Ungated Post | 03 Jan 2018

Pinning down world flashpoints to protect against nasty surprises

The upsets and surprises of the past 12 months show all too clearly how, in an ever more unpredictable world, risk can catch out the unwary. And, as we begin 2018, nowhere is this more apparent than in the realms of economic and political risk.

As one of the world’s foremost independent economic forecasters, Oxford Economics has collaborated in a joint venture with Control Risks, the global specialist in political and security risks, to create a unique tool for organisations to weigh-up the uncertainties lurking in every corner of a volatile globe.

Our Economic and Political Risk Evaluator (EPRE) allows businesses and institutions to gauge current and emerging risks that may confront their activities by analysing a range of political, economic, business and security factors. Using advanced visualisation techniques, it can highlight dangers and help users hone in on potential political flashpoints or sources of economic or financial turbulence.

Canada and Iceland provide two excellent illustrations of how the political and economic risk scores available from EPRE let users pinpoint sources of risk that could impact their work and be on the alert while unwary competitors may be wrongfooted and caught off guard.

Canada gives cause for caution

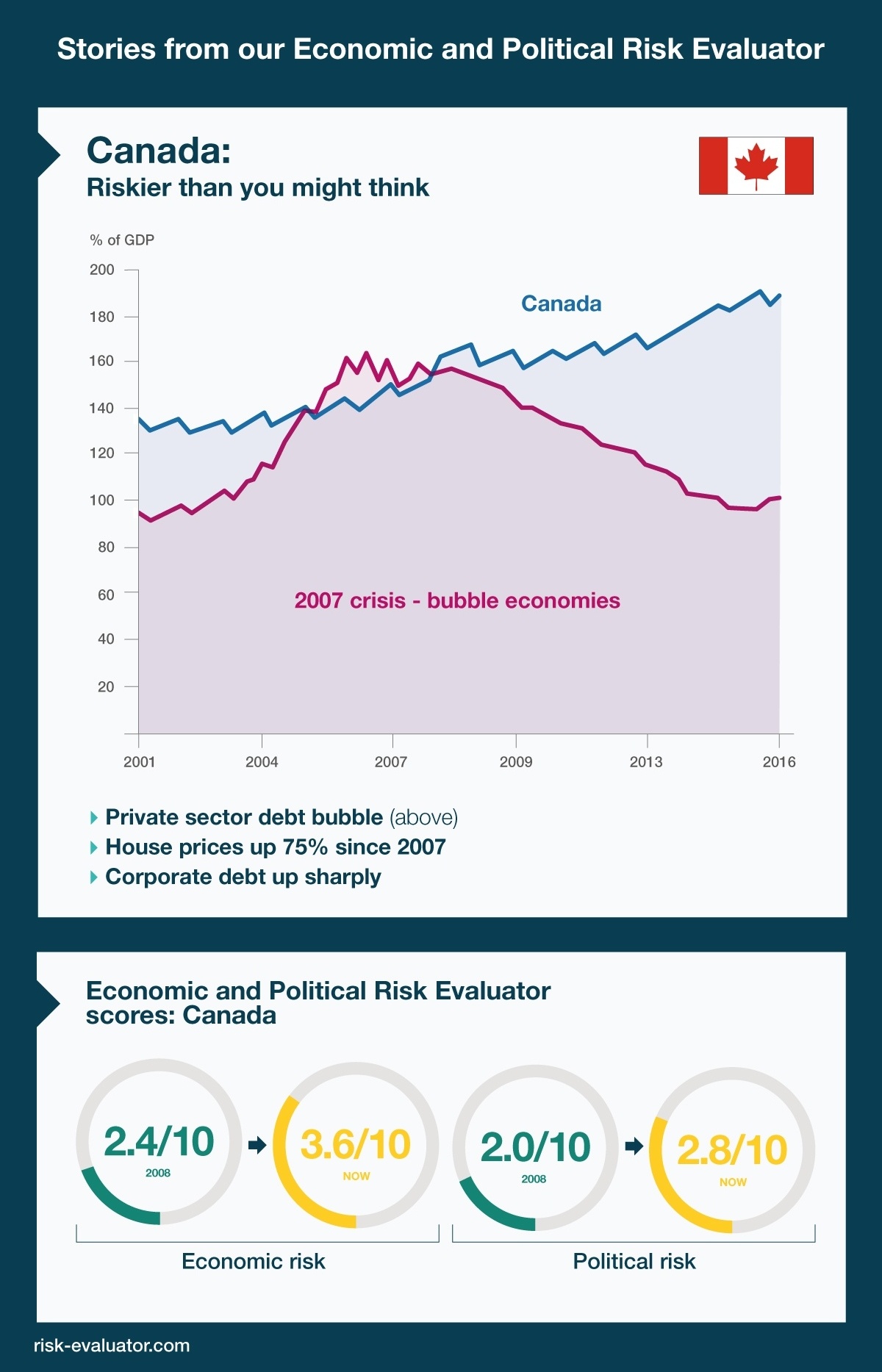

Our latest EPRE scores for Canada and how these have moved over time show how a country seen by many as a bulwark of stability may be riskier than many assume.

