Blog | 06 Dec 2021

Competition for FDI ramps up in the Middle East

Scott Livermore

Chief Economist, Oxford Economics Middle East, and Managing Director

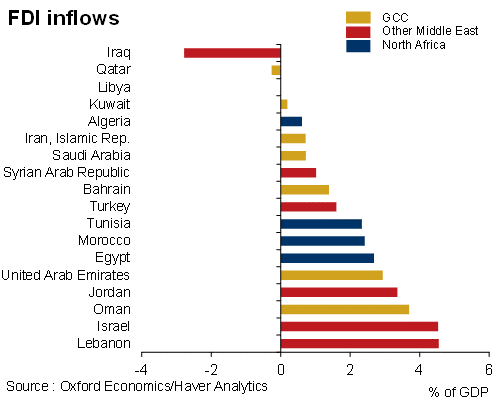

Attracting foreign direct investment (FDI) is central to the growth diversification strategy for countries in the Middle East, especially in the GCC. Saudi Arabia recently announced it hopes to attract FDI of US$100bn annually (up from an average of US$5.2bn in the period from 2015-19), and the UAE aims to become one of the 10 largest FDI destinations by 2030. Similarly, Bahrain’s updated economic plan includes measures to boost FDI inflows.

While competition in the region for FDI is ramping up, the outlook for global FDI remains uncertain. The pandemic hit global FDI hard, with flows falling by 35% to US$1 trillion in 2020, the lowest since 2005. And FDI flows have only partially recovered this year, with pre-crisis levels of FDI not expected until 2022 or 2023.

FDI is a key pillar of growth and diversification strategies across the region, and the benefits it brings in terms of finance, knowledge transfer, and integration with the global economy are clear. However, the MENA region has struggled to attract FDI, with some countries seeing inflows decline and FDI currently standing below ambitious targets.

One of the main motivations for FDI is access to relatively cheap and well-educated workforces to integrate into global supply chains. Workforce attractiveness, however, is not typically seen as a competitive advantage of the Middle East—although following Covid the lure of low-cost undiversified supply chains may recede and FDI may be driven more by technological and digital factors. This potential offers opportunities to countries in the GCC.

The focus for enhancing FDI attractiveness in the GCC has been the quality of infrastructure and improving business regulations. The GCC economies are likely to continue to invest in upgrading their infrastructure. They have ambitious growth and diversification plans and the financial wherewithal to undertake investment. The private-public partnership (PPP) market could help support infrastructure investment across the wider region. Tightening spending budgets and widening infrastructure investment gaps are creating the conditions for PPP mechanisms to take off. Presently, Dubai and Kuwait are the stand-out markets in the region, with PPP programmes for roads and other infrastructure, but there is scope for other countries to capitalize on PPP.

Great efforts have been made towards improving the business environment and reducing the regulatory burden in the GCC and the Middle East. Over the past year, there have been a number of reforms across Saudi Arabia, the UAE, and other Gulf economies aimed at attracting foreign investment. These include regulations governing foreign ownership, announcement of special economic zones, bankruptcy laws, and visa regulations for expat workers.

Countries that have typically placed an emphasis on FDI—the UAE, Qatar (despite a recent period of divestment), and Bahrain—stand in a good position competitively. The advantages of Saudi Arabia are clear, and if improvements to its business environment continue to be made and Vision 2030 is successfully implemented, then Saudi Arabia’s FDI attractiveness should rise, although its recent targets for FDI are extremely ambitious.

Tags:

You may be interested in

Post

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More