Recent Release | 25 Jul 2022

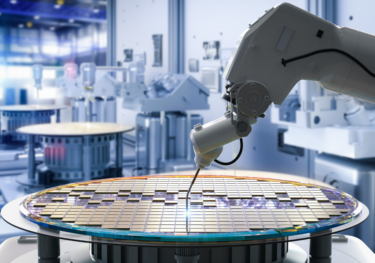

Industry Outlook 2030+ | The Semiconductor Industry

Johanna Neuhoff

Associate Director of Economic Consulting, Continental Europe

As a high-tech industry, the European semiconductor industry is indispensable for the digital and ecological transformation of the economy. It supplies other industries with important microelectronics for the smart control of electric cars and household appliances, for example, and also contributes to increased efficiency and sustainability in industrial production.

The European Union has acknowledge the semiconductor industry’s high strategic relevance and has defined an ambitious target for the next 10 years in its Digital Compass 2030 policy: Europe’s share of the world semiconductor market is to increase to 20 per cent by 2030 and the establishment of new, technologically leading chip factories is to be driven forward.

Our study analyses the strengths and weaknesses, opportunities, and threats for the European and German semiconductor industry in light of future transformation trends.

The Sector Outlook 2030+ Semiconductor Industry report is based on an analysis of the latest industry research and data. We find that:

- European semiconductor manufacturers design and produce highly innovative products and are intensively integrated into highly specialised global value chains.

- Driven by the trends of digitalisation and sustainability, the demand for semiconductor solutions will increase significantly in the future. The demand for automotive semiconductors, in which European manufacturers are world leaders, will grow the strongest of all semiconductor submarkets—driven by electromobility and automated driving.

- The efforts of the European Commission and the member states to invest massively in the expansion of the European semiconductor industry are meeting a growing future demand for semiconductors.

As a major location for the European semiconductor industry, Germany plays a vital role in meeting the European Union’s ambitious goals. Given the limited public budget available, resources should be spent to build on existing strengths. Therefore, we recommend seven measures German policymakers should consider to expand Germany’s position as one of the most important European industry players.

Read the full report in German

Read the English executive summary

Our economic consulting team are world leaders in quantitative economic analysis, working with clients around the globe and across sectors to build models, forecast markets and evaluate interventions using state-of-the art techniques.

About the team

Our Economic Consulting team are world leaders in quantitative economic analysis, working with clients around the globe and across sectors to build models, forecast markets and evaluate interventions using state-of-the art techniques. Lead consultants on this project included:

Johanna Neuhoff

Associate Director of Economic Consulting, Continental Europe

Related Posts

The economic impact of abandoning the WTO

Oxford Economics have been commissioned by the International Chamber of Commerce (ICC) to provide an independent assessment of the economic impact of WTO dissolution. This report details our findings and the assumptions underpinning our analysis.

Find Out More

The economic impact of the sports activities of public service media

This study shows how the sports activities of public service media supported €4.5 billion of GDP and 57,000 jobs across 31 European countries in 2022. The report also highlights wider economic benefits of public service media sports coverage, such as the way in which it leverages sponsorship income for sports bodies.

Find Out More

Global Trade Education: The role of private philanthropy

Global trade can amplify economic development and poverty alleviation. Capable leaders are required to put in place enabling conditions for trade, but currently these skills are underprovided in developing countries. For philanthropists, investing in trade leadership talent through graduate-level scholarships is an opportunity to make meaningful contributions that can multiply and sustain global economic development.

Find Out More

Mapping the Plastics Value Chain: A framework to understand the socio-economic impacts of a production cap on virgin plastics

The International Council of Chemical Associations (ICCA) commissioned Oxford Economics to undertake a research program to explore the socio-economic and environmental implications of policy interventions that could be used to reduce plastic pollution, with a focus on a global production cap on primary plastic polymers.

Find Out More