Blog | 14 Nov 2017

Over the cliff? No deal Brexit would cut UK growth by 1 point a year

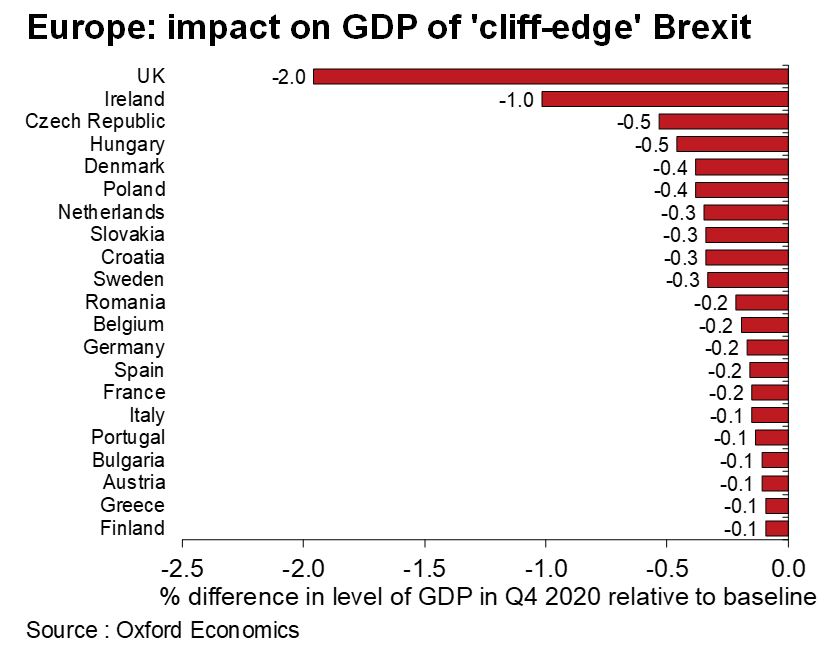

Economy would be 2% smaller than otherwise expected by end of 2020 – equivalent to a £16bn hit to GDP

With Theresa May’s UK Government struggling to make progress in ‘Brexit’ negotiations with the EU and strike a deal for Britain to leave the bloc, Oxford Economics analysed the potential impact of the talks collapsing with no agreement.

If Brexit negotiations were to break down, forcing the UK to quit the EU and to trade under World Trade Organisation (WTO) rules, the UK would face a significant increase in trade disruption from March 2019, even if it were able to put some basic trading arrangements in place, we found.

In a scenario where key sectors of the UK economy would face extra friction in trading with the EU, Britain’s biggest trading partner, our analysis concluded that a failure to reach agreement – what some call a “cliff-edge Brexit” – would have significant economic impact.

Impact on other EU economies much smaller than for UK

We found that this would leave the level of UK GDP some 2.0% – or £16bn in cash terms – lower at the end of 2020 compared with our baseline. The impact on the remaining EU countries, including Ireland, would meanwhile be much smaller.

The notion that the UK could simply walk away from Brexit negotiations and rely on WTO rules to trade with the world is deeply flawed, our study concluded. The UK would need to re-establish more than 750 very complex international arrangements just to maintain the status quo.

Little chance of detailed deal in 2019

We expect only the most critical issues – such as air travel – to be resolved by the March 2019 deadline when the UK is due to leave the European Union. Exporters also face a substantial increase in non-tariff barriers, in addition to tariffs under the WTO regime.

A breakdown in talks would also see both sides levying tariffs on imports from each other from March 2019, raising the cost of importing UK goods into the EU by 3.5% and by 3.1% for goods imported into the UK from the EU.

For the UK this will apply to roughly 60% of its goods exports and imports, but for all EU countries except Ireland the share would be less than 10%.

Risks to UK even greater than our central estimate of impact

Our study using our global economic model found that the additional trade frictions of a no deal Brexit would knock around 1 percentage point a year off UK GDP growth in 2019 and 2020, resulting in a period of very weak growth for Britain.

And the risks to this scenario are skewed to the downside – a slump in confidence or failure to establish the necessary customs infrastructure in time could easily generate a worse outcome.

This study by Andrew Goodwin, our Lead UK Economist, was the first note in a series looking at the impact of a “cliff-edge” Brexit. This analysis focused on what it would mean for trade costs and prices. Over the next few months we’ll also examine its effect on supply chains and migration, while we will analyse, too, the potential for policymakers to mitigate some of the negative effects via looser policy.

Read the full report: https://www.oxfordeconomics.com/my-oxford/publications/400390

Tags:

You may be interested in

Post

Oxford Economics introduces new Global Tech Spend Forecasts

Oxford Economics is excited to announce the launch of the Global Tech Spend Forecasts service, offering the most reliable forecasts on enterprise IT spending across 35 industries and 25 countries, with forecasts out to 2050.

Find Out More

Post

Oxford Economics Launches Commercial Real Estate Megatrend Resilience Index

Our Commercial Real Estate Megatrend Resilience Index evaluates the resilience of CRE markets in relation to four critical megatrends.

Find Out More

Post

Oxford Economics Unveils Cutting-Edge AI Assistant Tool

Oxford Economics is thrilled to announce the beta launch of its AI Assistant, an advanced artificial intelligence tool designed to enhance client experiences by streamlining access to and analysis of global macroeconomic data.

Find Out More