Blog | 05 Jul 2023

Timing of decarbonising the building stock through renovations

Amy Regan

Senior Economist

The European Union has an ambition to become net zero by 2050. The European Green Deal will play a central role in delivering this ambition and at the heart of the green deal lies the renovation strategy. The renovation strategy aims to decarbonise the existing building stock. A strong and deep renovation wave will be key to delivering on the net zero agenda as buildings are responsible for about ‘40% of the EU’s energy consumption, and 36% of greenhouse gas emissions from energy, but only 1% of buildings undergo energy efficient renovation every year’.

Given the amount of existing building stock that will need some level of renovations work to reduce its carbon footprint and increase its energy efficiency – 85% of buildings in the EU are over 20 years old, and out of those buildings between 85-95% will still exist in 2050 – renovations activity should serve as a major boost to total construction work done across Europe.

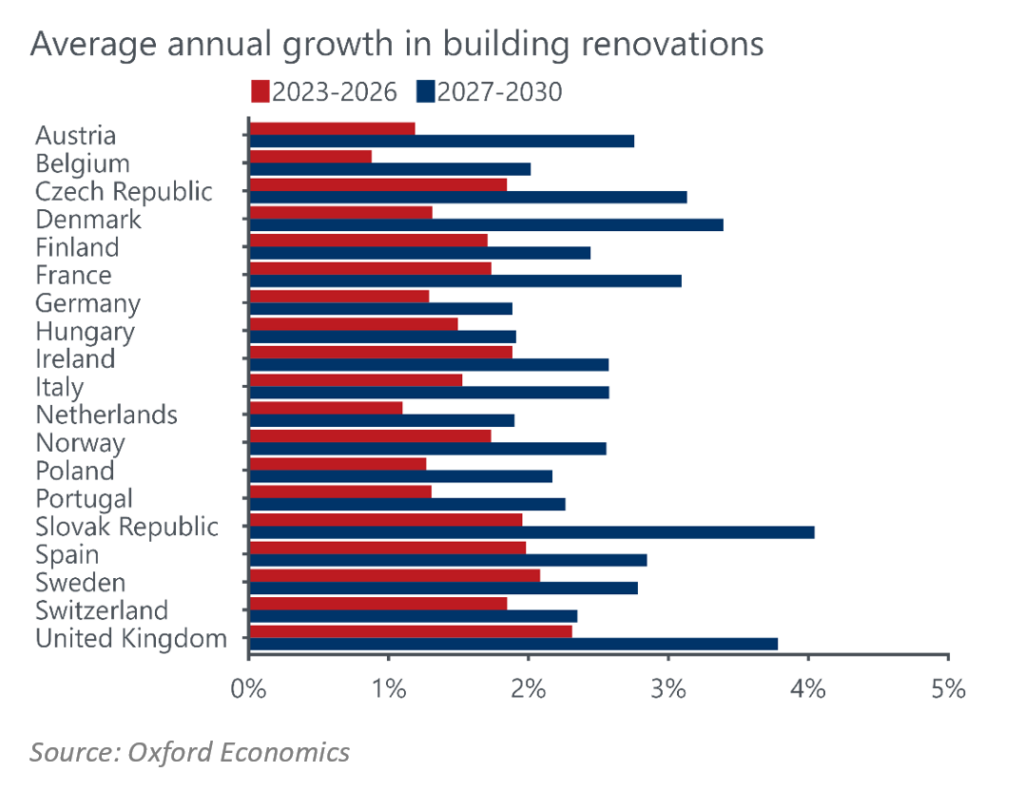

Chart 1: We anticipate a slow start to European renovation activity

Timing and sequencing of decarbonising the building stock through renovations

In our view the renovations boom is not yet imminent. A number of factors are coinciding that are constraining a near-term surge in renovations activity. The European construction market continues to grapple with numerous capacity constraints including labour shortages and high material costs. In addition, the global tightening cycle also threatens to drive a downturn in construction activity.