Increasingly, Canada is exposed to an apparent private sector debt bubble. While other developed economies have been deleveraging since the global financial crisis, Canada (which was spared most of the worst effects of the crisis) has gone in the opposite direction. Its total private sector debt relative to its GDP is now at higher levels even than those experienced by the ‘bubble economies’ of the crisis such as Denmark, Iceland, Ireland, Portugal and the US. The debt bubble is driven mainly by household debt and house prices are a key driver, having risen by 75% since pre-crisis 2007, while Canadian corporate debt is also well above long-run averages.

In EPRE, our scores reflect the increasing risks with our economic risk rating having risen to 3.6 out of 5 now, versus 2.4 in 2006. At the same time, the political risk score has also climbed to 2.8 from 2.0

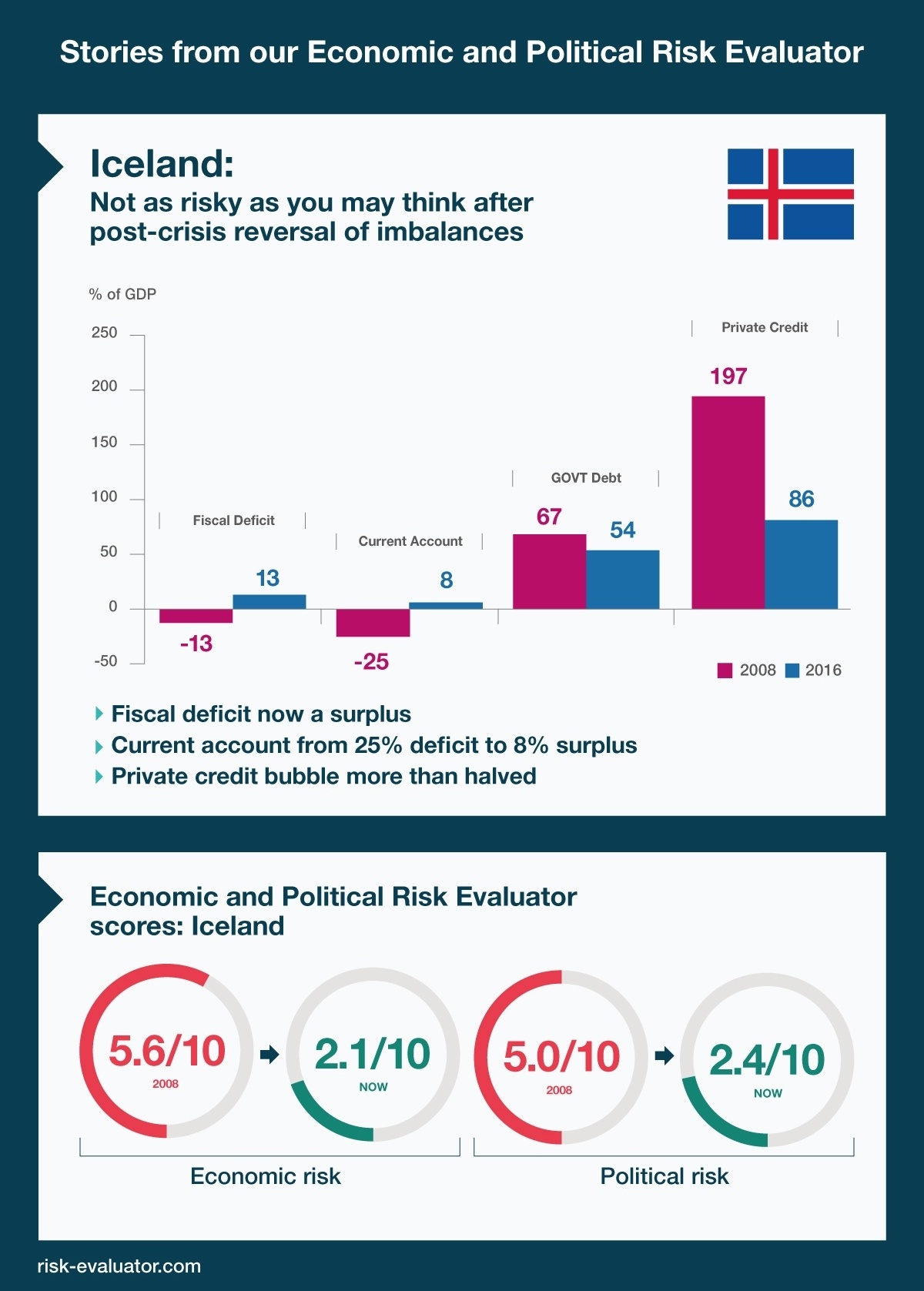

Yet while Canada surprises with these sources of anxiety, other nations that may commonly be labelled as risky turn out in reality to defy those preconceptions. One such example is Iceland, where a remarkable economic turnaround has been effected since the crisis.

Iceland dangers melting away

Iceland has managed a painful turnaround that has reversed many of the grave economic imbalances that beset it in the second half of the last decade. An annual fiscal deficit once standing at 13% of GDP has swung back into surplus, a current account deficit of 25% of GDP is now an 8% surplus, and private credit has fallen from nearly twice the size of the Iceland economy to a more manageable 86%.

Again, our EPRE score reflect the evolution of risks around Iceland’s political and economic fortunes. Our economic risk score has dropped from 5.6 out of 10 in 2006 to just 2.1 out of 10 now. And our political risk rating is down from 5.0 to 2.4.

Find out more about EPRE

Tags:

You may be interested in

Post

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More