Blog | 08 Feb 2024

Finding Opportunities in a Weak Global Economy

Oxford Economics set the stage for the year ahead, at our inaugural Global Economic Outlook Conference, in London on Wednesday, 24th January.

Throughout the day our line-up of speakers provided an array of insights focusing on finding opportunities in the global economy and major markets. Oxford Economics CEO, Adrian Cooper set the scene as he outlined how potential risks to economic growth appear more balanced than two years prior, with actions from central banks being seen as a likely major economic driver, with geopolitical issues dominating downside risks.

The conference was teeming with unparalleled insight, dynamic discussions, and ground-breaking perspectives on the current economic landscape, with both challenges and emerging opportunities, from city-specific economic variations to potential shifts in industrial activities as well as the short and long terms needs and impacts around funding the climate transition.

The presentations collectively painted a nuanced picture of the economic landscape, revealing both short-term challenges and long-term opportunities in navigating economic uncertainty.

Dealing with the Inflation Hangover

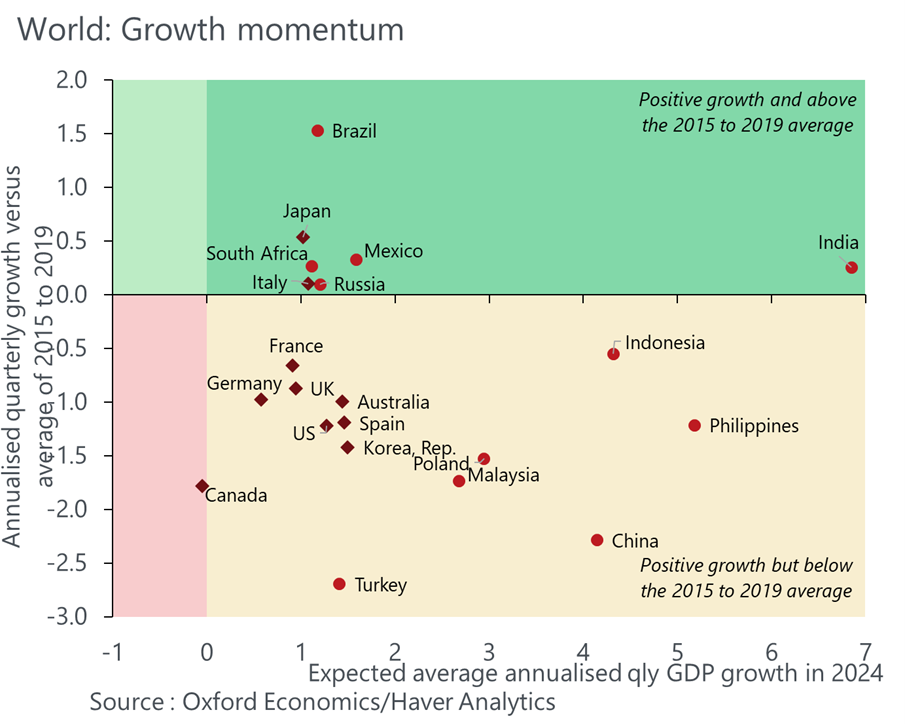

In his presentation “Dealing with the Inflation Hangover,” Innes McFee, Chief Global Economist of Oxford Economics addressed several key questions for 2024 and beyond. Despite anticipating a slow growth year, the outlook is cautiously optimistic, with a trough expected in Q1 and momentum poised to build thereafter.

McFee highlighted the US economy’s potential to outperform, while acknowledging ongoing structural challenges in China and the European economies’ escape from recession, bolstered by rising real incomes.

The discussion underscored Oxford Economics’ view that the inflation shock would likely subside in the coming year. However, it emphasised the cautious stance of major central banks in easing policy due to uncertainties surrounding the inflation generation process.

Download presentation deck, here.

What do high inflation and interest rates mean for cities, consumer spending, and travel & tourism?

Against a backdrop of a subdued global economy, most major cities will see slower economic growth in 2024 than in 2023. But in his presentation Anthony Light, Managing Director, City Services at Oxford Economics, indicated there will be wide disparities in performance. Cities in central and eastern Europe will outperform their western European peers, whilst in North America, metros with a heavy tech presence will grow faster than those reliant on traditional manufacturing. In Asia Pacific, the continued development of digital and professional services will support strong performances in many Indian cities, with growth here outpacing that in their Chinese and Japanese counterparts.

There remain significant opportunities for growth in the travel sector which will outpace wider activity in 2024, according to Dave Goodger, Managing Director, EMEA, Tourism Economics. Travel spending remains a priority for consumers in Advanced Economies and as a share of wider consumption it will remain towards the upper-end of the historic range, while recovery in some Developing Markets, notably China, will continue to gain pace. The return of long-haul travel will provide some boost to activity but short-haul demand is still the largest immediate opportunity. High prices remain the biggest risk factor with value-hunting on the increase in many markets. However, at the other end of the market, the luxury boom will continue, supported by earnings growth and accumulated savings among higher income households. Travel and hospitality growth is anticipated across all major destinations worldwide.

