Blog | 30 Jun 2023

Rampant wildfires could be a major disruptor for Canadian economy

Tony Stillo

Director of Canada Economics

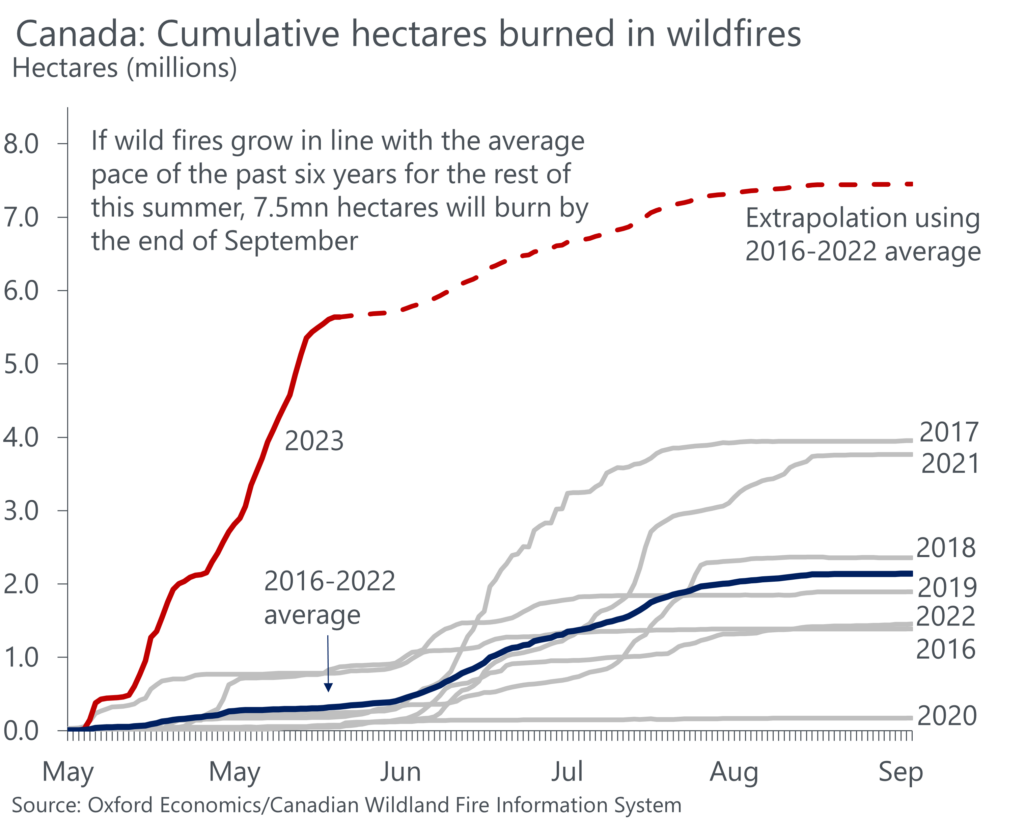

An extraordinary start to Canada’s nation-wide wildfire season has already destroyed more than 5.5 million hectares of timber and is on pace to burn 7.5 million hectares by the end of the summer, larger than the land mass of New Brunswick. This would roughly match 1989 for the country’s worst wildfire season on record.

On top of the threat to life, loss of timberlands, damage to the environment and health consequences, Canada’s historic wildfires are also hurting the economy. The rapid spread of forest fires has already forced more than 100,000 people to flee their homes, caused scores of businesses to temporarily shut down and shrouded much of the country’s most densely populated regions with smoke for days at a time.