As a result of these challenges, renovation activity across construction sectors will need to happen in stages. In our view renovation activity in non-residential buildings will pick up first, with commercial buildings leading the charge. This is largely based on the timing of the introduction of the minimum energy performance standards (MEPS) for buildings. EU MEPS will require the worst performing 15% of non-residential buildings to improve to at least class F in terms of energy performance by 2027, and class D by 2030, three years ahead of when residential buildings need to meet equivalent standards. In addition to legislation which targets non-residential buildings, we think owners of commercial buildings are better placed to access the relevant EU grants and loans to support activity.

Industrial and social buildings renovations activity will also follow similar timings, although the level of activity will be smaller, relatively speaking. We expect social building renovation activity will be driven by governments wanting to signal their commitment to the net zero agenda. It is probable that member states will be able to provide exemptions to a limited number of buildings. We expect most of these exemptions will apply to social buildings – heritage buildings and listed buildings (e.g., museums and government buildings) – as they are more costly to renovate.

As Europe is facing a cost-of-living crisis and bank lending to households has deteriorated, we believe residential building renovation work will be deferred until conditions improve. As such, our forecasts have residential renovations activity starting to pick up over the later end of the decade. There is an upside risk to our forecasts should higher energy prices encourage homeowners to invest in energy efficiency work sooner than we anticipate.

The extent of renovations work that will need to be carried out will vary significantly across countries. Together Germany, Italy, the United Kingdom, France, and Spain will constitute 75% of the total level of renovations activity across the 19 European countries[1] included in our analysis. Countries with older (and less energy efficient) building stock will need to undertake a higher level of renovations work relative to new construction activity. These countries include Italy, Germany, France, and Denmark. As some of these markets continue to face labour shortages that threaten to become structural, this will constrain the level of renovations activity that can be carried out, at least in the near term.

To learn more about our Europe renovation outlook, download the full research briefing here.

[1] The analysis in this research briefing is based on renovations activity for residential and non-residential buildings across 19 European countries, the majority of which are in the European Union. We have included the United Kingdom in our analysis because of the size of its construction sector.

Authors

Amy Regan

Senior Economist

Private: Amy Regan

Senior Economist

Sydney, Australia

Senior Economist

Nicholas Fearnley

Head of Global Construction Forecasting

+61 2 8458 4262

Nicholas Fearnley

Head of Global Construction Forecasting

Sydney, Australia

Dr Nicholas Fearnley is the Head of Global Construction Forecasting, based in Sydney. Nicholas oversees the teams that produce the various construction, mining, and maintenance studies. He works over the full construction spectrum, and regularly presents and provides commentary for both the construction and mining industries.

Nicholas joined Oxford Economics in 2019 after working at Macromontor, where he was responsible for producing regular Australian building construction forecast reports, and bespoke cost escalation and material demand forecasts.

Prior to joining Macromonitor, Nicholas completed a PhD at the University of Sydney with a thesis titled: “A Critical and Quantitative Analysis of the Relationship between Informal Institutions and Economic Development.” He was awarded the Walter Noel Gillies Prize for best PhD thesis in Economics, and his thesis was accepted without edits.

Nicholas has undergraduate degrees in both Accounting and Applied Finance from Macquarie University, and a first class honours degree in Accounting from the University of Sydney with a thesis titled: “Culture and the Measurement Decision Offered by Investment Property”.

Tags:

You may be interested in

Post

How Canada’s wildfires could affect American house prices

The Northern Hemisphere is now heading into the 2024 fire season, having just had its hottest winter on record. If it is anything like last year, we can expect to see further impacts on people, nature, and global markets.

Find Out More

Post

Major China cities face prospect of growth downshift

Over the next five years China and its major cities face the prospect of a significant downshift in economic growth. We forecast GDP to grow on average by 4.1% per year across 15 major cities in the years to 2028, down from 7.3% between 2015-2019.

Find Out More

Post

US metros to see decelerating growth in the medium term

We forecast stable GDP growth across most US metros in 2024, followed by decelerating growth over the subsequent four years. All of the top 50 metros are forecast to see real GDP growth in 2024 as well as continued but slower growth through 2028.

Find Out More