How should investment allocations prepare for central bank policy pivots and weak growth?

Our Cross Asset framework has improved in January and now signals an overweight stance on risk assets vs safe assets. Our forecast for US growth this year is now clearly above consensus. However, says Javier Corominas, Director of Global Macro Strategy at Oxford Economics, DM equities may be vulnerable to some consolidation in the near term as investor sentiment looks stretched following the year-end rally. We prefer to express our more sanguine view via overweights in HY yield credit and EM equities. The latter are more attractively valued and should benefit from an EPS recovery this year. 2024 will be characterised by an environment of volatile term premia and upside inflation risks. Central banks will (largely) not follow through with market pricing and we move to an underweight in DM duration, retaining our overweight bias in EM bonds. Inflation shocks beyond H1 may be the most underpriced risk in markets.

It won’t last all year, but we see the current conjuncture as representing a sweet spot for emerging market assets according to Gabriel Sterne, Head of Global Emerging Markets at Oxford Economics. Disinflation is secure, activity is turning up, valuations are generally attractive (with some exceptions), and global financial conditions appear fairly supportive.

Furthermore, those factors that affect strategic allocation decisions are mostly positive. We think it’s an opportune moment even for tactical investors to focus on: the credibility EM central banks deserve from their performance in this supply-shock era; the demographic forces that will push down on EM neutral rates in years to come; and the fact that fiscal vulnerabilities in larger EMs are generally being managed adequately.

We maintain our overweight on EM local currency debt, neutral on EM equities and FX. While we are underweight sovereign credit we see plenty of selective opportunities, particularly in identifying those high yielders with decent chances of regaining market access.

Have Central Bank Pivots Helped Commercial Real Estate Turn a Corner?

The market expectation for monetary policy pivots this year is benefiting Commercial Real Estate (CRE), as bond-property yield spreads widen. Lower debt costs and tentative signs of thawing credit conditions may boost transaction activity, leading to price discovery.

In their presentation Mark Unsworth, Associate Director of Real Estate Economics and Riccardo Pizzuti, Lead Real Estate Economist both of Oxford Economics, explained that we expect this will be a year of transition for CRE with further value declines in H1 before a pick-up in the second half of the year. Downside risks remain, particularly related to geopolitical tensions. But opportunities have started to emerge. According to our Global Relative Return Index analysis selective CRE risk-adjusted investment opportunities will re-appear this year, before becoming more widespread in 2025.

Where are we in the industrial cycle, and which sectors can thrive?

Jeremy Leonard, Managing Director of Global Industry Services at Oxford Economics led a panel of four industry experts, who explained that global industrial activity remains weak, and highly unsynchronised, at the outset of 2024. High interest rates, weak demand conditions, the lingering impacts of the energy crisis in 2022, and de-stocking pressures have created a subdued environment for manufacturing activity. The industrial weakness has been particularly pronounced in Europe and concentrated in energy-intensive and interest rate-sensitive sectors. However, we expect easing monetary policy and continued declines in energy prices over the course of the year to disproportionately benefit industry, resulting in a growth acceleration starting in the second half of 2024. After two years where industrial growth unusually underperformed global GDP, 2024 should see industry outperform the broader economy.

A reversal of momentum in interest-rate sensitive sectors will be crucial to the recovery. Industrial and building materials, metals products, mechanical engineering, and residential construction should all see activity improve during the second half of the year as we move past the peak of negative impacts from previous rate hikes. 2024 and beyond will continue to see a reshaping of critical industries as companies and governments increasingly seek to diversify away from China and source raw materials and locate “essential” manufacturing at home or in allied countries. The energy transition will have a significant impact on industrial activity in the years to come. While the power sector has taken positive steps to de-carbonisate, progress in manufacturing has been lacking. Alongside de-carbonising its own activity, industry will play an instrumental role in the development of technologies necessary for de-carbonising other parts of the economy, which will lead to major shifts in the composition of manufacturing activity.

Funding the Climate Transition

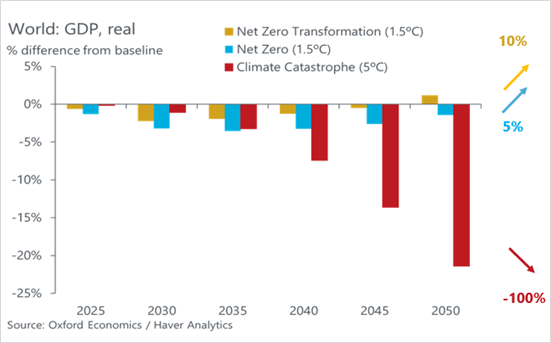

Meeting the 1.5°C climate goal requires deep structural changes to our economy and a doubling of global investment in clean energy by 2030. Whilst progress is happening, it is not at the required pace, Felicity Hannon, Head of Climate Change Macroeconomics at Oxford Economics summarised in her presentation “Funding the Climate Transition”.