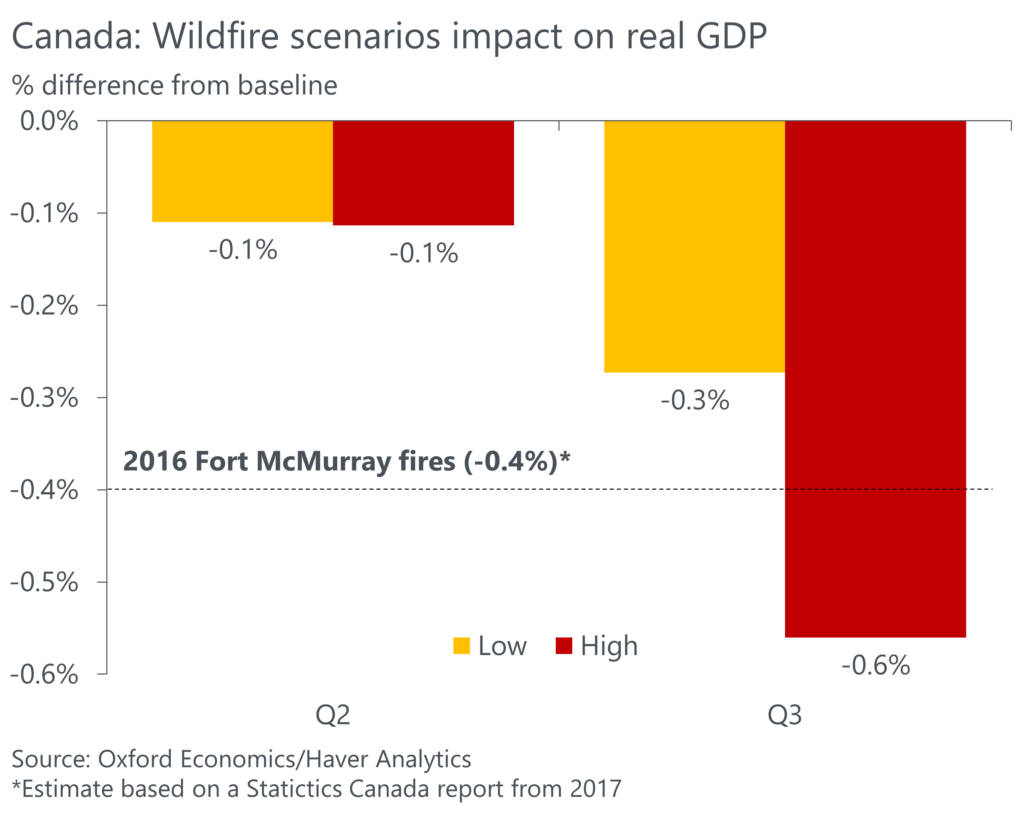

We estimate that the wildfires have already reduced overall Canada-wide GDP in Q2 by 0.1ppt. And if predictions of a record-breaking wildfire season turn out to be true, the level of GDP in Q3 could be cut between 0.3ppts-0.6ppts – a potentially larger hit than the -0.4ppt quarterly GDP impact from the 2016 Fort McMurray fires.

The bulk of the hit to the economy will be in mining, quarrying, and oil and gas extraction in Alberta, Quebec, Ontario and British Columbia where fires have already forced operations to shut down for various periods since mid-May.

Wildfire smoke is also causing bouts of poor air quality across much of Canada and parts of the US. So far, we don’t think this has had a measurable macroeconomic impact. But if smoke from the fires causes a higher-than-normal number of poor air quality days, it could restrict outdoor activities and lead some tourists to cancel trips planned for this summer. A study by Visit California found that 11% of potential travelers cancelled trips to the state during its record wildfire season in 2017. What’s more, a larger number of poor air quality days could disrupt Canada’s construction sector if labourers aren’t able to work safely outdoors.

While there will be some positive offsets from increased firefighting activity, support for those displaced from their homes, and rebuilding efforts once the fires have been extinguished, these will be overwhelmed by economic disruption from the fires this summer.

Ultimately, the economic damage will hinge on the degree to which the wildfires worsen this summer and, more importantly, where the fires occur. In a worse case, should wildfires shut major transportation corridors, cut off supply lines or disrupt power supply to large population and business centres, the economic consequences could be severe.

And these wildfire concerns are hitting a Canadian economy that we already expect will fall into recession this year.

Stay tuned, it looks like we’re headed for a history-making summer.

Author

Tony Stillo

Director of Canada Economics

+1 (437) 690 0267

Tony Stillo

Director of Canada Economics

Toronto, Canada

Tony Stillo is the Director of Canada Economics at Oxford Economics. He leads the team responsible for preparing the macroeconomic forecast for Canada using Oxford Economics’ Global Economic Model, reporting on key data releases, as well as producing and presenting research on key issues affecting the Canadian economy. Prior to joining Oxford Economics in 2018, Tony spent much of his career at the Ontario Ministry of Finance where he most recently led a team responsible for economic modelling, forecasting and impact analysis.

Tags:

You may be interested in

More pain still to come from the mortgage payment shock | Canada Up Close

Total mortgage payments surged after the Bank of Canada began aggressively hiking interest rates in early 2022. In this month’s video, Callee Davis, Economist, discusses why we believe there is more pain still to come from the mortgage payment shock in Canada.

Find Out More

How Canada’s wildfires could affect American house prices

The Northern Hemisphere is now heading into the 2024 fire season, having just had its hottest winter on record. If it is anything like last year, we can expect to see further impacts on people, nature, and global markets.

Find Out More

More pain still to come for Canada from the mortgage payment shock

Mortgage payments have soared since the Bank of Canada began aggressively hiking interest rates in early 2022, and there is more pain to come as borrowers continue to renew their mortgages this year.

Find Out More

After a weak 2024, robust medium-term Canadian metro growth

Overall, the medium-term outlook for Canadian metros is strong in terms of total GDP, with the country's 10 major metros averaging 2.6% growth per year to 2028, outperforming the national average. However, five-year growth rates mask a more turbulent story in most metros.

Find Out More