Blog | 25 Apr 2023

Mapping the future of business

Matthew Reynolds

Senior Research Manager, Thought Leadership

What does a cold pizza tell us about cutting-edge business practices?

Recently, my fiancée and I ordered a large margherita pizza with extra basil from a local shop. Instead of receiving the cheesy goodness in 40 minutes as promised, we were left to wait as time ticked by. And we were completely in the dark about the fate of our pie since the restaurant had not enabled delivery tracking—until it arrived, at something close to room temperature, 80 minutes later.

Geospatial services like tracking could have alerted us to problems with our delivery and possibly gotten it to our front door faster. Like most consumers, I’ve come to depend on real-time mapping capabilities for everything from pizza deliveries to vacation planning to determining where we should search for overpriced homes in unaffordable neighborhoods on Zillow.

The impact of geospatial technologies on businesses runs far deeper (and is more surprising) than most of us might imagine.

Recent research we conducted with Google Maps Platform, based on a survey of 1,000 business and IT executives conducted in late 2022, shows just how geospatial services are being used at businesses across the world today—including providing information to customers, improving logistics capabilities, and increasing efficiency.

Our comprehensive Impact Calculator (created by Oxford Economics economists) gauges the value geospatial services provide to organizations across different industries. Here’s what we found:

- Mapping goes beyond catering to the customer. Executives aren’t just making maps available on their apps or websites for the obvious customer benefits. Many are using it to make operations more efficient, too; half of respondents have invested in geospatial technologies for their internal operations, with two-thirds already having integrated these capabilities to some extent with early benefits emerging. As a result, about half have seen geospatial services create greater visibility into operations or improve operational efficiency.

- Business use is opportunistic and need-driven. Choosing from 12 distinct geospatial use cases, respondents were asked to select all the ways they were using them in their organizations. We were surprised to find 97% of respondents are using five or fewer of these use cases—but everyone is using at least three different use cases. This indicates executives are implementing geospatial services in highly-specific ways that benefit their business—from communicating information to customers, to helping them find services and making routes more efficient.

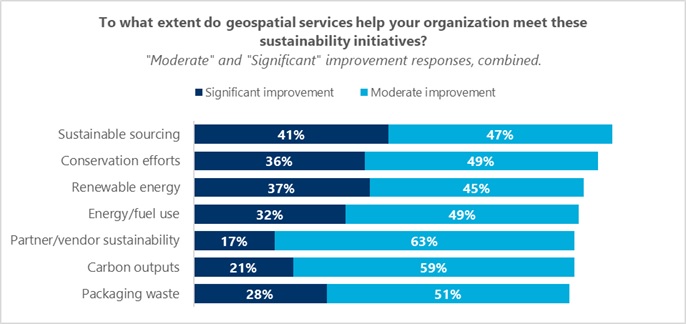

- Geospatial services move sustainability forward. The Impact Calculator shows that geospatial services end up having an impact on sustainability performance like energy and fuel reduction and carbon output—and with 93% of executives in our survey having at least one sustainability initiative in place today, this means a lot. Savings accumulated from geospatial service implementation are being reallocated towards various business needs, but roughly 15% of these savings are reinvested in sustainable initiatives (e.g., buying carbon credits).

For consumers, too, there are substantial payoffs beyond hot pizza. Benefits from improved supply chain visibility and more efficient operations trickle down in ways that can build brand loyalty while also bringing up the bottom line. At a time where competition is high and margins are slimming, these benefits are crucial—and with so many organizations yet to tap into the full value of geospatial services, these capabilities could deliver a true competitive advantage.

Author

Matthew Reynolds

Senior Research Manager, Thought Leadership

+1 646 503 3065

Matthew Reynolds

Senior Research Manager, Thought Leadership

New York, United States

Matt manages a broad spectrum of technology-centric Thought Leadership programs, from cloud and software innovation to how organizations can participate in the metaverse. He has led successful programs for dozens of large organizations during his tenure at Oxford Economics, including SAP, PwC, NTT Data, Accenture, IBM, and EY. Matt’s experience gives him deep knowledge of the ins and outs of successful end-to-end program management, and he is an integral part of the Thought Leadership team.

With the organization since 2015, Matt holds a Bachelor’s Degree in English from The College of New Jersey. He is scheduled to graduate with an MBA in IT and Analytics at the Rutgers School of Business in May, 2023.

Tags:

You may be interested in

Post

Amid disruption, what can US office learn from retail?

We examined the disruption of generative AI at the US county level. We identified several metros – Atlanta, Denver, New York, San Francisco, and Washington DC – that had at least one county with the highest percent of displaced workers from AI.

Find Out More

Post

Taiwan earthquake hit local chip production, but only temporarily

Taiwan was hit by the 7.2 magnitude earthquake on 3 April, the strongest in 25 years. However, the economic impact seems to be manageable so far, thanks to sparse population close to the epicentre, improving building codes and stronger disaster management and awareness in the past two decades.

Find Out More

Post

Greenomics – Ep. 9 | The nature of Travel & Tourism

A discussion of the crucial role of climate-ready buildings in the global push towards a net-zero future. They delve into sustainable construction practices, the importance of regulations, retrofitting existing buildings, and behavioural changes to create environmentally friendly homes. The conversation also touches on the economic challenges and choices associated with transitioning to sustainable living.

Find Out More