Ungated Post | 19 Jun 2018

Looming liquidity drain raises bond market risks

Markets’ attention in recent weeks and months has been focused intently on central bank policy actions as the US Federal Reserve and European Central Bank have pressed ahead with further moves toward ending the era of historically low interest rates and easy money. Yet beneath the surface of the world economy, potent trends in global liquidity driven by the vast capital flows across fixed income markets have commanded far less scrutiny – despite far-reaching implications.

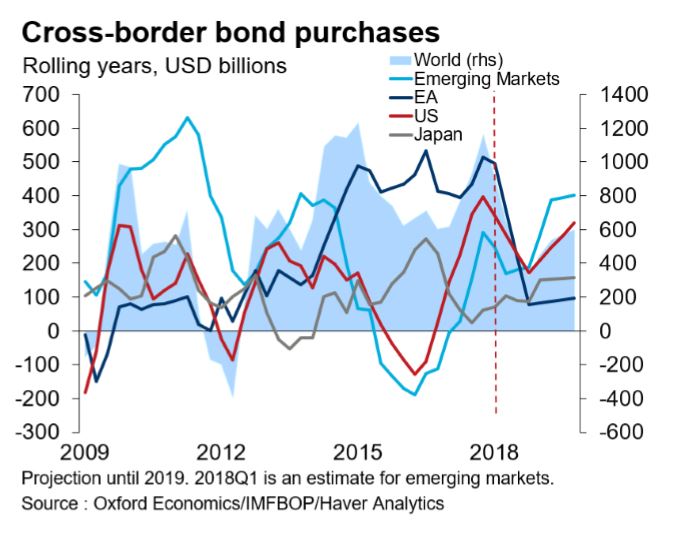

A large liquidity squeeze looms, with equally large potential consequences. Cross-border bond purchases by fixed income investors could plausibly drop by more than half this year and next, to an average of only $500 billion a year, versus 2017’s tally of $1.2 trillion.

A shift of this scale, if realised, will inevitably exacerbate existing upward pressures on global bond yields to an extent greater than markets presently anticipate, with the US bond market – and the dollar – particularly vulnerable.

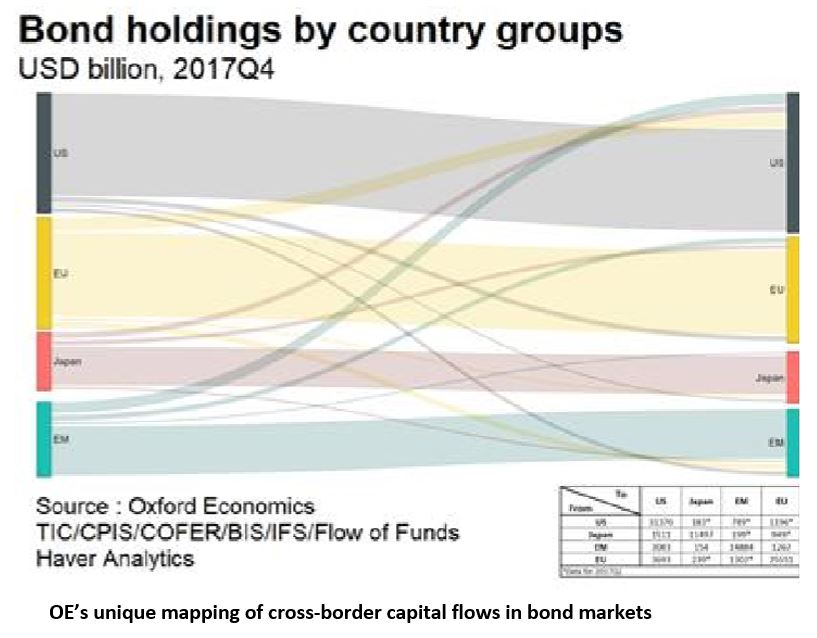

The extent of this expected tightening of global liquidity conditions is exposed by an intricate analysis of fixed income flows worldwide by Oxford Economics. Mapping the interdependencies across bond markets enables us to project the likely evolution of global liquidity.

The consequences for global markets of an end to the ECB’s quantitative easing through its asset purchase programme (APP) will be much larger than those associated with the ending of the Fed’s QE.

Global bond markets are heavily exposed to European investors who, in the last four years, have become the largest cross-border bond investors in the world – thanks to the shortages of eurozone debt generated by the ECB’s own bond-buying activity.

European investors left with little option but to seek fixed income assets overseas in the face of shortages of supply at home have accounted for an average of $500bn a year in purchases of foreign securities over the period. This compares with only $200bn a year of foreign purchases by US investors during the Fed’s QE and has exerted considerable downward pressure on global rates and spreads. European investors alone bought up over half of US net corporate issuance during this time, for example.

Now, though, this massive support for global bond markets from eurozone investors is set to move sharply into reverse as the ECB unwinds QE with a tapering of the APP and its subsequent end next year. Already, in the first quarter of this year, a halving of ECB monthly net bond purchases to $30bn saw cross-border bond-buying by eurozone investors drop by 30%. As European bond-buyers continue to rotate their portfolios back from foreign to domestic securities, their cross-border purchases could fall by €200 billion ($235 billion) a year, we estimate.

Importantly, US private investors are not expected to offset the reversal of European bond-buying we anticipate. While in 2014, Europeans picked up the slack when the Fed reduced its asset purchases under QE, no such compensating wave of buyers is likely to be available this time around.

The knock-on effects of the resulting liquidity drain will be compounded by several factors.

First, the bond supply squeeze is finally easing as the US Treasury steps up issuance to finance a rising US deficit and the Fed continues asset sales. Secondly, the US corporate sector is also adding significantly to supply this year. And thirdly, the increased US issuance will likely lead American investors to increase purchases of domestic over foreign securities, further reducing liquidity supply to global markets.

Nor are other advanced economies or emerging markets likely to plug the liquidity drain. In 2017, all other advanced economies together bought 14% of cross border funds – far less than the 46% bought by European investors. A considerable fall in Japan’s foreign bond purchases is expected to only partly reverse. And in emerging markets purchases are expected to remain subdued in the short-term after recent steep declines. A return of capital inflows to

EMs is likely to see some rebound of their purchases of advanced economies’ bonds – but not by enough to offset the expected retreat of American and European investors.

The tightening of global liquidity points to continuing upward pressure on global real interest rates and spreads. The macro-economic impact of this may even be sufficiently strong as to influence the future path of the central bank policy moves that are driving the squeeze.

As these trends unfold, our global mapping of bond market exposures shows that US markets are the most exposed to the anticipated retrenchment in cross-border liquidity: almost 10% of the total outstanding stock of US fixed income securities is held by Europeans, alongside 6% of the EM stock.

The euro should, in due course, also benefit – reinforcing our macro-based view of dollar weakness in coming years. While the dollar has taken support from recent flows of repatriated corporate capital and official sector rebalancing towards dollar-denominated assets, these developments are essentially one-off in nature.

Find out more – read the full research briefing

Tags:

You may be interested in

Post

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More