Blog | 26 Mar 2024

Easter Egg-onomics

Leeuwner Esterhuysen

Economist, OE Africa

Consumer groups around the Easter-egg-gifting parts of the world have recently highlighted the eggstraordinary cost of Easter this year. Their clever pun, not ours!

The cause of Easter egg inflation of 50% or more this year—and the reason we may need to make some hard choices about who receives Easter eggs from us this coming weekend—is largely explained in the latest paper from our Africa team on one of the key countries at the start of the supply chain, those producing the raw ingredient, Côte d’Ivoire. (Between them, Côte d’Ivoire and Ghana produce nearly 60% of the world’s cocoa.)

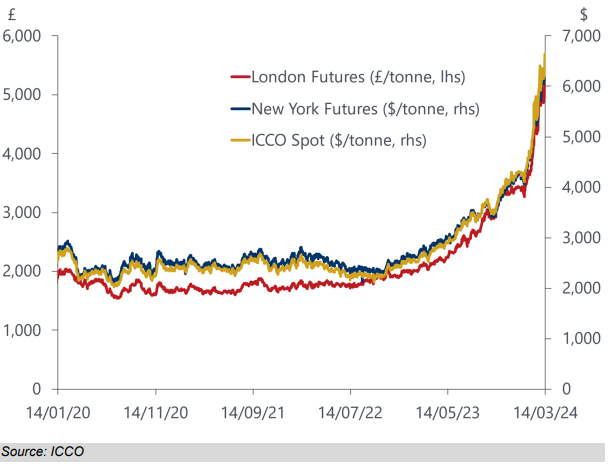

Cocoa is the hottest commodity to date in 2024, with spot prices surging by more than 52% over the first two-and-a-half months of the year. Moreover, spot prices for cocoa are over 157% higher now than at the same time in 2023. Most of the upward price pressures are stemming from the supply side, although demand for the soft commodity has also rebounded from its pandemic-induced lows. Adverse weather patterns have disrupted supply from West Africa, where most of the world’s cocoa is produced. Bean arrivals at Côte d’Ivoire’s ports are nearly 30% lower than a year ago, and the International Cocoa Organisation (ICCO) projects a third successive global supply deficit this season.

The effects of soaring prices on Côte d’Ivoire are not necessarily clear-cut. While strong prices will support the external position through higher export receipts, the real impact on cocoa farmers is broadly negative. Farmgate prices are set a year in advance, meaning that producers are receiving comparatively low prices for their weather- and disease-affected crops. There is also little incentive for farmers to ramp up output currently as their produce will only yield higher returns from next season when prices are lifted. Meanwhile, cocoa processing plants have been forced to shut down on several occasions due to the intermittent supply of beans.

While not fully benefiting from the cocoa price surge, the Ivorian economy is in a healthy position. Côte d’Ivoire is receiving favourable reviews from the IMF under its current programme, and the Fund is on the verge of approving a $1.3bn facility to improve the country’s resilience to climate change. The country also had a successful Eurobond sale in January, implying that investors have an optimistic outlook on the economy despite weak cocoa production. Meanwhile, Moody’s upgraded Côte d’Ivoire’s credit rating to the joint second-highest rating in Africa due to the economy’s resilience and increased private sector investment.

Ultimately, the Ivorian economy will likely continue to deliver a strong performance.

Contact us

If you would like to find out more about our services, please fill in the form and let us know a bit more about you and what you’re looking for. A member of the team will be in touch with you as soon as possible.

By submitting this form you agree to be contacted by Oxford Economics about its products and services. We will never share your details with third parties, and you can unsubscribe at any time.

Author

Leeuwner Esterhuysen

Economist, OE Africa

+27 (0) 21 863 6200

Leeuwner Esterhuysen

Economist, OE Africa

Paarl, South Africa

Leeuwner, who joined Oxford Economics Africa in July 2020, holds a Master’s degree in Economics from the University of Stellenbosch. He is the primary economist for Côte d’Ivoire, Cameroon, and Gabon, as well as a key member of the company’s consulting team. Before joining the company, he worked in the trading team at a top asset management firm.

Tags:

You may be interested in

Post

Africa: The long-term outlook for sub-Saharan African cities

Sub-Saharan cities will lead the way for GDP growth, but similarly strong demographic changes will limit gains in GDP per person, reaffirming the region’s position at the lower end of the development spectrum.

Find Out More

Post

Africa | Africa Country Insight: Côte d’Ivoire

Côte d'Ivoire managed to avoid an economic contraction in 2020, largely due to its robust agricultural sector and government's comprehensive Covid-19 health and economic response spending. In order to return to its optimal growth path, the country needs to increase its efforts regarding Covid-19 vaccinations and economic diversification. What you will learn: Côte d'Ivoire's economic capital, Abidjan, is the largest consumer market in comparison to cities in the country's West African neighbours. The country's travel and tourism industry suffered severely at the hands of the Covid-19 pandemic last year. Activity in the sector is not expected to return to 2019 levels before 2024. Côte d'Ivoire relies heavily on cocoa for growth, exports and fiscal revenue. The country needs to increase efforts to diversify the economy in order to make it less susceptible to either cocoa production or price shocks.

Find Out More

Post

Global sustainability scramble ushers in a new era for South Africa

Africa's mineral riches are central to its history. However, the race to combat climate change has reignited interest in the continent given its vast deposits of critical minerals. Southern Africa, in particular, has received much attention with the development of several key transport corridors with the almost explicit purpose of scaling up the availability of these minerals on international markets. We set out to investigate the economic potential of the region in terms of its critical minerals while taking into consideration what the establishment of these corridors means for the regional economy.

Find Out More