Specifically, investment in clean energy and infrastructure is increasing but it remains insufficient and imbalanced against a net zero pathway. It is therefore necessary to encourage investors and reduce financial risk by: fostering international collaboration; implementing climate polices that are resilient to economic and political cycles; offering government support; and encouraging a shift away from fossil fuels through global carbon taxes . The transition is likely to have have some heavy short term economic costs but in the long run it is better than no action, which would lead to global warming and severe economic damages. There are also potential upsides to a clean energy transition, for example our analysis shows that the right policy incentives could mobilise private investment and lead to innovation.

Author

Innes McFee

Managing Director of Macro and Investor Services

+44 (0) 203 910 8028

Innes McFee

Managing Director of Macro and Investor Services

London, United Kingdom

Innes McFee is the Managing Director of Macro and Investor Services, based in London. Innes oversees the activities of the Macro & Investor Services teams globally, including the Global Macro Forecast and Global Macro Service.

Innes joined Oxford Economics in 2017 after 6 years at Lloyds Banking Group as a Senior Economist. At Lloyds Innes was responsible for the economic scenarios underpinning the Group’s internal planning and stress testing; analysis of key risks; and developing Lloyds’ approach to multiple economic scenarios for IFRS9. In addition, Innes’ role included developing the Group’s capability in modelling macroeconomic fundamentals and UK banking markets and advising the Group Corporate Treasury on financial market developments.

Prior to joining Lloyds Innes was an Economic Advisor at HM Treasury where his roles included management of the UK’s foreign currency reserves; US economist; and G20 macroeconomic policy advisor. Innes has a first class undergraduate degree in Economics from the University of Durham and a MSc in Economics from Warwick University.

Tags:

Key Themes for 2024

Infographic: key themes driving location decisioning in 2024

In this infographic, we present the themes that are crucial to location decisioning in 2024 and pinpoint potential bright spots.

Find Out More

Dealing with the inflation hangover | Conference Presentation

In this presentation deck, Innes McFee, Chief Global Economist, explains how the outlook for the year is cautiously optimistic. Over the last year, inflation has come down as we expected with the economy holding up relatively better in the second half of the year.

Find Out More

A mid-year transition from recession to recovery | Canada Up Close

The Canadian economy will begin 2024 still mired in recession as the lagged impact of higher interest rates continues to filter through. In our first Canada Up Close video, Tony Stillo, Director of Canada Economics, examines four key themes that will shape the economy’s performance in 2024.

Find Out More

Cities Key themes 2024 – cyclical swings, structural shifts

Growth in the main economic indicators (GDP, employment, and consumer spending) is likely to be weaker in 2024 than in 2023 for most cities around the world. And a recurring theme for debate will be where cities sit within their national economic cycles.

Find Out More

Global Travel Key Themes for 2024: Resilient Recovery Amid Economic Uncertainty

Global travel recovery will continue in 2024 despite a slower economic backdrop. Many countries that were previously expected to endure recession are now likely to avoid this although economic growth will certainly slow.

Find Out More

Canada Key themes 2024 − A mid-year shift from recession to growth

The Canadian economy will begin 2024 still mired in recession as the lagged impact of higher interest rates continues to filter through. However, we expect a modest recovery in the latter half of 2024 as the Bank of Canada begins to cut interest rates, disinflation continues, and global growth improves.

Find Out More

Commodities Key Themes 2024 – Another year of price weakness for metals

We expect another year of industrial metal price weakness in 2024 and are generally below consensus. Metal demand will remain weak in H1 while supply continues to increase. However, metal prices will gradually increase later in the year and beyond as demand recovers.

Find Out More

China Key themes 2024 – A slower, but healthier, dragon year

China heads into 2024 with relatively loose policy settings, but private sector sentiment constrained by property pessimism. Policy efforts will reduce left tail risks but we don't expect it will be sufficient to prevent the growth downtrend persisting. Recognizing an upside risk that authorities could instead stimulate their way to a high growth target in 2024.

Find Out More

India Key themes 2024 – A slowdown is coming, eventually

The Indian economy has been more resilient than expected in 2023, but we believe the slowdown has only been postponed rather than called off.

Find Out More

Industry Key Themes 2024 – Industry to Outperform the Broader Economy

2023 has been a turbulent year for global industry, with growth on track to come in lower than any other year since 2000 other than the crisis-hit 2009 and 2020. After two years where industrial growth unusually underperformed global GDP, 2024 should see a resumption of the norm where industry outperforms the broader economy.

Find Out More

Can the banking system really rescue the Chinese property sector? | Beyond the Headlines

We are unconvinced that recent measures mark a turning point in China's housing downturn and the resulting banking system is likely to be less profitable, impairing the transmission mechanism of future monetary policy. In this week’s Beyond the Headlines, join Louise Loo, Lead Economist, Macro Forecasting and Analysis, as she discusses if the banking system can rescue the Chinese property sector.

Find Out More

MENA: Key themes 2024 – The GCC will defy the global slowdown

The Gulf Cooperation Council (GCC) region will expand less than we initially thought this year, but growth will improve in 2024 and outpace most advanced and emerging economies. There are four themes that shape our above-consensus 2024 GDP growth forecast for the GCC of 3.9%.

Find Out More