incisive reports we combine our global expertise in forecasting and analysis with the local knowledge of our team of economists.

Find Out More

Post

You don’t have to be an IT expert to lead on AI

The adoption curve for AI will vary across companies but, according to our data, it’s probably already in use in customer service and marketing—areas where women are more likely to hold leadership roles.

Find Out More

Post

The latest export from China is … deflation

We expect Chinese export price deflation to provide a helpful tailwind in the struggle to bring EM inflation back to target.

Find Out More